13 April, 2020

China’s non-performing loan ("NPL") market will have to embrace one more giant player, the fifth nationwide AMC.

On March 16, 2020, the China Banking and Insurance Regulatory Commission ("CBIRC") released the Approval of the Transformation of Jiantou CITIC Asset Management Co., Ltd. into a Financial Asset Management Company, in which CBIRC gave approval for Jiantou CITIC Asset Management Co., Ltd. ("Jiantou CITIC") to be transformed into a financial asset management company and is to be re-named China Galaxy Asset Management Co., Ltd. ("China Galaxy"). It also stated that Jiantou CITIC will complete the transformation within six months from the date of approval and file an application with CBIRC for the commencement of operations thereafter, in accordance with the relevant regulations and procedures. In other words, after nearly two decades, China is about to grant a fifth license for a nationwide financial asset management company ("AMC") following the establishment of the BIG FOUR AMCs.

In fact, there had been widespread speculation in the market that Jiantou CITIC would be allowed to transform into a nationwide AMC. The CBIRC’s recent approval has finally confirmed such speculation.

I. Background Information on Jiantou CITIC

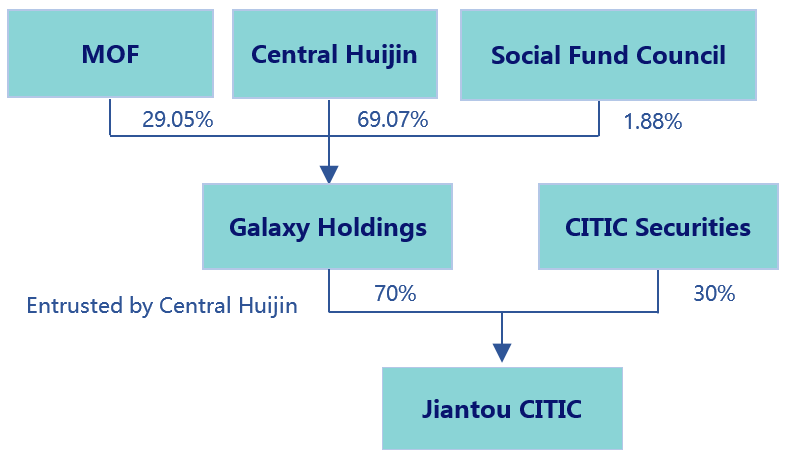

The following table shows the equity structure of Jiantou CITIC as of the date of this article.

In summary, the results of public searches show that Jiantou’s current registered capital is RMB 1.9 billion, of which 70% is held by Central Huijin Investment Ltd. (“Central Huijin”) and the other 30% is held by CITIC Securities Co., Ltd. (“CITIC Securities”). It is worth noting that Central Huijin, as the majority shareholder, has entrusted China Galaxy Financial Holdings Company Limited (“Galaxy Holdings”) to manage its equity interest in Jiantou CITIC since 2015. Therefore, Galaxy Holdings should be the actual controlling shareholder of Jiantou CITIC at present.

According to public information, Galaxy Holdings is a state-owned enterprise directly managed by the Central Government of the People's Republic of China ("PRC"). The business scope of Galaxy Holdings is registered as investment and management in multiple industries, including securities, funds, insurance, trusts, banks, etc. As of the date hereof, Central Huijin (69.07%), the Ministry of Finance of the PRC (“MOF”, 29.05%), and the National Council for Social Security Fund (“Social Fund Council”, 1.88%) are the shareholders of Galaxy Holdings.

When Jiantou CITIC was established in 2005, it assumed the task to manage and dispose of the non-securities assets of the original Huaxia Securities, with a view to maintaining and enhancing the value of the state-owned capital. Therefore, Jiantou CITIC has already had years of experience in the NPL market in China. Also, Jiantou CITIC has already made some moves in the science and technology enterprise rescue area, such as the execution of a tripartite agreement with the State-owned Assets Supervision and Administration Commission of Haidian District and Beijing Asset Management Co., Ltd., aiming to jointly set up a private rescue fund for science and technology enterprises with a target fund size of RMB 10 billion.

II. The Big Four AMCs

The Big Four AMCs refer to the existing four nationwide AMCs in China, namely, China Orient Assets Management Co., Ltd. (“China Orient”), China Cinda Assets Management Co., Ltd. (“China Cinda”), China Huarong Assets Management Co., Ltd. (“China Huarong”), and China Great Wall Asset Management Co., Ltd. (“China Great Wall”), all of which were established in the late 1990s in order to dispose of the large number of NPLs in the top four state-owned banks at that time.

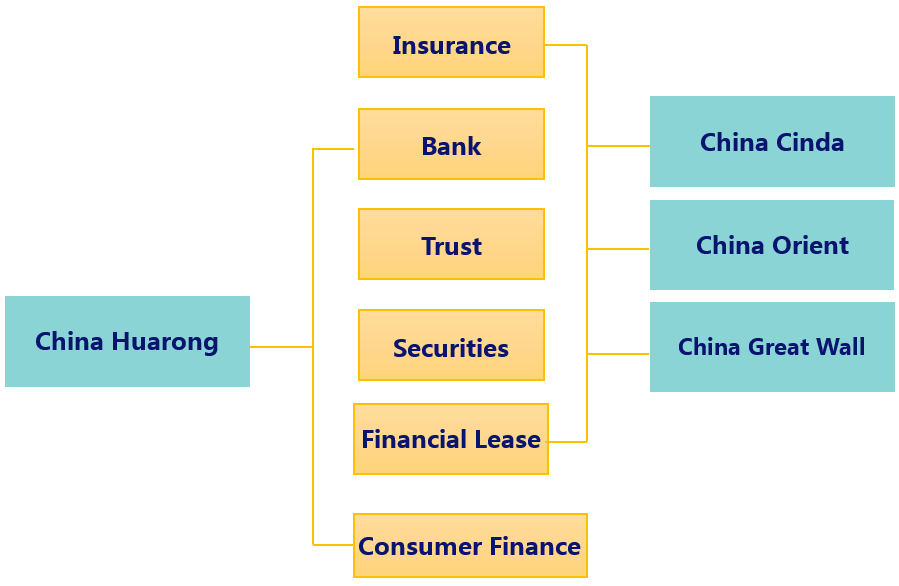

After completing the aforesaid task, the Big Four AMCs have gradually transformed into financial groups with comprehensive financial licenses covering banks, trusts, securities, insurance, consumer finance, financial leases, etc. At present, the Big Four AMCs remain the main players in transactions involving bulk acquisitions of NPLs from commercial banks, both in terms of trading volume and capital strength.

As of the date of this article, apart from the nationwide AMC licenses, the Big Four AMCs have also obtained the below financial licenses by and through their subsidiaries.

III. Other Institutions in the NPL Market

In addition to the Big Four AMCs, other institutions engaged in the NPL business in China include local AMCs, financial asset investment companies ("bank-type AMCs") and other non-licensed institutions.

1. Local AMCs

The regulatory regime for local AMCs has been gradually established since 2012. Unlike the Big Four AMCs, each local AMC is only allowed to acquire NPLs within the province (autonomous regions, municipalities) it resides. Locals AMCs are generally of a smaller business size and are subject to more restrictions.

In recent years, by virtue of policy incentives, the businesses of local AMCs have developed quickly and some restrictions on them have been gradually removed. For example, there were policy principles that each province could only set up one local AMC previously, and that the NPLs acquired by local AMCs could only be disposed of by way of debt restructuring (not transfer). Nowadays, local AMCs are allowed to dispose of NPLs by way of debt restructuring or transfer, with no geographical restrictions on the transferees. A trend of widening the business scope and the expansion of the numbers of local AMCs has also been noticed. According to the most recently available public information, there are 61 local AMCs in total, of which 57 have been approved by the People’s Government at provincial level and have obtained endorsement of the CBIRC, formerly known as the China Banking Regulatory Commission.

It is worth noting that the first phase of the ECONOMIC AND TRADE AGREEMENT BETWEEN THE GOVERNMENT OF THE PEOPLE’S REPUBLIC OF CHINA AND THE GOVERNMENT OF THE UNITED STATES OF AMERICA (“China-U.S. Trade Agreement”) signed in January 2020, stipulates that “China shall allow U.S. financial services suppliers to apply for asset management company licenses that would permit them to acquire non-performing loans directly from Chinese banks, beginning with provincial licenses. When additional national licenses are granted, China shall treat U.S. financial services suppliers on a non-discriminatory basis with Chinese suppliers, including with respect to the granting of such licenses.” Based on this, we expect that U.S. financial service providers will be able to obtain local AMC licenses in the near future and be allowed to acquire NPLs directly from Chinese commercial banks.

According to publicly available information, Oaktree Capital Management, a well-known investment management company, established Oaktree (Beijing) Investment Management Co., Ltd. ("Oaktree Beijing"), a wholly foreign-owned subsidiary, shortly after the China-U.S. Trade Agreement was signed. However, the approved business scope of Oaktree Beijing includes only "investment management, investment consulting and asset management", while the business of "financial asset management, and/or non-financial NPL disposal" and other businesses that the Big Four AMCs or local AMCs have engaged in, are not covered. Notwithstanding that Oaktree Beijing is more likely a PE firm rather than an AMC, the establishment of Oaktree Beijing is regarded by the market as the first step for Oaktree Capital Management to apply for an AMC license in China.

As the China-U.S. Trade Agreement has paved the way for foreign investors to enter China's NPL market, it is expected that foreign investors will participate in the market sooner or later and trigger the further expansion of local AMCs.

2. Bank-type AMCs

Under PRC law, financial asset investment companies are non-bank financial institutions approved by the banking regulatory authority of the State Council of the PRC (the "State Council") to mainly engage in the business of bank debt-to-equity swaps and other supporting businesses. As financial asset investment companies are generally set up by commercial banks, they are also known as bank-type AMCs.

The Guiding Opinions on Swapping Banks' Debts into Equities in a Market-Oriented Manner issued by the State Council in 2016 constitutes a legal basis for the formation of bank-type AMCs. Bank-type AMCs have become the third major type of acquirer of bank NPLs following the Big Four AMCs and local AMCs. The financial asset investment companies established by each of the five largest state-owned banks in the PRC respectively showed rapid business expansion in 2018.

In July 2019, the National Development and Reform Commission of the PRC, MOF, and CBIRC released a joint announcement calling for a more significant role by financial asset investment companies in market-oriented debt-to-equity swaps. According to market sources, two to three new financial asset investment companies will be established in the next few years.

3. Other non-licensed institutions

In recent years, a number of private funds, state-owned enterprises, insurance institutions, securities companies, local government-sponsored institutions, and other privately-owned institutions have entered the NPL market. Unlike licensed institutions, the aforesaid institutions can only acquire and dispose of NPLs in the secondary market but not directly from commercial banks.

In contrast, special assets that are not subject to similar restrictions often attract a larger variety of market participants, with different types tending to adopt different investment, management and disposal methods for different assets.

IV. Observations

There is no doubt that the Four Big AMCs are still the most important market players in the NPL industry and hold the majority of the market share at present. However, with the future participation of China Galaxy, and the continuous involvement of various types of investors (including foreign investors), the structure of the NPL market in the PRC may gradually change.

As the economy has slowed in recent years, in particular taking into account the impact of COVID-19, the scale of the NPL market may expand, thereby bringing more opportunities to various types of NPL market players. Nevertheless, due to factors such as the economic slowdown and the increasing complexity in business models, new difficulties may arise in the course of the management and disposal of NPLs. We will continue to monitor the legislation and change of practice in this area.