21 November, 2017

T+2 Settlement Cycle and the Pending Settlement Rules

Currently, Thailand Clearing House Co., Ltd. (TCH) has plans to develop settlement system to be in line with the international standard. Two major developments are T+2 settlement cycle and the pending settlement rules.

1. T+2 Settlement Cycle

TCH is under the process of moving the settlement cycle from three days from the trading date (T+3) to two days from the trading date (T+2) with an aim to reduce operation costs and risks across the industry as well as to be in line with global practices. The target date for launching the new settlement cycle is on 2 March 2018.

Under this process, after trading orders are matched on the Stock Exchange of Thailand (the SET), they will be settled within the second business day.

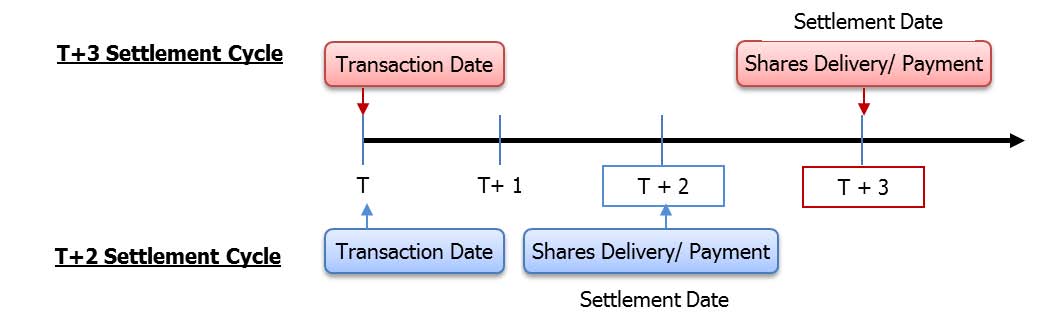

The comparison between the former and current settlement cycle is as follows:

Please click on the image to enlarge.

When implemented, investors will receive payment for their sale or receive the purchased shares one day sooner. Thus, they can manage their portfolios easier and the transaction cost should be lower due to the reduced systematic risk.

2. Pending Settlement Rules

Prior to launching the T+2 settlement cycle, the TCH intends to first implement the pending settlement rules which may be adjusted upon the launching of the T+2 settlement cycle. On 6 November 2017, the new rules of the TCH regarding pending settlement (the Pending Settlement Rules) came into force mainly to manage failures in shares delivery and to be in line with international standard – namely Principles for Financial Market Infrastructures (PFMI). Under these rules, at T+3, in case of insufficiency of the delivered shares, e.g. if the delivering side defaults by not delivering the shares, the delivery will be subject to the pending settlement process. TCH will require the participants who failed to deliver the sufficient shares to post collateral with the TCH at the amounts of 130% of the value calculated from the amount of defaulted shares multiplied by the price of shares. If the pending deliver party fails to deliver shares within T+7, TCH will then pay a sum of money, i.e. a fine or a collateral posted by the pending deliver party to the buying participant instead of shares for the shortfall of the shares it bought.

This is a major change to the previous process which the TCH will immediately overdraft and debit the balance of its own account so that the buying participant will receive all the shares it bought at T+3.

To our understanding, even if at T+3, the buyer will not physically receive all the shares they have bought but will still be able to sell all those shares, i.e. net buy/sell still can be made on the same day but if such buyer cannot deliver all the shares at the next T+3, they will be considered a pending deliver party and will need to place a collateral for the shortfall.

Therefore, these rules should be taken into account when selling and buying listed shares on the SET. For more information or advice, please contact our team at Baker McKenzie.

For further information, please contact:

Boonyaporn Donnapee, Partner, Baker McKenzie

boonyaporn.donnapee@bakermckenzie.com