31 October, 2017

Background

In August 2017 the Thai SEC issued a hearing paper on the reduction of minimum paid-up capital requirements for securities and derivatives operators in Thailand. The hearing process ended in September 2017. The Office of the Securities and Exchange Commission (the "Office of the SEC") plans to issue a new set of regulations by the end of 2017 (with the effective date expected to be in January 2018) (the "New Regulations") to relax the minimum paid-up capital requirements for securities companies and derivatives business operators in Thailand, with requirements reflecting the actual risk and exposure that business operators are subject to.

I. Overview

Under current regulations, the amount of minimum paid-up capital required for securities companies and derivatives business operators depends on the type of securities or derivatives license held or to be applied for by a business operator. For instance, a Type A securities business license allows the holder to operate securities dealing, brokerage, and underwriting businesses for all type of securities, and the minimum paid-up capital requirement is THB 500 million, notwithstanding whether the license holder activates and operates the full range of securities services covered by the license or only part thereof (e.g. operating only a securities brokerage service).

The minimum paid-up capital requirements under the New Regulations will be based on the actual securities or derivatives business a license holder actually activates and operates. For instance, if a securities company wishes to operate only a securities brokerage service and not securities dealing, securities underwriting, custodian services, proprietary investment in securities for its own portfolio, or fund management, and that securities company is not and will not be a member of the Thailand clearing and settlement system (Thailand Clearing House), it must have and maintain only THB 1 million in minimum paid-up capital (as opposed to the current requirement of THB 500 million), even if it holds a Type A securities business license. This is because the Office of the SEC believes that a securities brokerage service alone will not expose the securities company to high risk in its business operation.

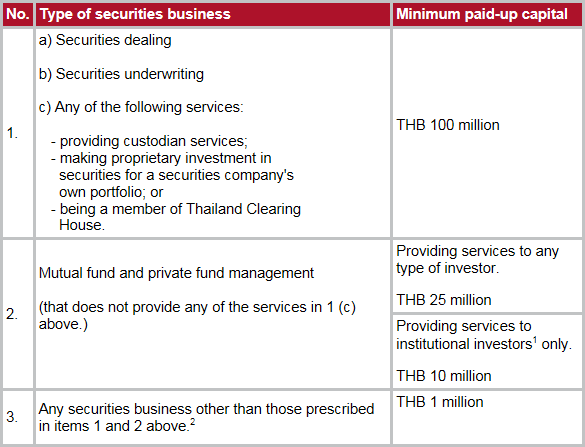

II. Summary of new minimum paid-up capital requirements for securities companies

The new requirements will benefit both existing securities companies that currently hold a license and also newcomers that wish to apply for a securities license in Thailand.

Summarized below, new requirements for a minimum paid-up capital for securities company under the New Regulation.

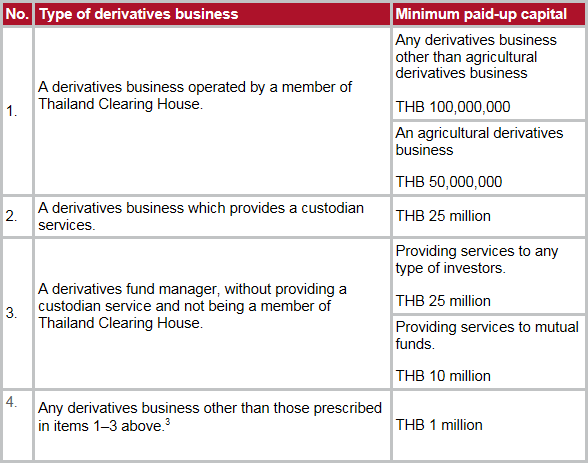

III. Summary of new minimum paid-up capital requirements for derivatives business operators

Similarly, when the New Regulations become effective, the type of derivatives license will cease to be relevant in determining minimum paid-up capital required for each derivatives business operator (both existing ones and newcomers). Rather, the minimum paid-up capital required will depend on the type of derivatives business each operator undertakes, as summarized below.

Please click on the table to enlarge.

We will provide updates when these New Regulations have been issued.

1"Institutional investors" include, for example, the Bank of Thailand, commercial banks, banks established under specific laws, finance companies, credit foncier companies, securities companies, life and non-life insurance companies, mutual funds, provident funds, the Government Pension Fund, the Social Security Fund, derivatives business operators, or any other persons as specified by the Office of the SEC.

2For example, investment advisory or securities brokerage service.

3For example, a derivatives advisory or derivatives brokerage service.

For further information, please contact:

Komkrit Kietduriyakul, Partner, Baker & McKenzie

komkrit.kietduriyakul@bakermckenzie.com