2 June, 2017

The Inland Revenue Authority of Singapore (IRAS) is seeking public consultation on their draft Goods and Services Tax (GST) Guide on Customer Accounting for Prescribed Goods (the Draft Guide).

We discuss the Draft Guide and its implications below.

Background

Under the current GST rules, a GST-registered supplier will typically charge and account for GST (output tax) on its local sales of goods unless GST is exempted. The GST-registered customer will then claim the GST paid on its local purchases and/or imports as input tax credit subject to satisfying the conditions for making the input tax claim.

The Draft Guide states that from 1 January 2018, customer accounting will apply in respect of local sales of prescribed goods, ie, mobile phones, memory cards and off-the-shelf software (Prescribed Goods) where the sale value before GST exceeds USD 5,000 and the sale is to a GST-registered customer for his business purpose (Prescribed Goods Transaction).

Under customer accounting –

- the GST-registered supplier will not charge the GST-registered customer GST (output tax) in respect of Prescribed Goods;

- instead, the GST-registered customer will account for the output tax on behalf of the GST-registered supplier. If the customer satisfies the input tax claim conditions, he will also claim the corresponding input tax in his GST return.

This shifts the accounting for output tax from the GST-registered supplier to the GST-registered customer. The supplier needs to issue a customer accounting tax invoice to the customer, indicating that the customer has to account for the output tax.

Please see Annex I for a simplified example of the differences between customer accounting and the current GST rules.

The Draft Guide seeks to explain the application and operational details of customer accounting for Prescribed Goods Transactions. The rationale provided by IRAS for the implementation of the customer accounting is to better address non-compliance relating to Prescribed Goods Transactions.

IRAS is now seeking feedback from GST-registered businesses dealing in Prescribed Goods on the implementation of customer accounting, so as to facilitate a smooth transition into customer accounting come 1 January 2018. The Ministry of Finance will also be conducting a Public Consultation on the legislative amendments for this implementation in May 2017.

How will this affect you

The operational and GST compliance details are complex with significant knock-on implications for both the supplier and the customer of the Prescribed Goods (within the whole supply chain in Singapore). The additional costs implications include (but are not limited to) the following:

- Where both Prescribed Goods and non-Prescribed Goods are supplied, the supplier must determine whether total GST-exclusive sale value of all the Prescribed Goods (whether of the same type/nature or not) exceeds USD 5,000. The sale value of non-Prescribed Goods should not be included in this computation;

- If there are both Prescribed Goods Transactions as well as non-Prescribed Goods transactions, the supplier is recommended to issue the appropriate tax invoice separately. In the case of Prescribed Goods, the supplier must include additional fields (including the GST registration number of the customer, to be provided by the customer) and not account for output tax accordingly in its GST reporting;

- The customer must provide additional information to the supplier, ie, its GST registration number, for Prescribed Goods Transactions (the supplier may check the GST registry to confirm the customer's registration status) and clarify if the Prescribed Goods are purchased for non-business purposes;

- Under customer accounting, the customer must be able to correctly account for GST;

- The accounting software/systems (for GST reporting purposes) for both the supplier and the customer need to be able to support the proposed changes for Prescribed Goods Transactions on top of the existing GST reporting requirements;

- Reverse logistics (for example, return of faulty goods) of Prescribed Goods in terms of GST reporting/compliance requirements will also be impacted and will need to be revised accordingly.

What you can do

If you have any specific concerns or feedback regarding the Draft Guide, you can reach out directly to IRAS before the deadline of 2 June 2017. The relevant template for submission of comments can be found in Annex A of the draft guide. A link to the draft guide can be found here.

We will also be providing our comments to IRAS and will be glad to hear your views and assess the impact of the proposed changes to businesses. As a preliminary, we believe there is scope for further clarification from IRAS. In particular, we are considering seeking clarification from IRAS on (but not limited to) the following matters:

- Obligations of the seller and customer, and situational examples in which seller and/or customer will be liable for errors and the range of penalties that will be imposed. As an example, paragraphs 9.1 to 9.1.2 of the Draft Guide currently state that the customer will be penalized for an omission in customer accounting even if it is the seller whom incorrectly standard-rates a relevant supply of Prescribed Goods. The basis of penalizing the customer should be elaborated upon and made clearer since it appears that seller and customer have their respective obligations in determining whether there is a Prescribed Goods Transaction or not;

- Whether the voluntary disclosure regime and its reduced penalties will apply;

- Whether customer accounting of Prescribed Goods Transactions will apply to business transfers and/or be subject to the Goods and Services Tax (Excluded Transactions) Order; and

- Whether customer accounting of Prescribed Goods Transactions will apply to GST agents under the relevant GST agency provisions (eg, section 33(2)).

Annex I

Example

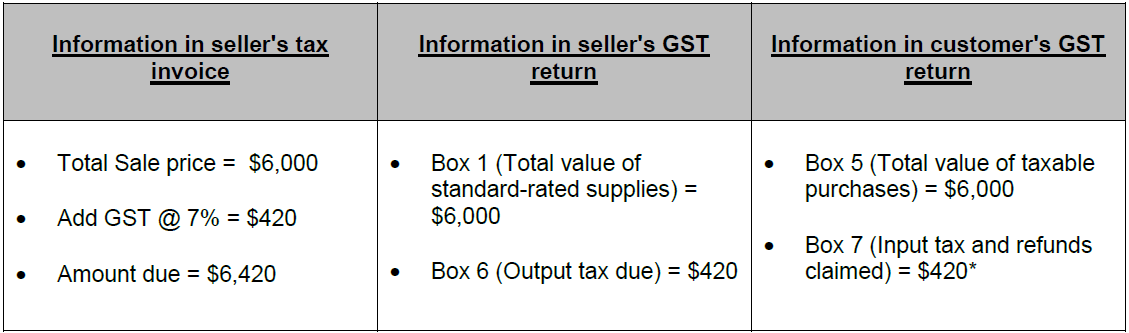

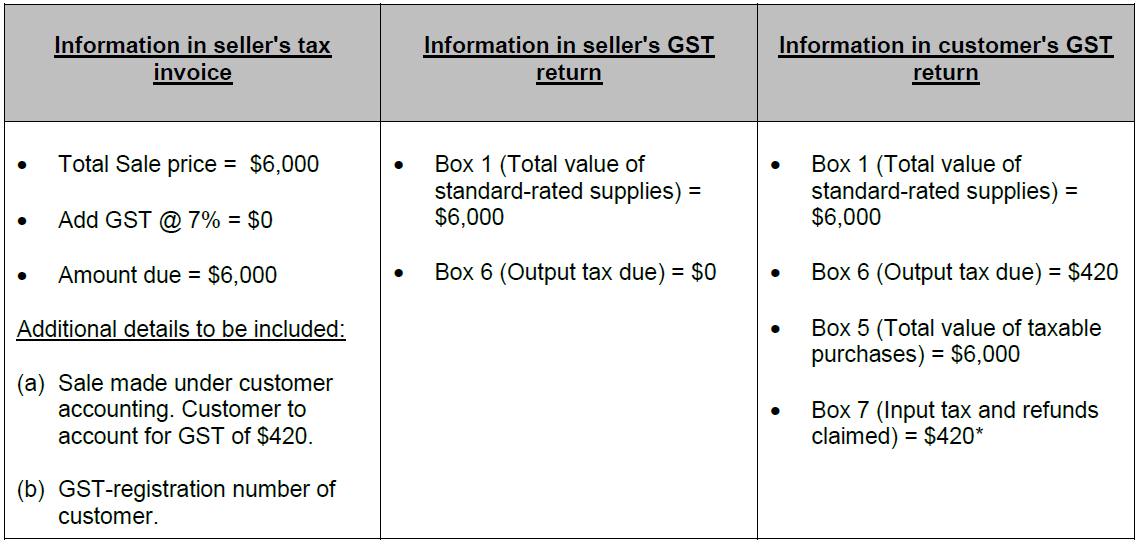

GST-registered seller sells handphones for $6,000 to a GST-registered customer for business purposes (the Sale), the Sale taking place in Singapore.

Current GST rules

Please click on the table to enlarge.

Customer accounting

Please click on the table to enlarge.

*The GST-registered customer will claim the GST paid on its local purchases and/or imports as input tax credit subject to satisfying the input tax claim conditions.

For further information, please contact:

Eugene Lim, Partner, Baker & McKenzie.Wong & Leow

eugene.lim@bakermckenzie.com