2 May, 2017

(A) Introduction

The Code of Governance for Charities and Institutions of a Public Character (“Code” was first published by the Charity Council in 2007. Since then, the Code has undergone two rounds of refinement, in 2011 and 2017. The 2017 refinement was open for public consultation (“Public Consultation”) from 20 September 2016 to 18 October 2016. (For the purpose of this article, references to the “2017 Code ” shall mean the Code as refined in April 2017.) According to the press release issued by the Charity Council on 6 April 2017 (“Press Release”), the 2017 Code will take effect

for financial year commencing from 1 January 2018.

The objectives of the Code are three-fold

– firstly, to make charities more effective by sharing best practices for governing and managing charities; secondly, to provide guidance to board members so that they can carry out their fiduciary duties more effectively, and thirdly, to boost public confidence in the charity sector. The Code applies to all registered charities and institutions of a public character (“IPCs”) in Singapore except for the following organisations:

(a) Exempt charities (Note: These are universities or educational institutions, hospitals or religious bodies established by an Act of Parliament or any other institutions which the Minister by order declares to be an exempt charity for the purposes of the Charities Act (Chapter 37)); and

(b) Self-funded grant-makers such as philanthropic foundations funded with private family or institutional money.

The 2017 Code (an 84-page document) is organised into four tiers (Basic Tier, Intermediate Tier, Enhanced Tier and Advanced Tier) (more on this later). Each tier contains the following 9 sections:

i. Board Governance

ii. Conflict of Interest

iii. Strategic Planning

iv. Programme Management

v. Human Resource and Volunteer Management

vi. Financial Management and Internal Controls

vii. Fundraising Practices

viii. Disclosure and Transparency

ix. Public Image

Each section starts with a general principle. For example, the general principle under the “Conflict of Interest” section for each tier states “Board members and staff should act in the best interests of the charity. Clear policies and procedures should be set and measures be taken to declare, prevent and address conflict of

interest.” Each general principle is supported by specific guidelines to put the

general principle into practical use.

Charities and IPCs are required to submit an online Governance Evaluation Checklist (“GEC”) via the Charity Portal every year, within six months from their financial year end. There is a specific GEC template for each tier, and all four GEC templates can be found in the 2017 Code. The objective of the list of questions in each GEC is to ascertain whether or not a particular charity or IPC has complied with the specific guidelines applicable to the tier under which it falls.

(B) Key refinements to the Code

This article will not discuss all the 2017 refinements to the Code but will instead highlight only the salient ones as summarised below.

(1) Changes to the Tiers

The specific guidelines in each tier are applicable depending on the IPC status and size of the charity. One of the key refinements to the Code concerns the determination of the charity size. Previously, the charity size was determined by

reference to only “gross annual receipts”. Under the 2017 Code, charity size will now be determined by gross annual receipts or total expenditure whichever is higher, in each of its two immediate preceding financial years.“

Gross annual receipts

” include all income, grants, donations, sponsorships and all other receipts of any kind. “Total expenditure” would encompass all costs of generating funds, costs of charitable activities, governance costs and other expenditures as reflected in the unrestricted funds, restricted income funds and endowment funds. A rationale for the refinement was that charities with high expenditure should also be subject to more stringent governance standards.

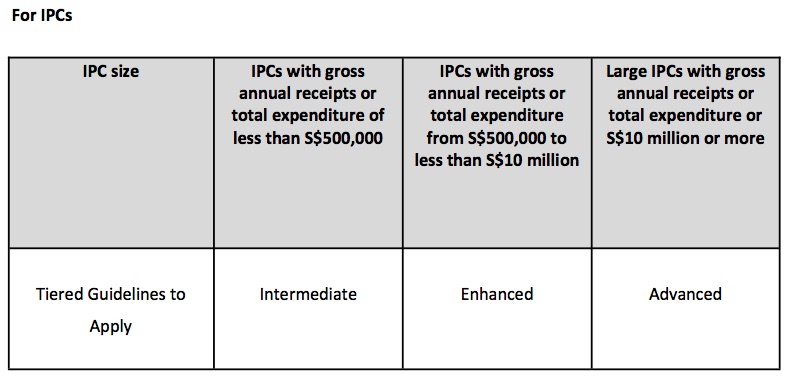

The refined tiers are as set out as follows:

Please click on the table to enlarge.

(2) Changes to the Governance Evaluation Checklist

With the removal of the “Not Applicable” option in the refined GEC, the 2017 Code will operate on the principle of “comply or explain”. This new reporting requirement will be applicable for financial years beginning on or after 1 January 2018. The first batch of charities and IPCs which would need to submit the refined GECs will be those with financial years ending on 31 December 2018, which means their refined GECs will be due in June 2019.

As mentioned above, small charities with gross annual receipts or total expenditure of less than S$50,000 are exempted from GEC submission. Save for the aforesaid category, the disclosure guidelines applicable to all other charities and IPCs under the 2017 Code are as follows:

- To submit a GEC on the Charity Portal;

- To indicate “Complied” or “Not Complied”;

- If “Not Complied”, to explain why it cannot comply. One possible explanation (as given in the 2017 Code) why a charity may not be able to comply is because it is in the process of working towards compliance;

- To indicate the steps it plans to take to comply e.g. to review or amend its constitution, by-laws or policies, or explain why if it decides not to comply;

- GEC is made available for public viewing on the Charity Portal; and

- For IPCs, the extent of Code compliance and reasons for non-compliance would be taken into account when they apply to renew their IPC status subsequently.

(3) Changes to the Specific Guidelines

(a) Board Governance

In relation to all four tiers (i.e. Basic Tier, Intermediate Tier, Enhanced Tier and

Advanced Tier):

i. There should be a maximum limit of four consecutive years for Board members holding Treasurer position or equivalent position e.g. Finance Committee Chairman or person on the Board responsible for overseeing the finances of the charity / IPC.

ii. If the charity/IPC does not have an appointed Board member, then it will be taken that the Chairman oversees the finances. It was indicated in the Public Consultation paper that should the Chairman assume the role of the Treasurer, his term limit as Chairman will need to follow that of the Treasurer i.e. four consecutive years.

iii. A person may be re-appointed as Treasurer (or equivalent) after a lapse of at least two years

. It was explained in the Public Consultation paper that the extension from one year to two years was to reduce the risk

for any potential continued influence.

iv. All Board members are required to submit themselves for re-nomination and re-appointment

at least once every three years.

In relation to Enhanced and Advanced Tiers:

i. The charity/IPC should establish term limits for all Board members to ensure steady renewal. The new wordings are more prescriptive than those in the 2011 version which stated “The Board may consider setting term limits for all Board members to ensure steady renewal of the Board.”

ii. Re-appointment to the Board can be considered after a lapse of at least two years

ii. The charity/IPC should disclose the reasons for retaining Board member(s) who have served on the Board for more than 10 consecutive years in its annual report

. Annex B attached to the Press Release noted that the initial proposal was for a maximum term limit of 10 consecutive years for at least two-third of the Board members to ensure steady renewal. The Charity Council subsequently revised this initial proposal after taking into account the public feedback received.

However, it is noted that the Charity Council still intends to implement the 10-year term limit in later years.

(b)Human Resource and Volunteer Management

In relation to all four tiers (i.e. Basic Tier, Intermediate Tier, Enhanced Tier and Advanced Tier), the 2017 Code now provides a definition of “volunteer” for greater clarity. “Volunteers” are defined in the Glossary as “persons who willingly give up time to serve a charity, without expectation of any remuneration”. For volunteers who are involved in the day-to-day operations of the charity, they should also abide by the best practices set out in the Code applicable to “staff”.”

In relation to Intermediate Tier, Enhanced Tier and Advanced Tier, there is a new specific guideline requiring the charity/IPC to have a documented Code of Conduct for Board members, staff and volunteers (where applicable) which is approved by the Board.

(c) Financial Management and Internal Controls

In relation to all four tiers (i.e. Basic Tier, Intermediate Tier, Enhanced Tier and Advanced Tier), the 2017 Code expressly requires that there should be a documented policy to seek Board’s approval for instances where the charity/IPC provides loans, donations, grants or financial assistance which are not part of its core charitable programmes. The coverage has been expanded to include other forms of monetary support such as financial assistance.

(d) Disclosure and Transparency

In relation to all four tiers (i.e. Basic Tier, Intermediate Tier, Enhanced Tier and Advanced Tier):

i. Board members should generally not receive remuneration for their Board services.

ii. Where the charity/IPC’s governing instrument expressly permits Board remuneration, it must disclose in its annual report the exact remuneration and benefits received by each individual Board member.

iii. If no Board member receives remuneration, the charity/IPC must disclose this fact in its annual report.

Prior to the 2017 refinement, the above guidelines only applied to large charities with gross annual receipts of S$10 million or more as well as IPCs with gross annual receipts of S$200,000 or more. Pursuant to the 2017 Code, the above guidelines will apply to all four tiers i.e. from Basic Tier to Advanced Tier.

In relation to Enhanced Tier and Advanced Tier, there is a new specific guideline requiring the charity/IPC to disclose in its annual report whether it has a whistle-blowing policy.

(4) Conclusion

In light of the 2017 refinements to the Code, it would be necessary for many charities and IPCs to consider reviewing and amending their governing instruments such as trust deeds, constitutions, charters, by-laws and policies to ensure compliance with the above specific guidelines. In certain instances, affected charities and IPCs would also need to have in place documented policies (e.g. whistle-blowing policies) and codes of conduct as well. Looking ahead, there will be practical challenges faced by a number of charities / IPCs in complying with the refined guidelines (in particular for board succession). Nevertheless, the 2017 Code is a step forward towards better governance in the Singapore charity sector and should be strongly supported by all stakeholders

Kaylee Kwok, Partner, RHTLaw Taylor Wessing