Tax inspection and tax examination are important matters to Vietnam-based enterprises. However, several enterprises are not clear on regulations regarding tax inspection – examination leading to loss of interests but arising potential risks.

Through this article, BLawyers Vietnam would like to note some points for the enterprises’ consideration.

1. Time and location of tax inspection and tax examination

Tax examination shall be conducted at: (i) headquarters of a tax authority; or (ii) headquarters of the enterprise. Tax inspection will be conducted at an enterprise’s headquarters.

The time of tax inspection and tax examination shall be presented on a decision for an inspection or an examination. Normally, tax authorities will conduct a periodical tax examination once a year or irregularity. In addition, tax authorities will inspect when an enterprise has statutory signs.

2. Grounds for conducting tax inspection and tax examination

Tax authorities shall conduct tax inspection and tax examination case-by-case upon the following grounds:

(i) Tax examination at the tax authorities’ headquarters shall be carried out to assess the completeness and accuracy of information and documents in tax dossiers and the tax laws compliance of enterprises.

(ii) Tax examination at the enterprise’s headquarters when:

- Such enterprise is subject to pre-tax refund or post-refund examination;

- Out of the time limit of tax examination at tax authority’s headquarters and such enterprise cannot explain, supplement information and documents or failed to supplement tax declaration or incorrect declaration;

- Post-customs clearance examination at the customs declarant’s headquarters under the Customs law;

- There are signs of violation of law;

- According to the plan, thematic or the recommendation of the State Audit, the State Inspectorate, or other competent authorities;

- The enterprise is under separation, division, merger, amalgamation, conversion, dissolution, termination of operation, equitization, tax code invalidation, relocation of business location; other cases of extraordinary examination or as requested by competent authorities, except for the cases of dissolution or termination operation in which tax is not finalized by tax authorities.

(iii) Tax inspection when:

- There are signs of violations of tax laws;

- To settle complaints, denunciations, or take anti-corruption measures;

- According to the request from tax administration based on the results of risk classification or at the recommendation of the State Audit, the conclusions of the State Inspectorate and other competent authorities.

3. Procedures of tax inspection and tax examination

a. Tax examination at tax authorities

b. Tax examination at the enterprises’ headquarters

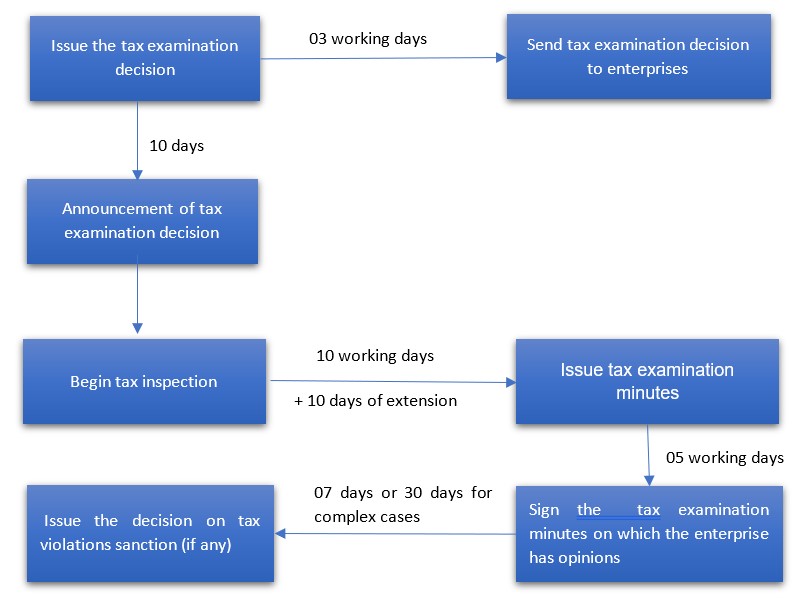

c. Tax inspection

4. Rights of enterprises during tax inspection and tax examination

During the tax inspection process, the enterprise has the following rights:

- Refusing tax inspection/ examination proceeding if lacking decision on tax inspection and tax examination;

- Refusing to provide information and documents not related to the contents of tax inspection and tax examination; information and documents belonging to state secrets, unless otherwise provided by law;

- Receive the minutes of tax inspection and tax examination and request an explanation about the contents of such minutes; Explaining issues related to tax inspection and tax examination contents; Reservation of opinions in the minutes of tax inspection and tax examination;

- Rights to complain, denounce, and bring the lawsuits as prescribed.

5. Things that the enterprise needs to prepare over tax inspection and tax examination

In the process of tax obligation implementation, the enterprises should review all tax dossiers for all periods. This helps enterprises to prevent unnecessary risks and mistakes.

During tax inspection and tax examination, the enterprises should coordinate with tax authorities and their in-charged teams to explain, provide and supplement information and documents for tax inspection and tax examination.

If there is a decision to sanction tax violations, the enterprise has the right to complain or bring a lawsuit over such decision but still must pay the full taxes, fines, late interest, or the fixed tax amount within the time limit specified in the decision.

For further information, please contact:

Minh Ngo Nhat, Partner, BLawyers

minh.ngo@blawyersvn.com