Is Your Business Ready For Malaysia’s Global Minimum Tax?

Introduction

Have you considered how the Global Minimum Tax (“GMT”) will impact your business in Malaysia? If your company benefits from tax incentives, could those advantages soon be reduced or even eliminated?

Malaysia has officially enacted the GMT legislation under the Finance (No. 2) Act 2023, aligning itself with over 140 jurisdictions in implementing the OECD’s Pillar Two tax framework. This initiative ensures that multinational enterprises (“MNEs”) contribute a fair share of taxes in all jurisdictions where they conduct businesses and generate profits. The primary objective is to curb profit shifting and tax avoidance strategies.1

Starting 1 January 2025, MNEs operating in Malaysia will need to ensure they meet a minimum effective tax rate (“ETR”) of 15%, or risk paying a top-up tax. This development is not just a compliance challenge—it reshapes the tax incentive landscape in Malaysia. With traditional tax incentives potentially becoming less effective, businesses must start reevaluating their tax strategies now.

Key Mechanisms under the GMT

The GMT framework introduces new taxation rights over MNEs that fall within its scope and are taxed below the globally agreed minimum rate of 15%. The tax is implemented through three interlocking mechanisms:2

- Qualified Domestic Minimum Top-Up Tax (“QDMTT”) – Ensures that a jurisdiction’s domestic law includes a minimum tax that calculates the Excess Profits of Constituent Entities within its jurisdiction in a manner consistent with the GloBE Rules. Malaysia is currently working to align its Domestic Top-up Tax (“DTT”) framework with the QDMTT requirements.

- Income Inclusion Rule (“IIR”) – Requires the parent entity to pay a minimum tax based on its ownership interests in entities with low-taxed income. The rule is primarily applied at the ultimate parent entity level and moves down the ownership chain. It also allows a parent entity with significant minority interests to apply the tax, preventing revenue loss from low-taxed income.3

- Under Taxed Profits Rule (“UTPR”) – Acts as a backstop, ensuring any remaining top-up tax not covered by the QDMTT and IIR is collected. It does this by making tax adjustments, such as denying deductions to increase the tax paid at the subsidiary level, ensuring the group pays its fair share of the remaining top-up tax.4

Who Is Affected?

GMT will apply to multinational corporations meeting the following criteria:

- Annual Revenue Threshold: Consolidated annual revenue of EUR 750 million or more in at least two of the four previous Fiscal Years (excluding the tested Fiscal Year); and5

- Cross-Border Presence: At least one entity outside Malaysia, including a subsidiary, branch, or permanent establishment, regardless of whether it generates income.6

- Labuan entities: Subject under the Labuan Business Activity Tax Act 1990; or7

- Chargeable Persons under the Petroleum (Income Tax) Act 1967: If a Constituent Entity is a member of an MNE Group.8

If an MNE’s ETR falls below 15%, it will be subject to top-up tax under the QDMTT, followed by the IIR, and finally the UTPR.9 These provisions apply to financial years starting on or after 1 January 2025. For an in-scope MNE group with a 12-month accounting period, the first applicable financial year will conclude on 31 December 2025, and the initial submission of the GloBE Information Return (“GIR”) and the Top-up Tax Return (“TTR”) must be completed within 18 months after the end of that financial year, falling on 30 June 2027.10

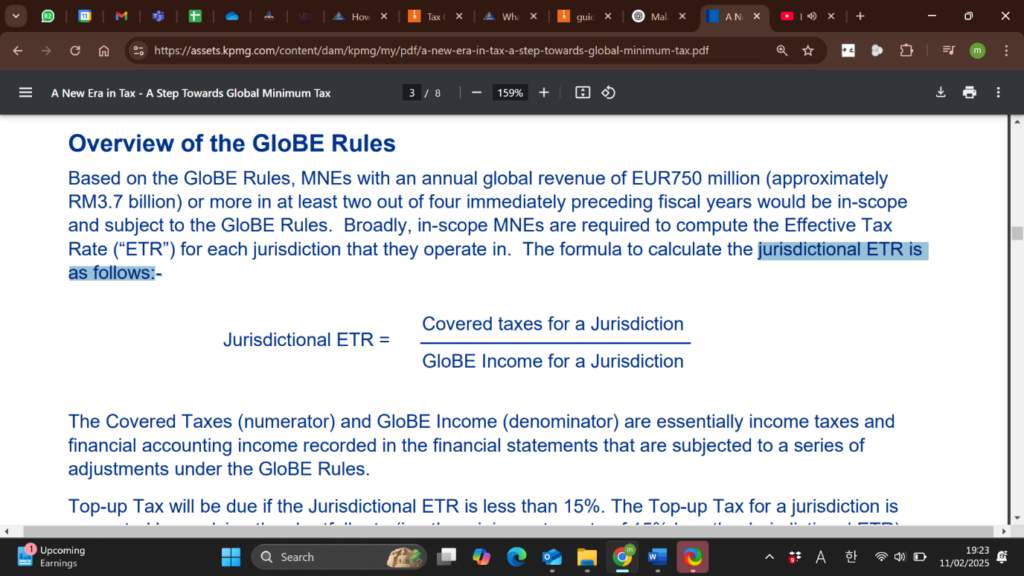

MNEs are required to compute the ETR for each jurisdiction in which they operate in. The formula to calculate jurisdictional ETR is as follows: –

This implementation demonstrates Malaysia’s dedication to preventing tax base erosion and profit shifting while ensuring its global market competitiveness. By adhering to international tax standards, this allows Malaysia to promote equitable taxation while still protect its tax revenue.

Are Malaysia’s Tax Incentives Still Beneficial?

With the GMT implementation, Malaysian businesses must evaluate whether existing tax incentives remain viable or whether they need restructuring. Some key considerations include:

- Jurisdictional Blending: GMT blends the tax positions of all qualifying entities within each jurisdiction. This means that even if a company enjoys a lower tax rate or an exemption, its overall ETR could still be pushed above 15% when combined with other in-scope entities.

- Exploring Alternative Tax Incentives: The Malaysian government has proposed a new Strategic Investment Tax Credit (“SITC”) as part of Budget 202511, which aims to provide GMT-compliant tax incentives.12 This approach aligns with the OECD’s Qualified Refundable Tax Credit (“QRTC”) under Pillar Two, ensuring that the credit is either refundable or treated as a cash payment and does not reduce the MNE’s ETR below the minimum 15%.

- Engaging with Tax Authorities: Given the complexity of GMT rules, businesses should proactively engage with tax authorities to determine the best way forward. Possible approaches include:

- Restructuring existing incentives (e.g., opting for reduced tax rates instead of full exemptions).

- Maximising tax allowances to optimise deductible expenses.

- Assessing the impact of Substance-Based Income Exclusions to reduce taxable profits.13

Conclusion: What Should Businesses Do Now?

The implementation of GMT in Malaysia signals a fundamental shift in corporate taxation. MNEs should act now to reassess their tax strategies.

Key takeaways at a glance:

| Key Issue | Impact of GMT | Next Steps |

| Minimum Tax Rate | Requires a 15% minimum ETR worldwide. | Conduct a tax impact assessment to evaluate whether your businesses or companies on the entity and jurisdictional level are expected to be liable for the top-up tax under GMT.14 |

| Jurisdictional Blending | Tax calculations aggregate all in-scope entities within each jurisdiction. | Review group-wide tax positioning under GMT and evaluate how blending affects overall ETR. |

| Tax Incentives | Traditional tax incentives may be less effective under GMT rules. | Consider restructuring incentives (e.g., SITC) and explore alternative tax strategies. |

| Compliance and Reporting | MNEs must file the GIR and TTR within 18 months after the first applicable financial year. | Develop internal compliance mechanisms, ensure accurate ETR calculations, and establish documentation processes to meet reporting obligations. |

| Engagement with Tax Authorities | Given the complexity of GMT rules, proactive discussions with tax authorities may be required. | Engage with tax authorities to clarify the applicability of GMT, restructure incentives, and leverage available guidance on compliance. |

The question is no longer if GMT will affect Malaysian businesses, but how. The impact of these changes will vary across industries, but one thing is clear: companies that take proactive steps now will be better positioned to navigate the new tax landscape.

For further information, please contact:

Dayang Roziekah Ussin, Partner, Azmi & Associates

dayang.roziekah@azmilaw.com

- Malaysian Investment Development Authority, ‘The Implementation of Global Minimum Tax (GMT) in Malaysia’ (https://www.mida.gov.my/the-implementation-of-global-minimum-tax-gmt-in-malaysia/).

- Deloitte, ‘GMT – A Wake-up Call for CFOs’ (https://www2.deloitte.com/my/en/pages/tax/articles/global-minimum-tax-ias12-cfo.html).

- Tax Challenges Arising from the Digitalisation of the Economy – Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023), Article 2.1.

- Ibid, Article 2.4.

- Ibid, Article 1.1.1.

- Guidelines, The Implementation of Global Minimum Tax in Malaysia.

- Ibid.

- Ibid.

- Deloitte, ‘Where are we on the Global Minimum Tax?’ (https://www2.deloitte.com/my/en/pages/tax/articles/where-are-we-on-gmt.html).

- LHDN Malaysia, ‘Frequently Asked Questions on the implementation of the Global Minimum Tax (GMT) in Malaysia’.

- Budget Speech 2025, Paragraph 112.

- KPMG, Tax News Flash on ‘Malaysia: Overview of direct tax measures in 2025 Budget’ (https://kpmg.com/us/en/taxnewsflash/news/2024/10/tnf-malaysia-direct-tax-measures-2025-budget.html?utm_source=chatgpt.com).

- Tax Challenges Arising from the Digitalisation of the Economy – Consolidated Commentary to the Global Anti-Base Erosion Model Rules (2023), Article 5.3.

- LHDN Malaysia, ‘Frequently Asked Questions on the implementation of the Global Minimum Tax (GMT) in Malaysia’.