2 August, 2018

Jiangsu sexual harassment rules place new obligations on employers

Employers in Jiangsu now have the most extensive obligations in the country to combat workplace sexual harassment against women pursuant to rules that came into effect on July 1, 2018. The province’s Special Provisions on Labor Protection of Female Employees require employers to develop and implement sexual harassment policies, provide training to all employees, ensure a work environment free of sexual harassment, create channels for employees to file harassment complaints, handle complaints in a timely manner, and protect the privacy of any employees involved in a complaint.

Significantly, the Special Provisions do not include a unique provision in an earlier draft that would have given female employees the right to unilaterally terminate their employment and receive severance pay if their employers did not fulfill any of the above obligations, even if the women have not themselves been sexually harassed. This provision would have made failure to protect female employees from sexual harassment grounds for constructive termination under Article 38(1) of the Labor Contract Law. This termination ground has usually been applied only when an employer has failed to protect employees from occupational injuries and illnesses.

The Special Provisions also introduce the following protection for female employees:

- A requirement of employers to seek the consent of any married female employee who is “preparing for pregnancy” to undertake work prohibited for pregnant workers, such as heavy physical labor or working in extreme temperatures. The new requirement would possibly be implemented by employers asking married female employees of child bearing age whether they are pregnant, or plan to soon become pregnant, before assigning them to such duties. The new rules do not give employers the right to make such inquiries when they are hiring employees.

- A “fetus protection leave”, which will provide employees in their first three months of pregnancy—regardless of whether they are married— with the right to take leave if they have a medical certificate recommending they do so. According to the Special Provisions, an employer would be permitted to reduce an employee’s salary during such a leave to 80% of the minimum wage. However, the drafters of the provisions, the Jiangsu branch of the All-China Federation of Trade Unions, have indicated that the leave would not be counted as use of an employee’s statutory medical treatment period. In 2017, Jiangxi province adopted a similar leave provision.

- Menstruation leave of 1-2 days would be available to employees when they experience menstrual cramps. Employers could require employees to submit medical certificates before granting the leave. Jiangsu joins Shanxi, Guangdong, Anhui, and Zhejiang provinces in providing menstruation leave.

- Employees going through menopause would be able to request less physically demanding work or alternative job positions, if recommended by a doctor. Guangdong, Guangxi and Shanxi provinces have also issued rules requiring employers to reduce the level of physical work for women going through menopause.

Shanghai court issues guidance on non-compete cases

The Shanghai First Intermediate People’s Court on July 5, 2018 released the details of five recommended non-compete cases, thereby providing guidance to employers on the enforceability of post-termination covenants. The cases were part of a report analyzing the 48 non-compete cases the court has decided from January 2015 to March 2018. Of these cases, 38 cases involved appeals filed by former employees challenging the enforceability of non-compete obligations and the imposition of liquidated damages.

The five recommended cases all related to disputes in which former employees had signed post-termination non-compete agreements with their former employers. The key judicial principles derived from the cases are as follows:

- A former employee is deemed to be competing with a former employer if the former employee is engaged in a business that is included in the registered business scope of the former employer.

- If a former employee runs a business that is not included in the registered business scope of the former employer, but such business has been agreed by the former employee and employer to be a competing business, the former employee can be in breach of a non-compete obligation if the former employer proves that it actually engages in such business.

- If a former employer has not paid the former employee non-compete compensation within three months of the former employee’s date of termination of employment, the former employee can give written notice at any time to the former employer terminating the non-compete obligation. If the former employee fails to provide such notice, the former employer can enforce the non-compete obligation, provided that accrued non-compete compensation is paid to the former employee.

- Non-compete obligations are enforceable against foreign national employees.

Foreign employees may face higher taxes under proposed rules

Income tax for many foreign nationals is expected to increase under proposed amendments to the Individual Income Tax (IIT) Law released on June 29, 2018, but will decrease for most PRC nationals. A period of public comment on the draft amendments ended on July 28, 2018 and it is expected that the finalized changes will be implemented on income earned from October 1, 2018.

Some of the key proposed changes include:

- The standard monthly personal deduction would be a uniform RMB 5,000, an increase from the current RMB 3,500 that applies to PRC nationals and from the RMB 4,800 for foreign nationals.

- Both PRC and foreign nationals would be entitled to deductions including children’s tuition, medical expenses, and housing rental expense.

- The top marginal IIT rates of 45%, 35%, and 30% wuld remain unchanged, but the current marginal rate of 25% would decrease to 20% or 10%, depending on an individual’s annual taxable income. The current marginal rate of 20% would come down to 10%, and the current marginal rate of 10% would be reduced to 3%.

- Salaries, wages, service income, and royalty fees would be aggregated as “comprehensive income” and would all be taxed at the same rates. This would represent a major change from the taxation of service income, such as fees paid to independent contractors, which is subject to a flat rate of 20%.

- The period for determining PRC resident taxpayer status of foreign nationals—as well as residents of Hong Kong, Taiwan and Macao—would be reduced from the current threshold of one-year of presence in China to 183 days, thereby more closely aligning with international practice. This change may result in more foreign nationals being subject to PRC tax on salaries and other income paid for services provided outside of China. The draft amendments also signal a possible overhaul of the IIT policies applicable to foreign nationals, such as the elimination of the“5-year rule”, and would mean that more foreign nationals in China would become subject to income tax on their worldwide income.

- Anti-tax avoidance rules would be introduced in order to provide legal grounds for the Chinese tax authorities to combat tax avoidance. More generally, the tax authorities are expected to tighten their supervision in the future, especially on high net income individuals and their transactions and business structure arrangements.

Under the proposed new tax rules, employers, as the statutory withholding agent, may find themselves facing greater complexity in calculating and withholding IIT for their employees. For example, it is not yet clear how an individual receiving service income from multiple payers would have the correct tax rate and deduction method applied to each payment source.

Fines possible for discriminatory job posts

Pursuant to a regulation issued on June 29, 2018 by the Ministry of Human Resources and Social Security, employers and their agents could be liable for fines if they post discriminatory job advertisements. The Interim Regulation on Human Resource Market, which will take effect on October 1, 2018, prohibits the posting of job advertisements that discriminate against applicants on the basis of characteristics such as ethnicity, race, gender, and religion. Employers found to have posted a violating advertisement could first be ordered by the labor bureau to remove the posting. If they fail to comply with such an order, they could then face a fine of between RMB 10,000 and RMB 50,000. These advertising rules supplement the general obligations on employers in the Labor Law and the Employment Promotion Law to not discriminate during recruitment and employment.

The new regulation also requires that job applicants should seek employment in good faith and provide basic personal information and job-specific information, such as their work experience and areas of specialized knowledge. While the regulation does not include possible sanctions, applicants who commit violations could face termination under the Labor Contract Law or other disciplinary action under employer rules.

Government proposes clarity on fines for work safety violations

Potential administrative fines for work safety violations were given greater clarity under draft rules issued on June 26, 2018 by the recently established Ministry of Emergency Management. The draft rules, which apply to all employers, are intended to provide more detailed guidance on the criteria for imposing administration penalties:

- “Main persons in charge of production and operation” (for example, company chairpersons or general managers) who breach a single duty of the Work Safety Law—there are seven duties in total—could face fines of between RMB 20,000-30,000. Those employers that violate two duties could be fined RMB 30,000-40,000 while those who breach three or more duties could be fined RMB 40,000-50,000.

- Employers that fail to provide work safety training to 30% of more of their staff could be fined RMB 40,000-50,000; for those failing to provide training to between 10% to 30% of their staff, the fine could be RMB 20,000-40,000; and for employers with less than 10% of staff who do not receive training, the fine could be a maximum of RMB 20,000.

- Any employer with more than 100 employees who does not establish written records of the measures taken to address potential unsafe working conditions or who fails to inform their employees of such measures could be fined RMB 20,000-30,000; employers with less than 100 employees who commit these types of violation could face fines of up to RMB 20,000.

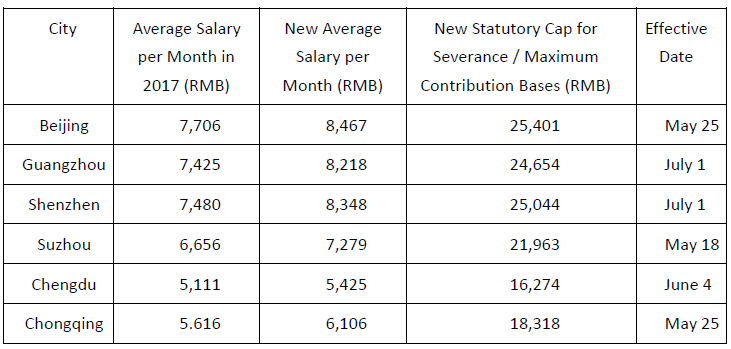

Statutory severance caps increase in major cities

Many employers in Beijing, Suzhou, Guangzhou, Shenzhen, Chengdu and Chongqing are likely to face higher severance obligations due to increases in benchmark salary figures announced this past spring by local labor bureaus. The cap on statutory severance is calculated at the rate of 300% of local average salaries while the average salary figures are also used as the basis for calculating maximum and minimum social insurance and housing fund contributions. The changes mean that many employers and employees in the cities will face increased contribution requirements.

The current average salaries and the new statutory caps and maximum contribution bases for the six cities are illustrated in the following chart:

Shanghai reduces employer occupational injury insurance rates

On May 1, 2018, in order to comply with a central government directive to reduce the burden on employers for funding the social insurance system, the Shanghai government reduced the employer contributions rates for occupational injury insurance by 50%.

Shanghai’s move came in response to an April 20, 2018 circular issued by the Ministry of Human Resources and Social Security. The circular has the aim to further implement a national policy, originally announced in June 2016, to control labor costs through reduced employer social insurance contributions rates, and thereby maintain China’s economic competitiveness.

Under the 2018 circular, local governments are required to cap employer contribution rates for pension insurance at 19% until April 30, 2019. In addition, through April 30, 2019, employers will be required to cap employer contributions for unemployment insurance at 0.5% and to reduce the employer contribution rate for occupational injury insurance by 50%.

China signs social insurance agreements with Japan and Serbia

Following negotiations that started back in 2011, China and Japan finally signed a social insurance agreement on May 9, 2018, exempting Chinese and Japanese nationals assigned to work in the other country from participation in statutory pension insurance.

Shortly thereafter, on June 7, 2018, China signed an agreement with Serbia, exempting Chinese and Serbian nationals assigned to work in the other country from participation in each other’s national statutory pension insurance and unemployment insurance plans.

The effective date of the agreements currently awaits domestic implementing legislation in China, Japan, and Serbia.

The PRC Social Insurance Law requires that foreign nationals working in China contribute to statutory social insurance programs unless there is an applicable treaty exempting participation. With these latest additions of Japan and Serbia, China now has such treaties with 12 countries, the other countries being Germany, South Korea, Denmark, Finland, Canada, Switzerland, Netherlands, France, Spain, and Luxembourg.

China, Germany agree on internship program

China and Germany have agreed to a program that will allow up to 1,000 interns from each country to undertake internships for up to six months in the other country. Eligible interns must be aged 18 to 35 and be current college or university students, or have graduated less than 12 months prior to starting the internship. Further details and requirements for the program have yet to be announced by the two governments. Implementation of the program is expected by the end of 2018.

The opportunity to undertake internships is likely to be attractive to both employers and students. Under Chinese immigration rules, there is currently no visa that specifically authorizes internships by foreign nationals in the country, and recent graduates do not usually qualify for work permits to take up jobs in China.

France is the only other country currently with a similar internship exchange program with China. Implemented in April 2016, the Chinese-French program also permits up to 1,000 interns from each country per year to work in the other country for up to six months. The maximum age for French interns coming to China is 30, and they should be students in French colleges or universities and have completed at least two years of study, or have graduated from a French or Chinese college or university within the past year. The rules specify that a French intern requires a category C work permit and should be paid at least RMB 20 per hour.

Chengdu to adopt the 144-hour visa-free transit policy

According to an announcement issued on July 23, Chengdu is planning to become the eighth area in China to offer 144-hour (six-day) transit visas. The visas, currently offered by Shanghai, Jiangsu, Zhejiang, Beijing, Tianjin, Hebei, and Liaoning, are available to nationals of 53 countries, provided they have booked onward tickets to a third country or region (including Hong Kong, Macao, and Taiwan). Foreigners who enter who enter China via Shanghai, Jiangsu, or Zhejiang may travel within these three areas during their 144-hour stay. The same three-area arrangement is available to visitors who enter via Beijing, Tianjin, or Hebei.

A further 11 cities, including Guangzhou and Xiamen, offer shorter, 72-hour transit visas, though a foreigner entering the country on a 72-hour transit visa is permitted to travel only in the city or province of arrival.

These types of transit visas have become increasingly attractive to visitors. Shanghai Pudong International Airport has recently reported a year-on-year increase of 20% in transit visas issued, with more than 25,000 foreigners arriving on transit visas so far this year through July 15.

Employees injured in Good Samaritan acts receive protection

The Supreme People’s Court (SPC) on June 27, 2018 made a lower court decision a de facto binding precedent thereby recognizing that injuries suffered by an employee in a voluntary, off duty act to combat criminal or illegal behavior may be deemed an occupational injury. The SPC designated the 2013 ruling by the Chongqing Peiling People’s District Court as a “guiding case”, which resolves a reported split among lower courts as to whether such injuries are deemed occupational injuries with consequential liability for employers.

In the 2013 case, Luo Renjun was working as a security guard employed by Peiling Zhida Property Management Co. He was on duty at a housing complex in Chongqing when he heard someone at another non-company property crying out for help during a robbery. Luo left his post to help, and while physically engaging with the thief, fell down a flight of stairs and suffered injuries.

Luo obtained an assessment from the local labor bureau that his injuries qualified as an occupational injury, and was therefore eligible for occupational injury benefits and legal protection. With the assessment meaning that Luo was protected from termination and that the company would be liable for his full salary and benefits during treatment, as well as for possible injury subsidies, the company sued the labor bureau in district court, challenging the assessment.

The district court’s decision rested on whether Luo’s acts fell within Article 15(1)(2) of the Occupational Injury Insurance Regulation, which provides that an employee is considered to have suffered an occupational injury if the employee is “injured in an act to protect national interests or public interests such as emergency rescue and disaster relief.”

The district court rejected the company’s arguments that Luo was protecting only the individual, private interests of the victim and not national or public interests. Instead, the district court ruled that a “Good Samaritan” act to prevent illegal or criminal acts should be treated as acting in the protection of the public interest, and therefore injuries suffered should be considered occupational injuries. The district court considered that the labor bureau had relied on a 2012 local government notice commending Luo’s behavior as that of a Good Samaritan to make their determination that Luo was acting in the public interest.

The district court decision noted that although an employee may not be at the workplace when an injury occurs, an employee who is acting as a Good Samaritan is acting in the public interest and any resulting injuries should be deemed as occupational injuries. Moreover, the district court said that types of actions by individuals should be encouraged. The court also cited a local Chongqing Good Samaritan regulation that provided injuries suffered while engaging in Good Samarian acts should be treated as occupational injuries.

Beijing court rules courier to be employee

In a decision that has thrown into confusion the status of workers in the gig economy, the Beijing Haidian People’s District Court on June 6, 2018 ruled that a courier for the online delivery platform FlashEx was an employee, rather than an independent contractor. Other courts in Beijing and Shanghai in 2016 and 2017 involving the same company had previously reached a different conclusion, finding instead that the company’s couriers were not employees.

According to the court’s official website, in the most recent case a Mr. Li signed a “service agreement” with FlashEx and registered on the platform’s app in May 2016. In July 2016, he was injured in a traffic accident while making a delivery. After losing a claim in labor arbitration, he sued FlashEx in district court, asking the court to confirm that he was an employee of FlashEx, in order that he could receive occupational injury insurance benefits.

The court found that he was a FlashEx employee based on these factors:

- He was required to satisfy certain recruitment conditions.

- He was required to wear FlashEx identification when working.

- He was required to comply with service procedures and requirements set by FlashEx when working, such as time limits for each delivery, restrictions on geographic service areas, and penalties for late delivery or damaged goods.

- He was not allowed to provide services to other online platforms.

- The compensation he obtained from the delivery work was the major source of his income.

- Although he was free to decide whether to accept certain delivery requests, he was required to make a minimum number of deliveries, thereby indicating that he did not actually have substantial discretion to refuse delivery requests.

- The court found the work tools or “means of production” to be the delivery orders placed by customers, and that these were solely controlled by FlashEx.

The court indicated that the factors supporting an employment relationship were sufficient to overcome the language in the service agreement that set forth a contractor arrangement.

The decision has generated a great deal of public debate, particularly because the earlier, conflicting decisions involved couriers with the same working conditions. Some commentators have inferred that the Haidian court has taken an activist approach in order to protect the large number of couriers (and other workers in the gig economy) by placing them under employment law, and in doing so has created a new set of factors to determine whether employment relationships exist. The Haidian court decision has also been criticized because FlashEx does not closely manage and supervise its couriers, and that the relevant work tools required to perform the job should be the motorcycles, which are provided by the couriers, and not the customer delivery orders.

Dongpeng Wang, Partner, Jun He

wangdp@junhe.com