In this issue, we cover regulatory developments impacting the investment management sector, including the Securities and Exchange Commission’s (SEC’s) focus on the annual 15(c) advisory contract approval process for fund boards, important XBRL compliance concepts for funds eligible to file short-form registration statements, targeted SEC examinations related to new rules, recent enforcement activity, and SEC bulletins and risk alerts covering critical areas in the investment management space.

- SEC Focuses on Advisory Contract Approval Process

- XBRL Update

- SEC Exams Targeting Board Approach to Derivatives Rule

- Examinations Risk Alert: New Investment Adviser Marketing Rule

- SEC Charges Firms With Record-Keeping Failures

- Enforcement Action: Toews and Proxy Voting Obligations

- Staff Bulletin: Standards of Conduct for Broker-Dealer and Investment Adviser Conflicts of Interest

- Form PF Proposed Amendments Could Require Increased Reporting by Hedge Funds

- Reopened Comment Periods Expected To Delay SEC Rulemakings

SEC Focuses on Advisory Contract Approval Process

As we noted in both the May 2022 and August 2022 editions of this newsletter, the director of the Securities and Exchange Commission’s (SEC’s) Division of Investment Management, William Birdthistle, has been actively delivering a series of prerecorded remarks to industry professionals, investment management attorneys and compliance personnel, placing great emphasis on what he perceives to be an imbalance of tools and resources available to retail investors to evaluate the performance of their fund investments relative to the fees fund managers receive.

More specifically, Mr. Birdthistle has made express references to Section 36(b) of the Investment Company Act of 1940 (1940 Act) as both a private right-of-action option for investors and an enforcement option for the SEC, noting, however, that no plaintiff has prevailed in a private claim. In discussing the fail rate of private litigants bringing actions under Section 36(b), Mr. Birdthistle cited the SEC’s power and authority to bring actions under Section 36(b), again in the context of underperforming, higher-fee funds.

At the time of our May 2022 discussion on this topic, we stated that funds, fund managers and fund boards should be mindful of the activities of the Division of Investment Management under Mr. Birdthistle’s leadership in light of his comments on Section 36(b) in relation to advisory fees. In August 2022, we noted that the SEC Division of Enforcement had begun sending out document requests to fund complexes, seeking information regarding:

- which personnel at the adviser are involved in the process for approval of investment advisory agreements (the 15(c) process) and what responsibilities each has with regard to the process;

- all board meeting materials related to the 15(c) process;

- any 15(c) process-related materials given to any director or trustee;

- documentation related to the board’s findings that fees are reasonable;

- and documentation regarding profitability.

There continues to be no confirmation of a formal sweep exam or an initiative related to Mr. Birdthistle’s concerns. That said, the environment these statements and inquiries have created, coupled with the potential for the SEC to begin bringing enforcement actions under Section 36(b), could create a dynamic where the SEC staff (Staff) focuses on fact-intensive aspects of evaluating the Jones/Gartenberg1 factors that could lead to enforcement actions and/or settlements that accomplish a regulation-through-enforcement objective.

Accordingly, industry participants, particularly those with underperforming funds or those receiving higher fees, should consider proactively engaging with their compliance consultants and legal counsel to take a fresh look at their 15(c) process and make sure:

- robust policies are in place for setting fees;

- the Jones/Gartenberg factors are being fully evaluated;

- boards obtain, and advisers provide, relevant materials that support the evaluation of these factors; and

- the 15(c) process is well documented.

While the industry does not have the precise road map for the objectives of Mr. Birdthistle and the Staff with this renewed focus on Section 36(b) and the 15(c) process, funds, fund managers and fund boards may benefit from reviewing certain of Mr. Birdthistle’s prior written Section 36(b) analyses, such as the amicus brief for which he served as counsel of record that was filed in the Jones case (the Jones Amicus Brief).2

The Jones Amicus Brief, unsurprisingly, quite accurately foreshadows the very themes Mr. Birdthistle has been emphasizing over the course of the past year — namely, that retail fund investors do not behave “rationally” and remain in high fee funds even in the face of poor performance and that “something” has to be done about it. In the words of the Jones Amicus Brief, “Meanwhile, investors, encumbered with ever-greater responsibility for their own retirement savings as 401(k) plans eclipse pension funds, have demonstrated little behavioral capacity to invest rationally: many investors fail to enroll in retirement plans, leave their contributions uninvested, or allocate their savings too rarely, riskily, or rapidly. The [lower court’s] assumption that high fees will ‘drive investors away’ thus ignores the enfeebled state of shareholder exit in mutual funds.”

The Jones Amicus Brief then proceeds to set forth the thesis that courts should emphasize comparisons between retail and institutional fees in evaluating whether the adviser’s “fiduciary duty with respect to the receipt of compensation for services” has been met. According to the Jones Amicus Brief, “None of the other Gartenberg factors alone or in concert provides so much probative value on the issue of fee excessiveness. Only by analyzing the lower rates paid by institutional funds, which enjoy a far less structurally intertwined and captive relationship with investment advisors, can a plaintiff demonstrate how far an advisor has strayed from its Section 36(b) obligations. This fee comparison — which is a proxy for fairness and uniquely free from self-dealing — should lie at the heart of [the Supreme Court’s] efforts to fashion a meaningful standard for the fiduciary duty.”

The Jones decision itself does address this point, but perhaps not with the degree of emphasis the Jones Amicus Brief advocated. Rather, the Jones decision states that there cannot be any categorical rule regarding the comparisons of the fees charged to different types clients and that, instead, “courts may give such comparisons the weight they merit in light of the similarities and differences between the services that the clients in question require, but courts must be wary of inapt comparisons.”3 The Jones court also states that “courts should be mindful that the [1940] Act does not necessarily ensure fee parity between mutual funds and institutional clients contrary to petitioners’ contentions.”4

Against this backdrop, the question is what reasonably informed conclusions may be drawn about the recent Staff focus on the 15(c) process and Section 36(b) under Mr. Birdthistle’s leadership. For one, it would not be surprising to see a focus on fee comparisons among different types of product offerings from an adviser. Such comparisons might be made not just between institutional accounts and retail funds, but also to other retail funds executing the same or similar strategies but offered through different distribution channels, or in a different wrapper or aimed at different client bases.

Additionally, the fundamental justification for any differences in fees —differences in factors such as services, liquidity needs that impact portfolio management, turnover of assets, legal and compliance obligations, and approaches to marketing the product line — is likely to be fact-intensive and thus subject to differences in interpretation. This fact-intensive dynamic could also be the case for other Jones/Gartenberg factors, such as the evaluation and comparison of the adviser’s profitability attributable to a fund, which inherently involves methodological judgments in how to allocate expenses. A regulator’s costs and benefits in bringing a regulatory action are fundamentally different than the costs and benefits of private plaintiffs in commencing litigation in the federal courts, and could lead to a different litigation risk calculus for advisers.

XBRL Update

As a reminder, the 2020 SEC rule amendments that obligate closed-end investment companies (CEFs) and business development companies (BDCs, and collectively defined in the adopting release and referred to herein as the “affected funds”) to submit certain filings with eXtensible Business Reporting Language (XBRL) have gone into effect for affected funds eligible to file a short-form registration statement pursuant to General Instruction A.2 of Form N-2 (seasoned funds), and will go into effect for the remainder of affected funds on February 1, 2023.

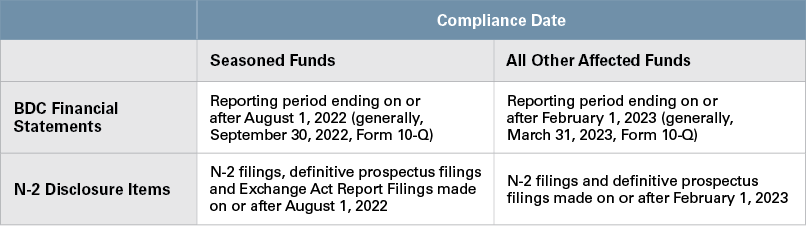

The XBRL tagging requirements fall into two categories: (1) BDC financial statements and (2) certain enumerated substantive Form N-2 disclosure items.5 According to FAQs published by the Staff, tagging of these two sets of information have the following compliance dates:

The enumerated substantive Form N-2 disclosure items requiring XBRL tagging are:

- Cover page data

- Item 3.1 – Fee table

- Item 4.3 – Senior securities table

- Items 8.2.b and 8.2.d – Investment objective, strategy, practices, techniques; industry concentration; etc.

- Item 8.3.a – Risk factors

- Item 8.3.b – Leverage risk example

- Item 8.5.b – Price range of common stock

- Item 8.5.c – Share price/net asset value, together with premium/discount as of most recent practicable date

- Item 8.5.e – Statement about tendency of common stock to trade at discount, if no history of public trading

- Items 10.1.a-d – Description of capital stock

- Items 10.2.a-c and e – Description of long-term debt

- Item 10.3 – Description of any other class of securities

- Item 10.5 – Outstanding securities table

The penalty for failure to comply with the above XBRL tagging requirements is loss of short-form registration statement eligibility, though eligibility generally springs back upon remedial filings to include the relevant XBRL tagging. Therefore, affected funds should have vendors in place to assist with XBRL tagging well in advance of the applicable compliance date and consider whether any remediation is needed for any untagged filings made after an applicable compliance date.

In addition, under Rule 406 of Regulation S-T, affected funds are required to tag the cover pages of all reports on Forms 10-K, 10-Q and 8-K once they are subject to XBRL tagging requirements generally under Rule 405 of Regulation S-T.

For more information, see our April 21, 2020, client alert “SEC Adopts Securities Offering Reforms for Business Development Companies and Registered Closed-End Investment Companies.”

SEC Exams Targeting Board Approach to Derivatives Rule

On October 28, 2020, the SEC adopted Rule 18f-4 under the 1940 Act. Rule 18f-4 permits registered funds to engage in derivatives transactions, subject to certain conditions. Among other things, funds that are not limited derivatives users under the rule must adopt a derivatives risk management program to be administered by a derivatives risk manager overseen by the fund’s board of directors. Rule 18f-4 went into effect on February 19, 2021, and the final compliance date was August 19, 2022.

Various media outlets have recently reported that the SEC has begun examining fund compliance with Rule 18f-4 and has sent a letter requesting a range of documents relating to board oversight of the derivatives risk manager. The letter reportedly requested various board materials, including, among others, board meeting minutes, board and committee calendars, meeting agendas, and any materials and reports provided to the board related to the approval, implementation and operation of the derivatives risk management program.

Takeaways

Although there has been no confirmation of a formal sweep exam, industry participants should take notice of what appears to be another example of a swift and aggressive approach to regulation from the SEC, and pay close attention to any regulatory response or actions that follow from this request.

Examinations Risk Alert: New Investment Adviser Marketing Rule

On September 19, 2022, the SEC’s Division of Examinations (Examinations) issued a risk alert informing investment advisers about upcoming review areas during examinations focused on amended Rule 206(4)-1 (Marketing Rule) under the Investment Advisers Act of 1940 (Advisers Act), which advisers must begin complying with by November 4, 2022 (Compliance Date).

According to the risk alert, following the Compliance Date, Examinations “will conduct a number of specific national initiatives, as well as a broad review through the examination process, for compliance with the Marketing Rule.” Examinations, according to the risk alert, will focus on whether investment advisers have adopted policies and procedures that are reasonably designed to prevent violations of the Marketing Rule, specifically reviewing:

- whether such policies and procedures are “objective and testable” with respect to the investment advisers’ advertisements, i.e., whether investment advisers have adopted and implemented active compliance procedures that can be independently assessed by Examinations;

- how investment advisers are substantiating material statements of fact in their advertisements, i.e., whether the advisers have a “reasonable basis” for believing they are able to substantiate such material statements of fact in their advertisements;

- whether investment advisers’ performance advertising, including the use of any gross performance, hypothetical performance, related performance and composites, comply with the specific performance advertising provisions set forth in the new Marketing Rule; and

- whether investment advisers are able to demonstrate compliance with the Marketing Rule’s related books and records maintenance requirements.

As a final reminder, and as the risk alert indicates, investment advisers must review their current compliance posture with respect to the requirements of the new Marketing Rule prior to the Compliance Date. They must also formally adopt and implement required changes to their compliance policies and procedures related to their advertising and solicitation activities. Advisers should also review and amend, to the extent necessary, agreements and disclosures governing solicitation activities, third-party endorsements, ratings and promoter functions.

For more information, see “SEC Adopts Modernized Marketing Rule for Investment Advisers” in the June 2021 issue of this newsletter.

SEC Charges Firms With Record-Keeping Failures

On September 27, 2022, the SEC announced charges against 16 financial firms for failures by the firms and their employees to maintain and preserve electronic records. The firms acknowledged that their conduct violated record-keeping provisions of the federal securities laws and agreed to pay combined penalties of more than $1.1 billion to settle the charges.

The charges were brought in connection with the Staff’s investigation into the use of personal mobile devices and other unmonitored, off-channel communication platforms, such as WhatsApp, at financial firms. The SEC determined that, from January 2018 through September 2021, the firms failed to maintain records of routine communications of their employees, including senior executives and management, regarding business matters made using unauthorized text messaging apps on their personal devices. In doing so, the SEC asserted violations of the record-keeping requirements under Section 17(a)(1) of the Securities Exchange Act of 1934 (the Exchange Act) and Rule 17a-4(b)(4) thereunder, or Section 204 of the Advisers Act and Rule 204-2(a)(7) thereunder, and failures to reasonably supervise employees as required under Section 15(b)(4)(E) of the Exchange Act or Section 203(e)(6) of the Advisers Act.

Separately, the Commodity Futures Trading Commission (CFTC) announced settlements with the firms for related conduct. These charges follow a related proceeding brought against another financial firm in December 2021 and further demonstrate the SEC’s and other regulators’ focus on record-keeping requirements under the federal securities and commodities laws.

More recently, it has been reported that similar inquiries have shifted to focus on the investment management industry, including funds and fund advisers, and fund managers may wish to review these matters, including 1940 Act and Advisers Act record-keeping requirements and the monitoring associated with compliance obligations thereunder.

Takeaways

Companies should consider using this time as an opportunity to review their policies and procedures regarding retention and monitoring of electronic communications, and the use of personal devices and third-party messaging platforms. Companies may wish to evaluate whether relevant employee communications are preserved and maintained in compliance with the record-keeping requirements under the Exchange Act, 1940 Act and Advisers Act, as well as any other regulatory regimes applicable to the company or its activities. Companies may also wish to evaluate whether adequate training and testing are conducted regularly to verify employees’ understanding of, and compliance with, such policies and procedures.

Enforcement Action: Toews and Proxy Voting Obligations

On September 20, 2022, the SEC announced a settlement order (Order) with Toews Corporation (Toews), an investment adviser registered under the Advisers Act. The Order was in relation to charges that Toews had directed a third-party service provider to vote proxies on behalf of registered investment company (RIC) clients managed by Toews “without taking any steps to determine whether the votes were in the clients’ best interests, and for failing to implement policies and procedures reasonably designed to ensure it voted client securities in the best interests of its clients.”

According to the Order, from at least January 2017 to January 2022 (Relevant Period), Toews provided standing instructions to a third-party service provider to “vote all of the RICs’ securities in favor of the proposals put forth by the issuers’ management and against any shareholder proposals” without exception, and that Toews failed to review the proxy materials related to the votes submitted by the third-party service provider to ensure such standing instructions were in the best interests of the RICs in contravention of:

- Toews Form ADV Brochures in effect during the Relevant Period (asserting, “[w]e will vote proxies in the best interests of our clients”), and

- Toews’ own compliance policies and procedures in effect during the Relevant Period (stating, with respect to Toews objectives in voting proxies, “Toews exercises its proxy voting rights … with the goal of aligning the interest of management with those of shareholders, and stating, with respect to emphasis Toews places on importance of proxy voting, “[p]roxy voting is an important right of shareholders and reasonable care and diligence must be undertaken to ensure that such rights are properly and timely exercised.”).

According to the Order, by failing to conduct a review of the proxy materials related to the votes submitted by the third-party service provider, Toews willfully violated Sections 206(2) and 206(4) of the Advisers Act and Rule 206(4)-6 promulgated thereunder. Section 206 is generally considered the anti-fraud provision of the Advisers Act, and Rule 206(4)-6 (Proxy Rule) requires investments advisers that are registered or required to be registered with the SEC to adopt policies and procedures “(a) reasonably designed to ensure that you vote client securities in the best interest of clients, which procedures must include how you address material conflicts that may arise between your interests and those of your clients; (b) [d]isclose to clients how they may obtain information from you about how you voted with respect to their securities; and (c) [d]escribe to clients your proxy voting policies and procedures and, upon request, furnish a copy of the policies and procedures to the requesting client.”

Takeaways

In light of the Order, investment advisers and boards of regulated funds should review their existing proxy voting disclosures and compliance policies and procedures to ensure such disclosures and related compliance policies and procedures are consistent with the SEC’s publicized statements and expectations relating to an adviser’s proxy voting obligations under Section 206 of the Advisers Act and the Proxy Rule.

Staff Bulletin: Standards of Conduct for Broker-Dealer and Investment Adviser Conflicts of Interest

On August 2, 2022, the SEC Staff issued “Staff Bulletin: Standards of Conduct for Broker-Dealers and Investment Advisers Conflicts of Interest” (Staff Bulletin) using a Q&A format to reiterate the requirements for broker-dealers (under Regulation Best Interest, or Reg BI) and investments advisers (under the fiduciary standard, or IA Fiduciary Standard, under the Advisers Act) to identify and address conflicts of interest that “might incline a broker-dealer or investment adviser — consciously or unconsciously — to make a recommendation or render advice that is not disinterested.”

The Staff Bulletin suggests the Staff remains focused on broker-dealer and investment adviser (Registrants) conduct with respect to Registrants’ treatment of conflicts of interest with retail investors, and examinations will likely focus on whether such Registrants have adequately sought to identify and address their conflicts of interest with retail investors using a “robust, ongoing process that is tailored to each conflict,” or whether Registrants have merely treated their obligations using a “check-the-box” exercise.

According to the Staff Bulletin, the Q&A format style — which includes examples of conduct and activity the Staff would consider relevant under each standard addressed — “is designed to assist firms and their financial professionals with addressing conflicts of interest such that they comply with their obligations to provide advice and recommendations in the best interest of retail investors.”

Takeaways

While the content of the Staff Bulletin is largely a refresh of existing guidance related to standards of conduct for Registrants’ conflicts of interest, Registrants should be mindful of the concentrated emphasis the Staff places on these issues and review existing disclosures and policies and procedures related to identifying and addressing conflicts of interest with retail investors to ensure such disclosures and conflicts of interest are consistent with the Staff’s interpretation of Registrants’ obligations.

Form PF Proposed Amendments Could Require Increased Reporting by Hedge Funds

On August 10, 2022, the SEC and CFTC jointly announced proposed amendments to Form PF (Form PF Amendments), a confidential reporting form for certain SEC-registered investment advisers to private funds, including those that are registered with the CFTC as a commodity pool operator or commodity trading adviser.

Form PF, adopted by the two agencies in 2011 as mandated by the Dodd-Frank Act, collects information about the basic operations and strategies of private funds in order to facilitate the monitoring of systemic risk by the Financial Stability Oversight Council (FSOC). The SEC and CFTC also use information collected on Form PF in their regulatory programs, including with respect to examinations and investigations.

The Form PF Amendments proposal follows a January 2022 SEC proposal to adopt amendments to the SEC-only portion of Form PF. If adopted, the Form PF Amendments would increase reporting by hedge funds, particularly large hedge fund advisers on qualifying hedge funds (i.e., those with a net asset value of more than $500 million); increase reporting on basic information about investment advisers and funds; amend how advisers report complex structures; and remove the ability to use aggregate reporting for large hedge fund advisers.

The SEC explains the Form PF Amendments by asserting that they will strengthen the FSOC’s ability to assess systemic risk and bolster the SEC’s regulatory oversight of private fund advisers. The SEC also predicts that the Form PF Amendments will improve the usefulness of collected data and is soliciting comments on whether certain of the Form PF amendments should apply to Form ADV.

The Form PF Amendments propose to accomplish the following:

- Increase Reporting by Large Hedge Fund Advisers on Qualifying Hedge Funds

- Increase the reporting obligation for “large” hedge fund advisers with respect to investment exposures, borrowing and counterparty exposure, market factor effects, currency exposure reporting, turnover, country and industry exposure, central clearing counterparty reporting, risk metrics, investment performance by strategy, portfolio correlation, portfolio liquidity and financing liquidity.

- Increase Reporting on Basic Information About Advisers and Their Private Funds

- Require additional basic information about advisers and the private funds they advise, including identifying information, assets under management, withdrawal and redemption rights, gross asset value and net asset value, inflows and outflows, base currency, borrowings and types of creditors, fair value hierarchy, beneficial ownership and fund performance.

- Increase Reporting Concerning Hedge Funds

- Require more detailed information about the investment strategies, counterparty exposures, and trading and clearing mechanisms employed by hedge funds, while also removing duplicative questions.

- Amend How Advisers Report Complex Structures

- Currently, Form PF allows advisers to report complex structures either in the aggregate or separately, as long as they do so consistently. The Form PF Amendments generally would require advisers to report separately each component fund in complex fund structures, such as master-feeder arrangements and parallel fund structures.

- Remove Aggregate Reporting for Large Hedge Fund Advisers

- Remove the ability of large hedge fund advisers to report certain aggregated information about the hedge funds they advise.

Takeaways

If adopted as proposed, the Form PF Amendments would increase the reporting obligations for private fund advisers, in particular large hedge fund advisers. Advisers should consider in advance whether and how the Form PF Amendments may impact their reporting obligations. Comments on the Form PF Amendments were due on October 11, 2022.

Reopened Comment Periods Expected To Delay SEC Rulemakings

On October 7, 2022, the SEC issued a press release announcing that it will be reopening the comment period for several rulemakings due to a technological error that resulted in the agency not receiving certain public comments. According to the press release, “all commenters who submitted a public comment to one of the affected comment files through the internet comment form between June 2021 and August 2022 are advised to check the relevant comment file on SEC.gov to determine whether their comment was received and posted. If a comment has not been posted, commenters should resubmit that comment.”

The deadline to submit comments for the affected releases is November 1, 2022. Accordingly, those seeking to submit or resubmit comments on the affected releases should make note of the new deadline in order to ensure timely submissions.

Affected Releases

- Reporting of Securities Loans, Release No. 34-93613

- Prohibition Against Fraud, Manipulation, or Deception in Connection With Security-Based Swaps; Prohibition Against Undue Influence Over Chief Compliance Officers; Position Reporting of Large Security-Based Swap Positions, Release No. 34-93784

- Money Market Fund Reforms, Release No. IC-34441

- Share Repurchase Disclosure Modernization, Release Nos. 34-93783, IC-34440

- Short Position and Short Activity Reporting by Institutional Investment Managers, Release No. 34-94313; see also Notice of the Text of the Proposed Amendments to the National Market System Plan Governing the Consolidated Audit Trail for Purposes of Short Sale-Related Data Collection, Release No. 34-94314

- Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure, Release Nos. 33-11038, 34-94382, IC-34529

- Private Fund Advisers; Documentation of Registered Investment Adviser Compliance Reviews, Release No. IA-5955

- The Enhancement and Standardization of Climate-Related Disclosures for Investors Release Nos. 33-11042, 34-94478

- Special Purpose Acquisition Companies, Shell Companies, and Projections, Release Nos. 33-11048, 34-94546, IC-34549

- Investment Company Names, Release Nos. 33-11067, 34-94981, IC-34593

- Enhanced Disclosures by Certain Investment Advisers and Investment Companies About Environmental, Social, and Governance Investment Practices, Release Nos. 33-11068, 34-94985, IA-6034, IC-34594

- Request for Comment on Certain Information Providers Acting as Investment Advisers, Release Nos. IA-6050, IC-34618

Takeaways

As a result of the comment periods reopening, we expect the timing of any final rules with respect to the affected rulemakings will be delayed.

For further information, please contact:

Eben P. Colby, Partner, Skadden

eben.colby@skadden.com

1 Jones v. Harris, 559 U.S. 335 (2010); Gartenberg v. Merrill Lynch Asset Management, Inc., 694 F. 2d 923 (2nd Cir. 1982).

2 Birdthistle, William A., Supreme Court Amicus Brief of Law Professors in Support of Certiorari, Jones v. Harris Associates, No. 08-586 (Jun. 15, 2009).

3 Jones, 559 U.S. at 348.

4 Id. at 349.

5 This second obligation covers the use of XBRL tagging of such disclosure items contained in any (1) registration statements and post-effective amendments; (2) prospectus filed pursuant to Rule 424; and (3) documents filed pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act (e.g., Form 10-K, Form 10-Q, Form 8-K, Form N-CSR, proxy statements, etc.) (Exchange Act Report Filings).