4 January 2021

-

Both IPO volume and value grew with growth in value due to a continuing trend toward mega deals (valued at over USD 1 billion) driven by Chinese and US companies.

-

Pandemic brings developing trends in how companies are choosing to go public and raise capital, most notably the marked increase in Special Purpose Acquisition Companies (SPACs) in the US, with 2020 also seeing the largest SPAC IPO in history.

-

COVID-19 and political tensions contributed to a growing shift in the balance between cross-border and domestic listings, as key changes in certain jurisdictions are encouraging many to list closer to home.

-

While financial sponsor-backed activity was fairly flat, the level of VC investment across all markets, and particularly in the technology and healthcare industries, was record-breaking.

In 2020, the world has seen the highest IPO capital raising activity in a decade, with USD 331 billion raised across 1,591 listings – a 42% increase compared to 2019. In Baker McKenzie's IPO Report 2020, we detail market data and insights into regulatory and market drivers for 2020 and into 2021.

The Global Picture

After a global slowdown in Q1 and Q2 due to the pandemic, a strong boost in IPO activity in Q3 saw the volume of listings more than double as compared with Q2 2020. Of this, 76% of capital raised came from domestic IPOs, which also account for approximately 86% of listing volumes for 2020, due in large part to a surge in US and China domestic listings. In the US overall, domestic listings raised 118% more capital in 2020 (USD 127 billion) than in 2019; volume of domestic listings also rose by 93% to 345 listings. In Mainland China, domestic listings raised 77% more capital in 2020 (USD 64 billion) than 2019; domestic listing volume rose 81% to 365 listings, up from 202 in 2019.

Click here to enlarge the image.

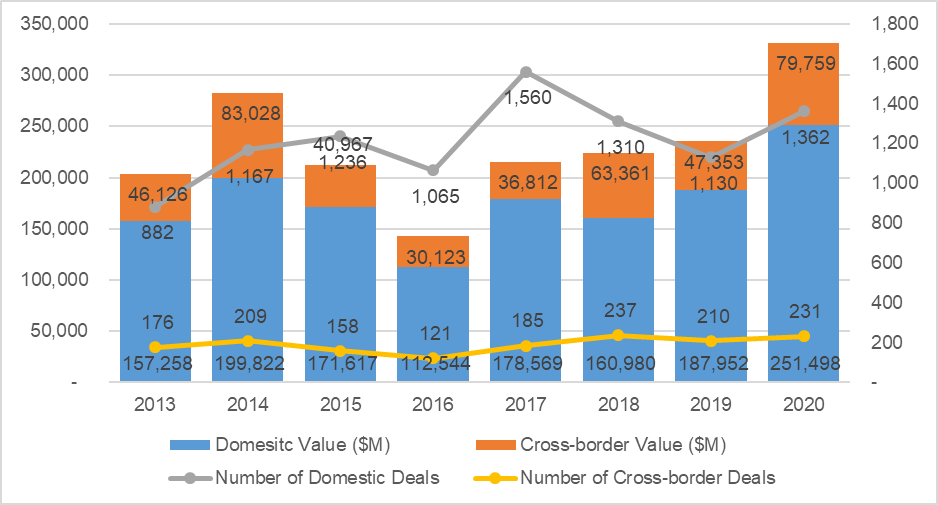

While domestic activity accounted for a large part of overall activity, cross-border listings also saw an increase in both volume and value, raising USD 80 billion from 231 listings, up 68% and 10% respectively, as larger deals came to market.

Trends to Watch in 2021

“The strongest trend that I see is the proliferation of SPACs sponsored by reputable asset managers, family offices or known industry players. I expect to see a very significant number of de-SPAC transactions during 2021, as operating companies will seek to access the public capital markets in that particular fashion.”

Steven Canner – Partner, New York

Although SPACs have historically been met with skepticism by both the market and investors, improved regulatory requirements and a number of recent successful acquisitions have ensured that heavy SPACs activity is here to stay for the foreseeable future. As a vaccine for COVID-19 becomes widely available, and economic activity begins to normalize, we see businesses re-engineering their financial statements to an economic environment of recovery, and we can expect to see capital raises for businesses to start expanding and investing in their growth and development, leading to a ripple effect of economic activity.

Another trend in 2021 will be the rising importance of ESG considerations in public disclosures and financing arrangements. No matter where you are in the world or what industry you operate in, ESG has become one of the hottest topics for businesses, their boards, their customers and their employees. While in previous years, some viewed the inclusion of ESG elements to be at the expense of returns and efficiency, among other things, this has rightly shifted to viewing ESG strategy as a prerequisite to business success. The recent announcement by NASDAQ that it will require boards of listed companies to have at least one woman and one director who self-identifies as an underrepresented minority or L.G.B.T.Q. is an indication of the increasing importance of ESG and the peril companies face if they are not attentive to it.

"We are firmly in the age of stakeholder capitalism, and for companies real change will come when the stakeholder voice is seen as a normal part of the decision-making process of the board. Long-term value maximization (rather than simply short-term profit generation) is the currency of the moment. It is now widely accepted that there is no inherent tension between creating value and serving the interests of employees, suppliers, customers, creditors, communities and the environment. A clear corporate purpose and good stakeholder governance, which underlie effective ESG strategies, are what boards must pursue."

Beatriz Araujo – Partner, London and Fellow to the World Economic Forum’s Platform on Shaping the Future of Investing

The Industry Perspective

Across all IPOs, Financials grew by 37% in volume compared to 2019, raising USD 108 billion in 2020, across 360 listings. Financials also top both domestic and cross-border IPOs as the top industry according to the amount of capital raised. SPACs are included in this data, which is one key reason for the sector’s dominance.

|

Top 5 industries (Global IPOs) |

Volume of Issues 2020 |

Capital raised (USD billion) |

% change in vol vs 2019 |

% change in capital raised vs 2019 |

|

Financials |

360 |

108 |

37% |

100% |

|

Technology |

257 |

55 |

13% |

50% |

|

Industrials |

193 |

24 |

40% |

129% |

|

Healthcare |

162 |

33 |

57% |

57% |

|

Consumer Products and Services |

161 |

27 |

128% |

128% |

Technology companies raised USD 55 billion in 2020 across 257 listings, due to increased activity in Asia Pacific, which saw a 13% increase in 2020 compared to 2019.

Industrials saw the biggest growth year in terms of capital raising, increasing over 120% to raise USD 24 billion in 2020. Asia Pacific also saw a big jump in activity with volume up 36% to 167 listings, raising USD 16.6 billion. Many companies saw the favorable market environment and shored up their balance sheets in light of the difficulties posed by COVID-19.

Healthcare companies raised USD 33 billion in 2020 across 162 listings. Asia Pacific saw a 33% increase in volume of Healthcare IPOs as compared to 2019 and at 110 listings, drove the most activity for the industry in 2020.

The US and China dominated the list of top exchanges with the NYSE coming in first place by value at USD 79 billion followed by NASDAQ, the Hong Kong exchanges (HKEx and HK GEM), the Shanghai Stock Exchange, and Shenzhen Stock Exchange rounding out the top 5.

The Regional Perspective

North America

In 2020, the highest number of US companies went public in 20 years, the vast majority of which were domestic listings. This is also the first time in history that US companies have raised over USD 100 billion through IPOs.

As companies dealt with economic uncertainty and valuation concerns due to the COVID-19 pandemic, IPO activity during the first half of 2020 was lackluster. During the third quarter of the year, however, there was a significant uptick in IPO activity, reflective of the backlog of IPO-ready companies, the substantial liquidity and support provided by the Federal Reserve, and the resulting rebound in the US equity markets. North America as a whole raised USD 154 billion in 2020, a 118% increase in value from 2019. With 497 listings, it also saw a 41% increase in volume of listings as compared with 2019.

Domestic activity accounted for USD 130 billion of capital raised across 411 listings, which makes for a 118% increase in capital raised from 2019. North America cross-border activity grew 28% in volume versus 2019, and raised USD 25 billion, a 120% increase from 2019.

Canada also saw big gains in 2020 with a total of 71 offerings for a total of nearly USD 3 billion.

Looking ahead to 2021, there is an expectation of major changes on the regulatory side due to the new US administration. The movement of The Holding Foreign Companies Accountable Act through both the Senate and House of Representatives has led to a number of jurisdictions, Hong Kong and London in particular, planning and introducing regulatory changes on stock exchanges in an effort to lure Chinese listings from New York, which could result in lower deal flow going forward. However, the recent approval by the SEC of a proposal from the NYSE to permit capital raising for direct listings has the potential to alter the future IPO landscape significantly if approved.

Asia Pacific

“While there has been a general dip in activity in main APAC markets due to COVID-19, there is an expectation that markets will continue to recover, as we have seen since Q3 2020 across key exchanges in the region. This increased activity reflects a delayed pipeline, with many issuers deferring listings due to the significant market volatility brought about by COVID-19 in the first half of the year, and focusing instead on securing further private investment to strengthen balance sheets and position themselves financially to weather the pandemic storm.”

Ivy Wong – Asia Pacific Chair of Capital Markets, Hong Kong

On the regulatory side, one of the changes coming from the US, The Holding Foreign Companies Accountable Act, which is aimed at enforcing certain US auditing requirements for foreign companies listed in the US, will likely impact Chinese company listings in 2021 and beyond. With this new law on the horizon, we can expect existing US-listed Chinese companies and those preparing to go public to take greater interest in alternative international listing venues and dual-listings.

Overall, according to the report, Asia Pacific raised USD 139 billion across 937 listings; a 39% increase in capital raised from 2019. The bulk of this activity (USD 91 billion) was raised through 811 domestic listings, representing a 33% increase in capital raised through domestic activity.

Europe, Middle East and Africa

IPO activity was down across the board in EMEA and while other markets have seen record-breaking rebound performances in the second half of 2020, with certain exceptions, the pace of EMEA IPO activity remains subdued due to dampened domestic activity. Domestic listings fell to 112, a 7% drop from 2019, raising 22 billion. Despite a significant increase in capital raised in cross-border

IPOs, the totals for EMEA were just USD 29 billion raised across 128 listings. This represents a 51% drop in capital raised and 2% drop in volume from 2019.

However, this level of activity does not extend to the broader equity markets where Europe, and London in particular, have seen an explosion of secondary offerings. Secondaries on the London Stock Exchange alone have raised USD 44 billion year-to-date, up 60% on last year and almost half of which was generated in Q2, largely from UK issuers. Other active markets included Warsaw, which saw its biggest-ever IPO with the $2 billion IPO of E-commerce platform Allegro, and in volume terms Nasdaq First North, which is rapidly becoming alternative exchange of choice in Europe. Italian, German and Spanish stock exchanges all had relatively moribund years with declining IPO activity.

“An interesting trend on the secondary piece, and indeed more broadly across global equity, is the increase in financial sponsor involvement. We are seeing financial sponsors become much more active in public market transactions, with an increasing willingness to become investors in listed companies and to look at other structures, such as SPACs, in considering how to deploy capital. We expect to see more of this as we move into 2021.”

Helen Bradley – Global Chair of Capital Markets, London

Looking ahead, we envision an increase in both domestic and cross-border IPOs across Europe as we move into 2021, particularly in London and the Nordics where we are already seeing a robust pipeline of offerings. The Shanghai-London Stock Connect delivered three of EMEA’s largest listings this year, and will likely spark further interest from Chinese issuers considering alternative international listing venues to New York, given the recent passing of The Holding Foreign Companies Accountable Act in the US. Financial sponsor backed exits, notably within tech and biopharma, should also see an increase in 2021 and beyond, given the recent and significant levels of investment. Pending listing rule changes within the UK could further entice these typically larger tech and biopharma offerings from New York, and even Hong Kong venues. Brexit remains an uncertain factor, however, for London's appeal as a listing venue in 2021.

Latin America

Latin America raised USD 9 billion in 2020, which is an increase of 159% in capital raised versus 2019. With 29 listings in 2020, the region recorded a 314% growth in volume of activity.

Growth in Brazil's IPO activity was the strongest in the region. With 26 IPOs in 2020, raising USD 8 billion, this is the first time Brazil saw its number of IPOs reach the double digits since 2017 and its largest number since 2007. Overall activity was fueled by a recovery in asset prices and a surging number of everyday investors buying into stocks. Brazilian big box retailer Grupo Mateus raised USD 824 million when it debuted on B3 in October 2020, coming close to being a mega IPO.

“Latin America has seen many of its countries undergo massive political changes and turmoil over the last decade; however, despite much political instability, many Latin American governments have had the foresight to maintain their economic views and goals. The region's political instability has also affected the equity markets, making them very opportunistic.

The result is a number of companies have positioned themselves to grow nationally, regionally or globally to take advantage of market opportunities independent of the political and economic climate of their respective countries.”

Pablo Berckholtz – LatAm Chair of Capital Markets, Lima

For further information, please contact:

Ivy Wong, Partner, Baker & McKenzie

ivy.wongn@bakermckenzie.com

.jpg)