Pre-bid Stakes In Australian Public M&A.

In the final instalment of our three-part series, HSF has analysed pre-bid stakes acquired by bidders in public companies between calendar years 2022 to 2024. The data reveals that pre-bid stakes are a strong indicator of bidder success. However, they are not impenetrable, with some forms of pre-bid stake more susceptible to rival bids than others. The previous instalments of this series can be found here on NBIOs generally and private equity NBIOs.

In brief

Our review of pre-bid stakes in non-binding indicative offers (NBIOs) during 2022 to 2024 above $250m in deal value reveals the following:

- Bidders had a pre-bid stake in 61% of NBIOs.

- In 83% of instances where a bidder had a pre-bid stake, the bidder was ultimately successful in securing control.

- In those successful cases, 55% of the time the bidder had to increase their price either unilaterally or to fend off a rival bid. For target Boards, this shows that there is still scope to create value for shareholders when facing a bidder with a pre-bid stake.

- The effectiveness of a pre-bid stake can depend on the form it takes. Hard pre-bids (direct holdings and call options) are much more likely to be successful, failing to have the desired effect only 7% of the time. While soft pre-bids (voting / acceptance agreements or intention statements) are more likely to be unsuccessful, failing 30% of the time.

Background on pre-bid stakes

A pre-bid stake that gives a bidder a relevant interest above (or an association with a person having above) 5% of the voting shares requires disclosure to the market in a substantial holder notice. Voting intention statements may not give rise to a relevant interest or an association, but are usually announced to the market to show support for the bid.

The 20% rule caps a pre-bid relevant interest at this level, and the Takeovers Panel considers long derivative interests above this level as likely unacceptable.

Foreign Government investors may be capped at acquiring an interest in 10% or more without FIRB approval, though it is possible to stage the acquisition (for example in a call option), with the second tranche at or above 10% subject to receipt of FIRB’s approval.

A bidder can take a pre-bid stake, before or as part of making an approach, for various reasons. These include (though the extent to which these are available depends on the form of the pre-bid):

- Providing a lower entry price to reduce the overall acquisition price.

- Signalling shareholder support for a bidder’s proposal.

- Serving as a potential blocking stake for any rival bid.

A bidder who takes a pre-bid stake before engaging with the target can be perceived as behaving in a more hostile fashion, being considered as putting pressure on the Board to engage. However, the equal purposes of testing shareholder support at the price levels and increasing deal certainty (i.e. protecting from rival bids) are legitimate reasons for taking a stake.

Pre-bid stakes can take a variety of forms with varying pros and cons (our study covers all of these forms). These are described below and can be mix-and-matched with one another.

| Form of pre-bid | Key pros | Key cons |

| Direct holding: acquisition of shares on market or from one or more specific shareholders (including an “overnight raid” targeting select institutional investors). | Can acquire at or below first bid price. Can vote against / not accept rival proposal. Counts towards general compulsory acquisition threshold. | Needs to be funded. On-market can take time. Off-market disclosed to prospective sellers. Identifiable on register. Cannot vote on own scheme. Consider treatment (e.g. sell-down) if bid unsuccessful. |

| Derivatives: commonly a total return swap with an investment bank, delivering returns akin to owning the shares, with the swap writer usually hedging their position by buying underlying shares. | Full stake does not need to be funded upfront. Bidder cannot be identified (as not on register and usually no relevant interest). | Usually economic interest only, no voting rights. Practically, can only be acquired to the extent hedged (i.e. underlying shares available to the swap writer). |

| Call option: a right to acquire shares at a pre-agreed price mechanism (that may change depending on circumstances) that may be exercisable on certain occurrences (e.g. a rival bid being made). | Shareholder can vote shares in scheme. Ability to call shares to block rival bid. No immediate funding. | Shareholder may support bid, but be reluctant to dispose or provide a blocking stake to a potential auction. Shareholder may want compensation for higher bids. |

| Voting / acceptance agreement: agreement to vote in favour of scheme and / or accept takeover bid, usually accompanied by a restriction on disposal. | Certainty of support at price level. Support can influence other shareholders No immediate funding. | May create separate “class” (cannot vote with other shareholders) if not subject to a superior proposal exception. Shareholder may want a superior proposal exception. |

| Voting / acceptance intention statement: public statement by substantial shareholder to vote in favour / accept bid. Enforceable under ASIC’s ‘Truth in Takeovers’ policy. | Certainty of support at price level. Support can influence other shareholders No immediate funding. | Typically subject to a “no superior proposal” exception, though only mandatory if >20% in aggregate. |

Pre-bid stake success rates CY22-241

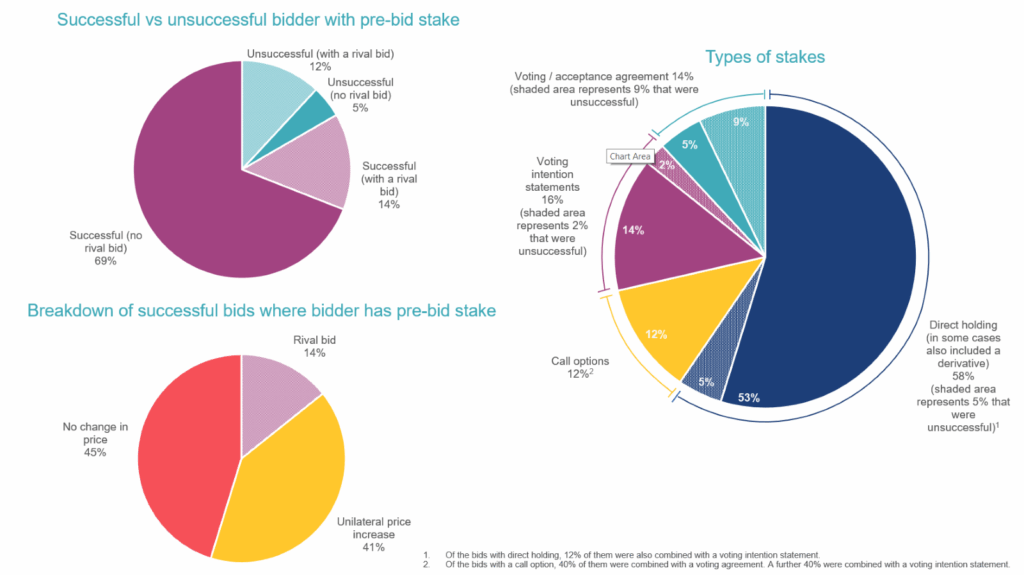

We have analysed pre-bid stakes of more than 5% of a potential target’s voting shares acquired by bidders who made a NBIO during 2022 to 2024. The charts below summarise our analysis of the data and we dissect the findings further below.

What proportion of bidders who take pre-bid stakes ultimately succeed?

Bidders had a pre-bid stake in 61% of NBIOs.

In 83% of cases where the bidder had a pre-bid stake, the bidder was successful in securing control of the target.

However, targets should not interpret this as meaning that control will necessarily pass at the price of the first approach. In 41% of cases where a bidder with a pre-bid stake was successful, the bidder unilaterally increased their price. While on the one hand this is consistent with conventional wisdom that the first price is rarely the bidder’s final price, on the other hand it indicates that a pre-bid alone is rarely enough to strong arm the target Board into acceptance.

In a further 14% of cases where the bidder with a pre-bid stake was successful, the bidder had to overcome a rival bid. In 12% of cases where a bidder took a pre-bid stake, the bidder was unsuccessful due to a rival bid. These statistics show that pre-bid stakes are not impenetrable. However, generally, a bidder that takes a pre-bid stake has high conviction and willing to take on and beat a rival bidder.

Do success rates differ based on the form of pre-bid stakes?

In short, yes. We divide pre-bid stakes into two forms, ‘hard’ and ‘soft’ pre-bids:

- ‘Hard’ pre-bids: direct holdings, derivatives and call options because the bidder effectively puts their foot on the shares in these forms of pre-bid and does not make them accessible to a rival bidder.

- ‘Soft’ pre-bids: voting / acceptance agreements and voting / acceptance intention statements, which are typically subject to a superior proposal exception, meaning the shareholder is released from the commitment to support a higher bid.

Hard pre-bid stakes, which were 70% of our sample, are more likely to result in the bidder acquiring control, only being unsuccessful 7% of the time. Soft pre-bid stakes, representing 30% of our sample, were much less likely to succeed, failing 30% of the time. In particular, a bidder with the benefit of a shareholder intention statement more often than not was unsuccessful. We conclude that these soft pre-bid stakes are useful for showing shareholder support for the price level, but are relatively weak deal protection mechanisms.

Interesting pre-bid scenarios

We consider how these pre-bid arrangements have played out in specific scenarios.

Overcoming a call option

In the battle for control for Village Roadshow, the Kirby family held 40% of the target and wanted to remain invested given the family’s legacy with the company. In December 2019, Pacific Equity Partners entered into a call option over 19% of the Kirby’s shares, exercisable at $3.90 a share on a rival bid being announced. If the call option was exercised, the Kirbys had the right to acquire the shares back if Pacific Equity Partners did not secure control of Village within a period of time, giving the Kirbys certainty that they would retain their stake. A similar “call-back” structure was used by Kirin and Marcus Blackmore in the Blackmore acquisition. In the Village transaction, Pacific Equity Partners’ pre-bid arrangement was overcome by a successful rival bidder, BGH Capital, after the COVID-19 pandemic in February 2020 resulted in Village Roadshow’s share price trading well below the option exercise price, rendering the option uneconomic and ineffective.

Voting / acceptance agreement that protects a certain price level

In Potentia’s bid for Tyro in 2022, major shareholder Grok (who held 12.5% of the target) entered into a novel voting and acceptance agreement with the bidder. Grok agreed to accept a takeover bid, or vote in favour of a scheme, if proposed by Potentia at $1.27 per share or higher. Presumably, a tension emerged, Grok did not want the pre-bid to prevent a rival bid, while Potentia wanted to prevent a rival bidder from accessing the Grok stake. The solution they agreed was that Grok was not permitted to support a competing proposal unless the rival offer was worth $0.25 or more per share than Potentia’s most recent proposal and was unmatched by Potentia. Grok also agreed to reimburse Potentia’s costs if a rival bidder was successful, presumably as a means of encouraging Potentia to make the first move and put Tyro into play, with downside protection if it was outbid.

Concurrent scheme and takeover is not the perfect solution to overcome a pre-bid stake

The use of a dual structure scheme and takeover bid to apply pressure to a blocking shareholder to vote in favour of the scheme or risk having a minority position under the takeover bid was used effectively in the battle for control of Healthscope in 2019. However, this has not always worked to overcome a rival bidder. In August 2022, Potentia Capital acquired a combined relevant and economic interest of 17% (12% physical and ~5% in cash settled total return swaps) in Nitro at the same time it launched an NBIO at $1.58 a share. Potentia’s offer was rejected by Nitro, upon which Potentia physically settled the swap and increased its physical stake to 19.9%. Nitro received multiple offers from third parties, spurring Potentia to launch an unrecommended takeover bid at $1.80 per share. Nitro entered into an agreed deal with a rival bidder Alludo, for a scheme at $2.00 and takeover at the same price, designed to force Potentia to accept the offer to avoid being stuck in a minority shareholder position. Potentia matched this price under its unrecommended takeover, at which time Alludo went to $2.15. Alludo’s scheme was voted down (including using Potentia’s stake) and only amassed 13% of acceptances under its bid. With Alludo having declared its offer best and final, Potentia increased its bid to $2.17 and ultimately reached compulsory acquisition. While the concurrent scheme and takeover put pressure on Potentia, which contributed to Potentia bidding up its price, the example shows the power of a pre-bid as a blocking stake to a rival bid and ability to control the outcome, notwithstanding this tactic.

Pre-bid by a rival bidder that trumps the initial bid

In the recent Selfwealth control situation, first bidder Bell Financial had an agreed deal, after which time M&A arbitrage fund, Harvest Lane, amassed a 13% stake. Harvest Lane sold its stake to a second bidder, Syfe, who acquired a total blocking stake of just under 19% and submitted a higher rival bid that was ultimately successful. The example shows the power of a blocking stake. A similar situation is emerging in respect of PointsBet, where following an agreed deal with MIXI, a rival bidder, betr, acquired 19.9% from an institutional investor before submitting a higher proposal. This demonstrates that where an initial bidder declines to acquire a pre-bid stake, the initial bidder can be vulnerable to a second bidder emerging with such a stake (and potentially losing the deal), notwithstanding the exclusivity granted to the initial bidder by the target.

The power of the pre-bid unleashed

In the long running battle for control of Pacific Smiles, first bidder Genesis Capital amassed a cash settled long swap position for 19.9% of the target in December 2023. In May 2024, Genesis announced it had acquired 19.9% of the shares in Pacific Smiles by requiring physical settlement of its swap. Genesis had failed to inform the market that in December 2023 it had altered its swap arrangements to allow physical settlement of the swap, which the Takeovers Panel found to be unacceptable (though it did not make any orders). In April 2024, National Dental Care (owned by Crescent Capital) entered into an agreed deal with Pacific Smiles at $1.90 a share. In July 2024, Genesis informed the target it intended to vote against the NDC proposal ahead of the scheme meeting, at which time NDC increased its offer price to a best and final $1.91 a share, absent a superior proposal, which Genesis said it would also vote against. Genesis submitted a proposal at $1.90 a share that the Board considered superior (notwithstanding it was below the latest NDC offer price) because it would be reasonably likely to be more favourable to shareholders. NDC increased its offer to $2.05 ahead of the scheme meeting, but was voted down by Genesis and other shareholders (only 63% voted in favour) and the deal with NDC was terminated in August 2024. Genesis made a subsequent takeover bid at $1.90 a share, which the target Board recommended shareholders reject. Genesis increased its price to $1.98 per share and got to 45% voting power under the takeover bid, at which time the Board recommended remaining shareholders accept the bid. Genesis currently holds 89% of the shares, and will presumably reach compulsory acquisition imminently.

Conclusion

These success rates for and interesting examples of pre-bid stakes provide valuable real data for bidders and targets when assessing their next move in a potential NBIO situation. If you have any queries regarding the data or specific situations, please do not hesitate to contact us.

For further information, please contact:

Kam Jamshidi, Partner, Herbert Smith Freehills

Kam.Jamshidi@hsf.com

Footnotes

- Analysis has been restricted to control transactions involving an ASX-listed target where the implied equity value of the target > A$250m (CY21-24).