6 February, 2017

In efforts towards global transparency, over 100 countries have agreed to automatically exchange information relating to financial accounts (AEOI) with each other under the Convention on Mutual Administrative Assistance in Tax Matters (Convention). The OECD had also developed the Common Reporting Standards (CRS) which set out the common information to be collected and reported by financial institutions of participating jurisdictions, for purposes of implementing AEOI locally.

As part of Malaysia's commitment to implement AEOI, Malaysia had:

a) on 27 January 2016, signed the Multilateral Competent Authority Agreement which details the rules on exchange of information between participating jurisdictions; and

b) on 25 August 2016, signed the Convention in view of fostering all forms of administrative assistance in tax matters with the other signatories of the Convention.

New Legislations in Malaysia

On 23 December 2016, the following legislations were introduced in Malaysia:

a) the Income Tax (Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information) Order 2016;

b) the Income Tax (Convention on Mutual Administrative Assistance in Tax Matters); and

c) Income Tax (Automatic Exchange of Financial Account Information) Rules 2016 (AEOI Rules).

Exchange of Information by Malaysia

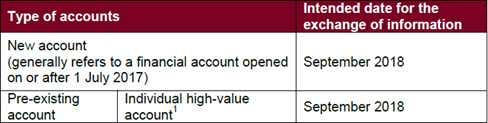

Under the new legislations, Malaysia has committed to exchange information with respect to different types of accounts opened and maintained by the Malaysian financial institutions in accordance with the following timelines:

The Inland Revenue Board of Malaysia (IRB) has announced that the first list of reportable jurisdictions will be published by 15 January 2018, and will be revised by 15 January of the following years.

Obligations of the Malaysian Financial Institutions

The AEOI Rules, which came into effect on 1 January 2017, implements the CRS in Malaysia, with certain modifications. The AEOI Rules apply to every Reporting Financial Institution, which is defined as a Financial Institution that is resident in Malaysia (excluding any branch of that Financial Institution that is located outside of Malaysia) and any branch of a Financial Institution that is not resident in Malaysia if that branch is located in Malaysia. A Financial Institution is defined under Section VIII of the CRS.

Under the AEOI Rules, every Reporting Financial Institution is required to comply with the following:

1. Due Diligence Requirements

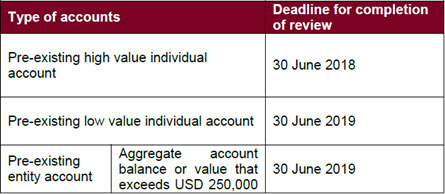

Each Reporting Financial Institution is required to identify the relevant reportable accounts maintained by the Reporting Financial Institution by applying the relevant due diligence procedures as prescribed under the CRS. There are different due diligence procedures depending on whether these are pre-existing accounts or new accounts, and whether such accounts are held by individuals or entities. The Reporting Financial Institutions are required to complete the due diligence review in respect of its account holders in accordance with the timeline below:

2. Reporting Obligations

Every Reporting Financial Institution is required to furnish an information return to the Director General of Inland Revenue (DGIR) on or before 30 June of the year following the calendar year to which the return relates. As such, the first reporting in respect of the calendar year 2017 will be required to be made to the DGIR by 30 June 2018. The reporting would need to be made via the IT platform maintained by the IRB, the details of which are expected to be released later this year.

The information return will need to contain certain details relating to each reportable account, including the name, address, jurisdiction(s) of residence, tax identification number(s) of the account holders, and the account balance or value as of the end of the relevant calendar year (or, if the account was closed during such year, the closure of the account).

New Penalties

The Finance Act 2016, which was gazetted on 16 January 2017, introduces new penalty provisions to the Malaysian Income Tax Act (MITA). Under the proposed new Sections 113A and 119B of the MITA, it is an offence for any person to make an incorrect or false return, or fail to comply with any rules made to implement or facilitate any mutual administrative assistance arrangement (including the AEOI Rules).

Any person who is convicted for an offence under these new provisions will be liable to a fine of not less than RM 20,000 and not more than RM 100,000 and / or imprisonment for a term not exceeding six months.

Key takeaways

Most of the players in the financial industry are Financial Institutions within the meaning of the CRS, including banks, insurance companies, brokers, investment funds and trust companies. However, the classification rules under the CRS and AEOI Rules are complex and it is important for the industry players to undertake a detailed assessment of their internal activities in determining how these rules apply to them.

With the introduction of the AEOI Rules, it is also timely for Malaysian financial institutions to review and refine the customer due diligence procedures and internal processes to ensure that reportable accounts are identified in accordance with the AEOI Rules. On-going monitoring for changes in circumstances is also crucial in ensuring that information relating to the account holder maintained by the financial institutions is accurate and up to date.

In light of the broad list of jurisdictions adopting and enforcing the AEOI, individual taxpayers should also be cognizant that the Malaysian government will receive financial information of Malaysian residents relating to bank accounts maintained outside of the country. For high-net-worth individuals in particular, AEOI and CRS would result in significantly increased transparency in relation to their financial assets and wealth management structures. In this regard, it would be prudent to undertake a review of the existing structures to consider if there are any historical non-compliance issues which need to be addressed via any applicable tax amnesty programmes or voluntary disclosure schemes. Tax and foreign exchange control rules will also need to be considered and assessed as the exchange of information will further bring in light any non-compliance in these areas.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com