On August 30, the U.S. Department of the Treasury (“Treasury”) published in the Federal Register proposed regulations addressing the prevailing wage and apprenticeship (“PWA”) requirements under Sections 45(b)(7) and (8) of the Inflation Reduction Act (“IRA”). These proposed regulations incorporate and supplement the limited guidance issued previously, which includes Notice 2022-61, published by the Treasury in November 2022, as well as the Frequently Asked Questions (“FAQ”) on the Department of Labor’s IRA website. The proposed regulations shed light on various issues of significance to taxpayers seeking the enhanced tax credits provided by the IRA, as well as other stakeholders.

Key Definition Provisions

The proposed regulations define several key terms relating to the PWA requirements. Notably, “construction, alteration, or repair” is defined to exclude “work that is ordinary and regular in nature that is designed to maintain and preserve existing functionalities of a facility after it is placed in service,” including basic maintenance. Basic maintenance that occurs before the facility is placed in service, however, may constitute construction for which PWA requirements may apply. Additionally, the proposed regulations specify that work that improves a facility, adapts it for a different use, or restores functionality as a result of inoperability is not routine maintenance, and therefore PWA requirements apply regardless of the time in which such work is performed. The proposed regulations also clarify the circumstances under which the locality of a facility includes secondary construction sites. PWA requirements apply at secondary construction sites when:

- A significant portion of the facility is constructed at the secondary location – a “significant portion” requires that one or more entire portions or modules of the facility be completed at the secondary site, not merely construction of materials or prefabricated component parts;

- Construction is for specific use at that facility and does not simply reflect the manufacture or construction of a product available to the general public; and

- The site is established either specifically for, or dedicated exclusively for a specific period of time to, the construction, alteration, or repair of the facility.

Incorporation of the Davis Bacon Act

While the FAQ explicitly stated that certain definitions from the Davis Bacon Act (“DBA”) should be applied to the same or substantially similar terms in the IRA, the proposed regulations provide additional detail and explanation as to the extent to which DBA standards are to be incorporated into the IRA’s PWA requirements. The preamble to the proposed regulations explains that while the proposed regulations incorporate DBA guidance relating to wage determinations and the meaning of pertinent terms and phrases (including “laborer,” “mechanic,” “construction, alteration, or repair,” “wages,” and “employed”), the proposed regulations do not adopt DBA guidance where doing so would not be in furtherance of sound tax administration.

Specifically, the proposed regulations do not incorporate DBA provisions specific to the contractual relationship between federal agencies and contractors, nor do they incorporate the requirement of submission of weekly certified payroll records. Additionally, whereas the DBA requires employees to be paid weekly, the proposed regulations state only that laborers and mechanics must be paid “in the time and manner consistent with the regular payroll practices of the taxpayer, contractor, or subcontractor,” indicating that a weekly pay period is not required. State frequency of pay laws, of course, must be followed. Notably, the proposed regulations do adopt the review and appeal procedures available to any interested party under the DBA with respect to wage determinations.

Taxpayer Responsibility

The proposed regulations make clear that the ultimate responsibility to satisfy the PWA requirements of the IRA in order to earn enhanced credit rests with the taxpayer, regardless of whether the taxpayer directly employs laborers and mechanics. Although the PWA requirements apply throughout the qualifying project, the obligation to satisfy PWA requirements does not become binding until the taxpayer files a tax return claiming the enhanced credits. The proposed regulations clarify, moreover, that a taxpayer deemed to be ineligible for the enhanced credit may still be entitled to the base amount of the renewable electricity production credit under Section 45(a) without satisfying PWA requirements.

Taxpayers eligible for the credits under Sections 30C, 45, 45Q, 45U, 45V, 45Z, 48 or 48E may transfer credits to unrelated third parties. For a more detailed discussion regarding the transferability of credits under the IRA, please refer to our previous client alert here.

Prevailing Wage Requirements

With regard to the prevailing wage requirements of the IRA, the proposed regulations attempt to clarify, among other things, (i) the procedures for obtaining wage determinations; (ii) the application of the provisions allowing a taxpayer to cure a failure to pay prevailing wages by making correction and penalty payments; and (iii) the standard by which to determine whether a taxpayer has “intentionally disregarded” the prevailing wage requirements.

Obtaining a Wage Determination

The proposed regulations describe two types of wage determinations: (1) a general wage determination in effect for the specified type of covered work in the geographic area in which the construction is performed; and (2) a supplemental wage determination to be obtained in situations in which no general wage determination covering the necessary geographic area or labor classification exists. Requests for a supplemental wage determination are to be emailed to the U.S. Department of Labor, Wage and Hour Division no more than 90 days before the beginning of construction, alteration, or repair, or as soon as practicable if the need for the request cannot be determined prior to the beginning of the project. The proposed regulations provide a detailed list of information to be included in a supplemental wage determination request, including the applicable general wage determination(s), if any, a description of the work to be performed, the geographic area, the start date of construction, the labor classification needed, the duties to be performed, the proposed wage rate, including any bona fide fringe benefits, any pertinent wage rate information, and any additional relevant information. The proposed regulations also state that, for a facility located in an offshore area for which a wage determination is not available, a taxpayer, contractor, or subcontractor may rely on the general wage determination for the geographic area closest to the location of the facility. Apprentices may be paid wages less than prevailing wages, expressed as a percentage of the journeyworker hourly rate, when they are employed pursuant to a registered apprenticeship program and working in a classification that is part of the occupation of that program.

The proposed regulations clarify that the applicable wage determination is to be determined at the time the construction, alteration, or repair begins and remains valid for the duration of the work performed by that taxpayer, contractor, or subcontractor. A new wage determination is required if additional construction, alteration, or repair work that was not within the original scope of work is undertaken. In the event a supplemental wage determination is issued after the beginning of construction, it is deemed to apply retroactively to the date construction began. While the proposed regulations are silent as to who is required to furnish the wage determination, the taxpayer bears the ultimate responsibility for ensuring that the correct wage determination is used. Stakeholders should consider this risk allocation in contract negotiations and establishing compliance procedures.

Correction and Penalty Payments

In the event a taxpayer fails to ensure that all laborers and mechanics are paid prevailing wages, the IRA allows a taxpayer to cure such failure by making a correction payment (with enhanced interest) to the worker and a penalty payment. Under the proposed regulations, deficiency procedures under subchapter B of chapter 63 of the Internal Revenue Code do not apply to penalty payments for prevailing wage underpayments, but a determination by the IRS disallowing a claim for the enhanced tax credit will be subject to such deficiency procedures.

Notably, the examples provided by the proposed regulations make clear that the correction and penalty provisions apply even in cases in which a taxpayer has self-corrected prior underpayments. The proposed regulations, however, provide an exception for cases in which a wage determination was requested but not issued by the Department of Labor until after the start of construction, and the taxpayer ensures that the laborer or mechanic is paid the difference between the determination and the amount previously paid within 30 days of the issuance of the determination. The proposed regulations also provide for a waiver of the penalty payment if (i) the taxpayer makes a correction payment (including enhanced interest) by the earlier of 30 days after the taxpayer became aware of the error or the date on which enhanced tax credit is claimed, and (ii) either (a) the underpayment is for not more than 10 percent of all pay periods of the calendar year for which the laborer or mechanic was employed, or (b) the difference between the amount paid and the amount required to be paid is not greater than 2.5 percent of the amount required to be paid. No penalty payment is required for work done pursuant to a qualifying project labor agreement, as defined in the proposed regulations.

The preamble to the proposed regulations also clarifies that correction payments must be made even when the laborer or mechanic to whom the correction payment is due can no longer be located. In that case, the taxpayer must look to state rules regarding payment of wages to former laborers and mechanics who cannot be located.

Intentional Disregard

The proposed regulations provide that whether a failure to pay prevailing wages is due to “intentional disregard” will be determined based on an analysis of the “facts and circumstances,” including but not limited to:

- Whether there was a pattern of conduct including repeated or systemic failures to ensure that prevailing wages were paid;

- Whether the taxpayer failed to take steps to determine the applicable classifications and prevailing wage rates;

- Whether the taxpayer promptly cured any failures to pay prevailing wage rates;

- Whether the taxpayer has previously been required to make a penalty payment;

- Whether the taxpayer undertook at least quarterly reviews of wages paid;

- Whether the taxpayer included payment of prevailing wages and recordkeeping requirements in contracts entered into with contractors and subcontractors;

- Whether the taxpayer posted in a prominent place in the facility or otherwise provided written notice of the applicable wage rates, and

- Whether the taxpayer had in place procedures for laborers and mechanics to report suspected failure to pay prevailing wages.

The proposed regulations also create a rebuttable presumption of no intentional disregard if the taxpayer makes the correction and penalty payments prior to receiving notice of an audit.

Apprenticeship Requirements

The proposed regulations also elaborate on the IRA’s apprenticeship requirements, including (i) the interaction between the “Labor Hours,” “Ratio,” and “Participation” requirements (defined in Section 45(b)(8)(A)-(C)), (ii) the “Good Faith Effort exception” (defined in Section 45(b)(8)(D)(ii)), and (iii) the penalty payment required to cure noncompliance with the apprenticeship requirements.

Labor Hours, Ratio, and Participation Requirements

The proposed regulations clarify that the IRA requires satisfaction of each of the three apprenticeship requirements: Labor Hours, Ratio, and Participation. The Labor Hours requirement, which requires the taxpayer to ensure that the applicable percentage of the total labor hours for a covered project is performed by qualified apprentices, is subject to a daily Ratio requirement, which is set by the Department of Labor or applicable State apprenticeship agency. For any day on which the required ratio of apprentices to journeyworkers is not satisfied, the labor hours performed by any apprentices in excess of the ratio would not only need to be paid at the prevailing wage rate for journeyworkers, but also may not be counted toward the Labor Hours requirement. In contrast to the Ratio requirement, which must be satisfied on a daily basis, the preamble to the proposed regulations clarifies that the Participation requirement is not a daily requirement.

Faith Effort Exception

According to the proposed regulations, the Good Faith Effort Exception requires a taxpayer, contractor, or subcontractor to submit a written request for qualified apprentices to at least one registered program which (i) has a geographic area of operation that includes the location of the facility, or to a registered apprenticeship program that can reasonably be expected to provide apprentices to the location of the facility, (ii) trains apprentices in the occupations needed, and (iii) has a usual and customary business practice of entering into agreements for placement of apprentices. The request must contain the proposed dates of employment, occupation of apprentices needed, location of the work to be performed, number of apprentices needed, expected number of labor hours, and a statement that the request is made with an intent to employ apprentices in the occupation for which they are being trained and in accordance with the requirements and standards of the registered apprenticeship program. The examples provided in the proposed regulations make clear that the party intending to employ and train the registered apprentices is the proper party to make the request, meaning that a taxpayer should not submit a request to a registered apprenticeship program for apprentices to be employed by a contractor or subcontractor, even though the taxpayer will bear the ultimate responsibility for substantiating that the Good Faith Effort Exception has been satisfied.

The Good Faith Effort Exception will apply for 120 days from the date of the request if the request is denied or no response is received within five business days of receipt of the request. After 120 days, the Good Faith Effort Exception will no longer apply unless an additional request is submitted. In the event of a denial, a taxpayer may only claim the Good Faith Effort Exception with respect to the portion(s) of the request that were denied, meaning that if a registered program agrees to provide some number of apprentices but cannot satisfy the request in full, the Good Faith Effort Exception will apply only as to the parts of the request that the program cannot meet. The taxpayer will be required to satisfy the apprenticeship requirements to the extent of the program’s ability to meet them.

Penalty Payments and Intentional Disregard

The IRA provides taxpayers the ability to cure failures to meet the Labor Hours and Participation requirements by paying a penalty, or an enhanced penalty in cases involving intentional disregard. The facts and circumstances to be considered in determining whether a failure to satisfy the apprenticeship requirements is due to intentional disregard are similar to those to be considered for failure to pay prevailing wages. The proposed regulations create a rebuttable presumption that the failure is not due to intentional disregard if the penalty payment is made prior to a taxpayer receiving notice of an audit. Payments of enhanced penalties due to intentional disregard are subject to the deficiency procedures of the Internal Revenue Code. No penalty is required to cure a failure to satisfy the apprenticeship requirements where the work is performed pursuant to a qualifying project labor agreement.

Recordkeeping Requirements

The proposed regulations provide specific requirements for taxpayers claiming credits in connection with PWA requirements. According to the regulations, when taxpayers file their return, they must provide the following information:

- the location and type of qualified facility;

- the applicable wage determinations for the type and location of the facility;

- the wages paid (including any correction payments) and hours worked for each of the laborer or mechanic classifications engaged in the construction, alteration, or repair of the facility;

- the number of workers who received correction payments;

- the wages paid and hours worked by qualified apprentices for each of the laborer or mechanic classifications engaged in the construction, alteration, or repair of the facility;

- the total labor hours for the construction, alteration, or repair of the facility by any laborer or mechanic employed by the taxpayer or any contractor or subcontractor, and

- the total credit claimed.

For prevailing wage requirements, the regulations require that taxpayers claiming the credit must keep a record of the payrolls for mechanics and laborers who construct, alter, or repair any qualified facility. Taxpayers must meet this requirement regardless of whether the employee was a direct employee or an employee for a contractor or subcontractor.

If the claimed credit has an apprenticeship requirement, then the taxpayer must maintain records that support its contention that the apprenticeship met the Labor Hours Requirement, Ratio Requirement, and Participation Requirement. Documents that may be sufficient to establish these requirements include agreements for a registered apprenticeship program, documents that show the ratio of apprentices to journeyworkers (including daily ratios), payroll records, and records of each apprentice’s registration in the apprenticeship program. As with the prevailing wage requirements noted above, taxpayers must maintain these records regardless of whether the employee was a direct employee or an employee of a contractor or subcontractor.

Overall, in the event of an audit, these records will help taxpayers verify their eligibility for claimed credits.

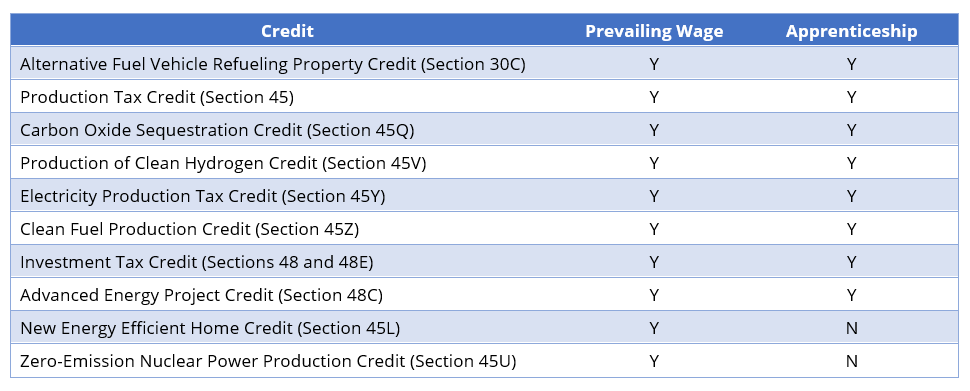

Applicability:

PWA requirements apply to various tax credits available under the IRA, as shown in the below chart:

Action Items

These regulations, coupled with the recent changes to the DBA rules, have significant implications for current and upcoming projects. Stakeholders involved in projects with PWA requirements should consider submitting comments to the proposed regulations, which are due October 30, 2023 and attending the public hearing scheduled for November 21, 2023.

Attorneys at Crowell & Moring have been following these developments carefully and are available to discuss the likely impact of these regulations and how stakeholders should best position themselves to ensure eligibility for enhanced credits.

For further information, please contact:

Eric Su, Partner, Crowell & Moring

esu@crowell.com