1. Presentation of the question

Litigation preservation liability insurance is a hot topic in recent years. Under litigation preservation liability insurance, in addition to issuing an insurance policy to the insured (i.e., the preservation applicant), the insurance company also needs to provide a guarantee letter (policy guarantee letter) to the court[1], the insurance company needs to specify in the letter of guarantee that it “assumes joint and several liability” with the insured. Therefore, when filing a lawsuit for compensation for preservation errors, the preserved person will generally sue the insurance company as a joint defendant based on the letter of guarantee.

In this case, the insurance company’s liability under litigation liability insurance is different from other liability insurance: on the one hand, whether the court judges the insurance company to bear the liability for the insured depends mainly on the insured (that is, the preservation application People) are at fault in the basic litigation preservation process, but basically do not review the insurance contract relationship between the insurance company and the insured. On the other hand, the time point when the parties apply for property preservation is generally at the filing stage, so the insurance company may only require the insured to provide preliminary evidence (evidence proving the existence of a legal relationship, such as a loan contract, payment certificate, etc.) ), it is impossible to confirm the authenticity and completeness of the information provided by the insured, and it is also impossible to know the defenses raised by the insured in the subsequent court hearing (for example, the insured has actually paid off the loan, and the preservation applicant also exists default, etc.).

A problem arises from this, that is, if the insured fails to disclose the true facts or complete facts of the case to the insurance company when applying for insurance, which leads to a preservation error, the insurance company is judged by the court to bear the compensation in the preservation error compensation lawsuit Liability, then does the insurance company have the right to recover from the insured? Especially in some difficult and complicated high-risk cases, the insurance company may require the insured (preservation applicant) to issue a counter-guarantee letter or a letter of commitment before underwriting the insurance to fully cover the insurance company’s possible compensation liability. How does the court determine the effectiveness of such counter-guarantee letters? These are issues to be analyzed and discussed. At present, judicial practice cases and research on such issues are relatively rare, so this article will try to conduct a preliminary discussion on this issue based on current legal regulations and judicial cases for readers’ reference.

2. Under the liability insurance, the basis for the insurer to exercise the right of recovery

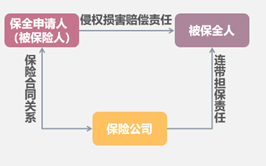

As mentioned above, “in the performance of the litigation preservation liability insurance contract, there are internal and external legal relationships. Internally, the insurance contract relationship is formed by the insurer, the policyholder, and the insured. The arrangement shall comply with the mandatory provisions of the Insurance Law and other laws and regulations; externally, the insurer shall provide the court in the form of a letter of guarantee for litigation property preservation liability insurance in accordance with Article 7 of the Provisions of the Supreme People’s Court on Several Issues Concerning the Handling of Property Preservation Cases. Judicial preservation guarantee. Once the guarantee letter is approved by the court, it will be used as a judicial guarantee document to maintain a stable guarantee effect during the entire process of judicial preservation, and it cannot be freely withdrawn or released.”[2](See the figure below for details).

Therefore, regarding the basis for whether the insurer can exercise the right of recourse against the insured, it is also necessary to combine the dual legal relationship between the insurer and the insured (preservation applicant) under the liability insurance (that is, the insurance contract relationship and the joint guarantee). relationship) for analysis: From the point of view of the legal relationship of the insurance contract, according to Article 60 of the “Insurance Law”[3], after assuming the insurance liability, the insurer naturally cannot exercise the right of subrogation to the insured; and from the point of view of the legal relationship of guarantee, after assuming the guarantee liability, the guarantor has the right to recover from the principal debtor according to law[4]. Therefore, the recovery of the insured by the liability insurance insurer is actually similar to the right of recovery exercised by the guarantor against the principal debtor after assuming the guarantee liability.

With regard to the issue of the insurer exercising the right to recover compensation from liability insurance, the Higher People’s Court of Guangxi Zhuang Autonomous Region in the (2020) Gui Min Zhong No. 1017 case and the Wuxi Intermediate People’s Court in the (2021) Su 02 Min Zhong No. The right of recovery under legal relationship is discussed in detail.

Among them, the Intermediate People’s Court of Wuxi City held that “the guarantee scope of the “Policy Guarantee Letter” issued by the insurance company to the court is usually greater than the insurance liability scope of the litigation preservation liability insurance… Can the insurance company in the litigation preservation liability insurance settle the claim to the court? The insured should not only pay attention to the guarantee legal relationship of litigation preservation liability insurance and determine that it can be recovered, but should consider the characteristics of the dual legal relationship of guarantee and insurance in litigation preservation liability insurance comprehensively.

The above-mentioned effective judgment further holds that if the insured violates the provisions of the insurance law or the corresponding obligations stipulated in the insurance contract, the insurance company may seek compensation from the insured after assuming the indemnity obligation to the insured. This can not only ensure that the insured’s legal property rights and interests can be effectively compensated for losses, but also prevent the insured from abusing litigation preservation methods based on the insurance contract provided by the insurance company, and prevent the occurrence of moral hazard. However, if the insurance company has no reasons for refusing compensation (for example, although the insurance company claims that the policyholder has not fulfilled the obligation of truthful disclosure, but the insurance company does not terminate the insurance contract within the exclusion period, etc.), the insurance company shall perform the compensation obligation in accordance with the insurance contract. Therefore, the insurance company’s right to guarantee recovery against the insured and the insured’s right to claim payment of insurance money from the insurance company constitute an offset in essence. In this case, the insurance company has no right to claim recovery from the insured.

Therefore, it can be seen from the above cases that in judicial practice, the issue of whether an insurance company can exercise the right of recourse against the insured mainly depends on whether the insurance company enjoys the right not to pay insurance money under the liability insurance contract. Condition.

3. In practice, the main situations in which insurance companies exercise their right of recourse

In current judicial practice, the main situations in which an insurance company exercises its right of recovery include:

First, the policyholder failed to fulfill the obligation of truthful disclosure.

Paragraphs 2 to 5 of Article 16 of the “Insurance Law” stipulates: “The insured fails to fulfill the truthfulness stipulated in the preceding paragraph intentionally or due to gross negligence.Obligation to inform, enough to influence the insurer to decide whether to agree to underwrite or to increaseinsurance rateIf so, the insurer has the right to terminate the contract. The right to terminate the contract stipulated in the preceding paragraph shall be extinguished if the insurer does not exercise it within 30 days from the day when the insurer knows that there is a reason for termination. If more than two years have elapsed since the date of establishment of the contract, the insurer shall not terminate the contract; in the event of an insured accident, the insurer shall be liable for compensation or payment of insurance money. If the policyholder deliberately fails to perform the obligation of truthful disclosure, the insurer shall not be liable for compensation or payment of insurance benefits for insured events that occurred before the termination of the contract, and the insurance premium shall not be refunded. If the policyholder fails to perform the obligation of truthful notification due to gross negligence, which has a serious impact on the occurrence of the insured event, the insurer shall not be liable for compensation or payment of insurance benefits for the insured event that occurred before the termination of the contract, but shall refund the insurance premium. ”

For example, in the (2021) Su 02 Min Zhong No. 5952 and (2023) Min 0902 Min Chu No. 197 cases, the insurance company mainly claimed the right not to pay the insurance money on the grounds that the policyholder failed to fulfill the obligation of truthful disclosure . However, since in these two cases, the insurance company did not claim to terminate the insurance contract within the period for exercising the right to terminate the contract stipulated in Article 16 of the Insurance Law, the court held that the insurance company should still perform the compensation liability in accordance with the insurance contract. Therefore, there is no right to exercise the right of recourse.

Second, the insurance applicant or the insured provided false materials in the insurance application and basic litigation, which violated the insurance clauses and the relevant provisions of Article 5 of the Insurance Law.

For example, in the (2021) Lu 06 Min Zhong No. 8019 case, since the key evidence submitted by the insured in the basic lawsuit was found by the court to be “seriously flawed and doubtful in terms of authenticity and validity”, the court was unable to compensate for wrongful preservation. In the lawsuit, the insured and the insurance company were judged to compensate the insured for their economic losses.

Afterwards, the insurance company filed a lawsuit for recourse against the insured. In the right of recourse litigation, the court held that: First, Article 10 of the insurance clause stipulates that “the insured violated the obligations stipulated in the above Articles 8 and 9 and the “Insurance Law of the People’s Republic of China” and caused the loss of the respondent, the insurer The respondent should be paid in advance, but the insurer has the right to recover from the insured.” Secondly, because the insured submitted flawed evidence of doubtful authenticity in the basic lawsuit, the behavior of the insured violated the “Chinese People’s The duty of good faith stipulated in Article 5 of the Insurance Law of the Republic of China that “the parties to insurance activities shall exercise their rights and perform their obligations in accordance with the principle of good faith”. Based on the above circumstances, the court held that the insurance company has the right to claim recourse against the insured in accordance with Article 10 of the insurance clause.

Third, the insured failed to fulfill the obligation of reporting the “significant progress” stipulated in the insurance clause.

For example, in the (2020) Gui Min Zhong No. 1017 case (retrial case No. (2021) Supreme Court Min Shen No. 3799), the court held that: Article 13 of the insurance clause stipulates: “The insured shall Inform the insurer of any major progress in the creditor’s rights and debt dispute case within 20 days from the date it knows or should know, including but not limited to the suspension of the case, rejection of the prosecution, mediation or judgment, etc. that are important to the progress of the case. In addition, it does not limit the disclosure obligation of the insured to the time of insurance application, nor does it require the insurer to ask the insured before it needs to notify. According to the facts ascertained by the court, the insured did not inform the insurance company of the progress of the case during the trial of the basic lawsuit, nor did it provide evidence materials submitted by other parties to the case. Based on the above facts, the court determined that the insured had violated the agreement in Article 13 of the insurance clause, and further determined that the insurance company had the right of recovery.

However, it should be noted that there are also contrary court cases regarding the issue of whether the insurer can exercise the right of recovery for the insured’s failure to fulfill the obligation of reporting “significant progress”. For example, in the (2021) Su 06 Min Zhong No. 4238 case, the court held that although the insured failed to fully disclose the obligation after purchasing the insurance, the insurance company also failed to provide proof that the resulting increase in the risk of the insured object , so the insurance company still has to bear the insurance liability, and thus does not enjoy the right of recovery.

Fourth, the risk level of the subject matter of insurance has increased significantly, but the insured failed to perform the notification obligation.

Article 52 of the “Insurance Law” stipulates: “During the validity period of the contract, if the risk of the subject matter of insurance increases significantly, the insured shall promptly notify the insurer according to the contract, and the insurer may increase the insurance premium or terminate the contract according to the contract. If the insurer rescinds the contract, it shall return the insurance premium collected to the policyholder after deducting the receivable part from the date of insurance liability initiation to the date of rescission of the contract according to the contract. Where there is no notification obligation, the insurer shall not be liable for indemnity for an insured event that occurs due to a significant increase in the degree of danger of the subject matter insured.”

For example, in the (2019) Su 01 Min Zhong No. 9254 case, the basic lawsuit was a decoration contract dispute. In the basic lawsuit trial, the appraisal company conducted the appraisal of the project cost, and the final cost amount was far lower than that of the insured , but the insured did not change the claim or reduce the preservation amount. Accordingly, the court held that with the continuous advancement of the basic litigation, the key facts involved in the case have changed significantly after the project cost appraisal results were issued, and the insured’s subjective cognition of the basic case is also significantly different from when the lawsuit was filed and the property preservation application was filed. However, the insured has been slack in notifying the insurance company of the fact that the risk has increased significantly. Therefore, the insurance company has the right not to Bear the liability for compensation and enjoy the right of recourse against the insured accordingly.

Fifth, the insured issues a letter of commitment or a letter of counter-guarantee to the insurance company.

As mentioned above, in some difficult and complicated high-risk cases, the insurance company may require the insured (preservation applicant) to issue a counter-guarantee letter or letter of commitment before underwriting the insurance to fully cover the insurance company’s possible compensation liability . In this regard, in the (2021) Su 02 Minzhong No. 5952 case, the court held that if the relevant commitment letter or counter-guarantee letter only involved the insured’s commitment to compensate the insurance company because it “bears losses or expenses that are not covered by the insurance company’s compensation” However, if the relevant commitment letter or counter-guarantee letter changes the nature of the liability insurance not being able to recover (subrogation) from the insured, it shall be an invalid clause. In this case, the insurance company should still claim its rights in accordance with the relevant provisions of the “Insurance Law” and the insurance clauses.

Four. Summary

It can be seen from the above cases that, after the insurance company loses the lawsuit for the preservation of wrongful compensation, in some cases, it is still possible to recover part of the loss from the insured through the lawsuit of the right of recourse. Therefore, in order to preserve the right of follow-up recourse, the following suggestions are made:

First, as analyzed above, whether the insurance company can exercise the right of recourse against the insured mainly depends on whether the insurance company enjoys non-payment of insurance money under the liability insurance contract. Therefore, in the process of underwriting liability insurance, it is recommended that the insurance company require the policyholder to fulfill the obligation of truthful disclosure, explain the case in writing, and make a written commitment to provide the authenticity and completeness of the materials and information, etc. In addition, for the exemption clause in the insurance clause, it is also necessary to fulfill the obligation of prompting and explaining.

Second, in the lawsuit for compensation for wrongful preservation, the insurance company must actively respond to the lawsuit, and at the same time, it also needs to pay attention to the evidence and procedural flaws of the insured in the basic lawsuit, and pay attention to whether the insured has violated the law. insurance contract or insurance law.

Third, if the insurance company finds that the insured has not fulfilled the obligation of truthful notification, etc., the insurance company shall exercise the right to terminate the contract in a timely manner, and use this as the basis for the insurance company to claim that it should not bear the insurance liability in the subsequent right of recourse litigation.

annotation:

[1]Article 7 of the Provisions of the Supreme People’s Court on Several Issues Concerning the Handling of Property Preservation Cases by the People’s Courts (2020 Amendment): “Where the insurer provides guarantee for property preservation by signing a property preservation liability insurance contract with the applicant for preservation, it shall The people’s court shall issue a guarantee letter.”

[2](2020) Gui Min Zhong No. 1017 “Civil Judgment”, date of judgment: 2020.9.

[3]Paragraph 1 of Article 60 of the “Insurance Law”: “If an insured accident is caused by a third party’s damage to the subject matter of insurance, the insurer shall, from the date of indemnity to the insured, subrogate the insured within the scope of the indemnity amount. right of a person to claim compensation from a third party.”

[4]Article 700 of the “Civil Code”: “After the guarantor assumes the guaranty responsibility, unless otherwise agreed by the parties, he has the right to recover from the debtor within the scope of his guaranty responsibility, and enjoys the rights of the creditor against the debtor, but the interests of the creditor shall not be damaged. “