Overview

On June 25, 2024, the Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) sanctioned nearly 50 entities and individuals involved in a shadow banking network used by Iran’s Ministry of Defense and Armed Forces Logistics (“MODAFL”) and Islamic Revolutionary Guard Corps (“IRGC”). MODAFL is responsible for development, production, funding, and logistics for all of Iran’s defense industries. MODAFL subsidiaries manufacture advanced conventional weapons, including ballistic missiles and unmanned aerial vehicles, which are used by Iran’s military, including the IRGC. This action builds on previous action OFAC took in March 2023 against a number of entities that operated as a part of this shadow banking network. We reported on that previous action in the following post. The Financial Crime Enforcement Network also issued an advisory in May 2024 highlighting the ways funds are moved through these shadow banking networks.

Deputy Secretary of the Treasury Wally Adeyemo made the following comment in light of the action: “The United States is taking action against a vast shadow banking system used by Iran’s military to launder billions of dollars of oil proceeds and other illicit revenue… We have sanctioned hundreds of targets involved in Iran’s illicit oil and petrochemical-related activity since President Biden took office, and we will continue to pursue those who seek to finance Iran’s destabilizing terrorist activities.”

Iranian Shadow Banking Networks

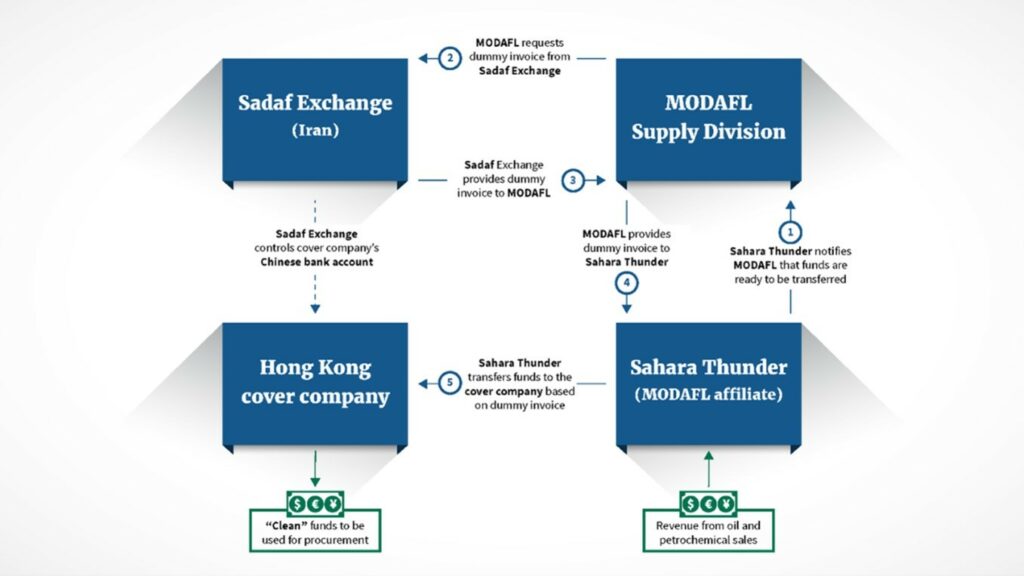

Shadow banking networks have been used by MODAFL and the IRGC to gain illicit access to the international financial system and process the equivalent of billions of dollars since 2020. The networks are multi-jurisdictional illicit finance systems which grant sanctioned Iranian entities access to the international financial system and obfuscate their trade with foreign customers. OFAC provided the chart below illustrating how the MODAFL Supply Division uses exchange houses in Iran that manage numerous cover companies registered in permissive jurisdictions such as Hong Kong or the UAE to launder the revenue generated through foreign commercial activity, including oil sales conducted by previously designated MODAFL affiliate Sahara Thunder, into clean foreign currency.

Networks of Iranian exchange houses and dozens of clandestine shell companies under the network has allowed MODAFL and the IRGC to disguise revenue generated abroad to use for a range of their activities including the procurement of advanced weapons systems such as unmanned aerial vehicles (“UAVs”). Such revenue has also been tied to supporting the provision of weapons to Iran’s regional proxy groups including Yemen’s Houthis, as well as the transfer of UAVs to Russia for use in its invasion of Ukraine.

OFAC Designations

Following the illustration above, OFAC issued sanctions targeting entities at several levels of such clandestine networks. OFAC sanctioned the following individuals and entities:

- OFAC designated Seyyed Mohammad Mosanna’i Najibi (“Najibi”) and Seyyed Mohammad Mosanna’i Najibi & Co. Company (“Sadaf Exchange”). Najibi is an Iranian-Turkish moneychanger who, since at least 2019, has managed several currency exchange businesses in Iran and Türkiye in coordination with the MODAFL Supply Division for the purpose of bypassing US and EU sanctions on Iran. Using Sadaf Exchange, Najibi has enabled the MODAFL Supply Division to conduct dollar-denominated transfers worth hundreds of millions of dollars to other MODAFL cover companies and exchange houses, including to Sahara Thunder and US designated Ansar Exchange. Najibi, Sadaf Exchange, and another involved entity Najibi owns, Golden Stars Kiymetli Madenler Tekstil Sanayi Ticaret Limited Sirketi, were all designated pursuant to E.O. 13224

- OFAC designated Omid Sepah Exchange Company (“Omid Sepah”) and Hekmat Iranian Exchange & Foreign Currency Services Company (“Hekmat Iranian”). Omid Sepah and Hekmat Iranian are Tehran-based currency exchange businesses controlled by US designated Bank Sepah that use foreign cover companies to engage in shadow banking transactions on behalf of the MODAFL Supply Division, in collaboration with Najibi and Sadaf Exchange.

- OFAC also designated 27 cover companies based in Hong Kong, the UAE, and the Marshall Islands that are controlled by Najibi. These companies have collectively moved hundreds of millions for dollars’ worth of revenue for MODAFL related to oil and petrochemical sales or foreign currency exchange operations. The cover companies are all being designated pursuant to E.O. 13224, for having materially assisted, sponsored, or provided financial, material, or technological support for, or goods or services to or in support of, MODAFL.

- OFAC re-designated Iranian moneychanger Asadollah Seifi (“Seifi”) for his continued involvement in sanctions evasion schemes, following his March 26, 2019 designation pursuant to E.O. 13224 for providing material support to a vast currency exchange network which supported both the IRGC and MODAFL. Seifi conducts sanctions evasion activities in support of the MODAFL Supply Division in Emirati dirham through UAE based shell companies. Seifi also establishes shell companies and accounts for MODAFL’s use, converts or transports foreign currency using couriers, retrieves revenue from oil and petrochemical sales through cover companies, and transfers foreign currency to suppliers of the IRGC.

- OFAC also designated five shell companies based in the UAE that were controlled and used by Seifi to obfuscate MODAFL’s financial activity under E.O. 13224.

- OFAC designated Ramin Jalalian (“Jalalian”) is an Iranian currency exchanger and businessman who has managed several currency exchange businesses in Iran and the UAE in coordination with the MODAFL Supply Division for the purpose of bypassing US and EU sanctions on Iran.

- Two shell companies based in the UAE, and one based in Hong Kong, controlled by Jalalian and used to obfuscate MODAFL’s financial activity, were also designated. Ramin Jalalian and the two shell entities are all being designated pursuant to E.O. 13224.

- OFAC designated Siavash Nourian (“Siavash”) the owner of Iranian exchange house Siavash Nourian & Co. Exchange (“Nourian Exchange”), which is used by the MODAFL Supply Division for a wide range for foreign currency activities, including establishing cover companies and accounts, holding MODAFL’s money in cover accounts outside of Iran, converting foreign currency, transporting foreign currency using couriers, retrieving revenue from MODAFL’s oil and petrochemical sales, and transferring currency to suppliers of MODAFL and the IRGC.

- Three shell companies based in Hong Kong and controlled by Nourian Exchange for the purpose of conducting foreign currency transfers on behalf of MODAFL were also designated. Siavash Nourian, Nourian Exchange, and the three shell entities are all being designated pursuant to E.O. 13224.

- OFAC designated Seyyed Reza Mir Mohammad Ali (“Mir Mohammad Ali”) a key confidant of the MODAFL Supply Division and the CEO and owner of Iran-based Atropars Company (“Atropars Exchange”), another exchange house that the MODAFL Supply Division uses to conduct financial activity outside of Iran. Mir Mohammad Ali establishes cover companies and financial accounts for the MODAFL Supply Division’s use, holds MODAFL funds in cover accounts outside of Iran, conducts foreign currency exchange, transports foreign currency to and from Iran using cover companies and couriers, and transfers foreign currency to suppliers of the IRGC and MODAFL. Between March 2022 and March 2023, Atropars Exchange processed the equivalent of over $40 million in euros in incoming and outcoming transfers. Seyyed Reza Mir Mohammad Ali and Atropars Exchange are being designated pursuant to E.O. 13224.

For a full list of all the individuals and entities designated in this action please refer to this link.

OFAC Designation Implications

As a result of OFAC’s designations, all property and interests in property of the persons above that are in the United States or in the possession or control of US persons are blocked and must be reported to OFAC. In addition, any entities that are owned, directly or indirectly, 50 percent or more by one or more blocked persons are also blocked. All transactions by US persons or within (or transiting) the United States that involve any property or interests in property of designated or blocked persons are prohibited unless authorized by a general or specific license issued by OFAC or exempt. These prohibitions include the making of any contribution or provision of funds, goods, or services by, to, or for the benefit of any blocked person and the receipt of any contribution or provision of funds, goods, or services from any such person.

For further information, please contact:

Jonathan Cross, Partner, Herbert Smith Freehills

jonathan.cross@hsf.com