23 July 2021

The Singapore and Hong Kong exchanges are considering loosening their listing rules to attract special purpose acquisition companies, but most of these blank-check companies will likely still opt for exchanges in the U.S. or South Korea, according to market experts.

Until now, most Asia-Pacific exchanges have effectively shut out SPAC IPOs due to their strict listing requirements. South Korea is a notable exception in the region, attracting smaller South Korea-based SPACS over the past decade. Now, Singapore and Hong Kong are hoping to reverse the trend and cash in on the SPAC craze — especially in the technology sector — as both explore a framework for SPAC listings. But market watchers think most of the bigger tech-focused SPACs will continue to favor U.S. markets.

The key benefit of going public through a SPAC for technology companies is that the SPAC route allows companies and acquisition targets to provide investors projected financial performance instead of historical profits. Given that many technology companies focus on fast growth and potential earnings, "for those companies, SPAC is really the right way to go public," said Li Ruomu, a partner at law firm Morrison & Foerster whose practice focuses on mergers and acquisitions.

Both Singapore and Hong Kong are open to loosening their financial requirements to make it possible for SPACs to list. But even if those proposed changes took effect, it probably would not be enough to attract some smaller and less profitable companies pursuing SPAC-backed listings, experts said.

The Singapore Exchange has proposed SPACs seeking to list there have a minimum market capitalization of at least S$300 million (US$223 million), with 25% of the total number of issued shares to be held by public shareholders. Nasdaq's threshold is lower: A SPAC IPO applicant to Nasdaq can list with a market capitalization of just US$160 million, provided that it has total assets of US$80 million and stockholders holding at least US$55 million.

Furthermore, a Nasdaq IPO applicant does not have to meet the market capitalization or total assets requirements if it has reported aggregate pre-tax earnings of over US$11 million in the prior three fiscal years, with earnings of more than zero dollars reported in all three years and at least US$2.2 million in earnings reported in the two most recent years.

Hong Kong Exchanges and Clearing Ltd. has not yet released a proposal on SPAC listings, but Hong Kong has a stricter financial requirement for main-board IPO applicants compared to its U.S. peers. In Hong Kong, main-board IPO candidates must report at least HK$80 million (US$10 million) in combined profits in the three years before listing starting January 2022, or report revenue of HK$500 million (US$64 million) in the prior year and have a market capitalization of HK$4 billion (US$515 million).

Alternatively, Hong Kong applicants are not required to report profits if they have free cash flow of HK$100 million (US$13 million) along with revenue, and a market capitalization of HK$2 billion (US$258 million).

In the U.S., the New York Stock Exchange accepts IPO applicants with no pre-tax income requirement, so long as they have a pre-market capitalization of at least US$500 million to US$750 million. Hong Kong does not provide listing applicants any options based solely on market capitalization.

U.S. attraction

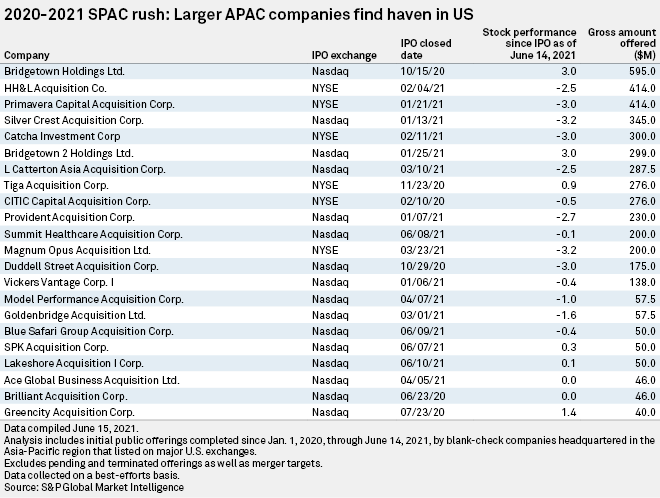

As of June 14, 22 SPACs with headquarters in Asia-Pacific were trading on U.S. exchanges. Hong Kong-headquartered Bridgetown Holdings Ltd., which reportedly plans to acquire the Indonesian travel and lifestyle company Traveloka Holding Ltd., was the largest Asia-Pacific SPAC to date, with proceeds of US$595 million from its October 2020 IPO. Traveloka was reportedly in advance deal talks with Bridgetown SPAC as of April. Bridgetown has until October 2022 to complete an initial acquisition under Nasdaq listing rules.

Please click on the image to enlarge

The profit test under the HKEX listing rules is very difficult for emerging companies to meet, Li said. "It's very difficult for Hong Kong to allow listing of a shell company, such as a SPAC, under its current regime."

Hong Kong has carved out a model for certain biotechnology companies to list on its main board without earnings requirements, but only if they have a "core biomedical product" ready for monetization, said Philip Law, TMT Hong Kong lead and a partner at consulting firm Deloitte.

The listing rules for biotech companies also require IPO applicants to reach a market capitalization of HK$1.5 billion and to hold working capital for 125% of the group's present requirements for the next twelve months.

Law predicted that Hong Kong will relax the rules for SPACs in time, much like it did for biotech. "It is only a matter of time," he said.

However, there are other reasons that SPACs list in the U.S. besides profitability or market capitalization rules, the experts said, including more favorable rules for shareholders regarding stock redemptions and the potential for class-action lawsuits to defend shareholder rights.

"The U.S. securities litigation regime is a protection to the smaller investors. If there's anything that hasn't been done correctly, the SPAC could face a class action," Li said.

South Korea trial

South Korea is the one Asia-Pacific market that has allowed SPACs in the past decade, but South Korean exchanges are less likely to attract international SPACs due to a lack of support to international IPO applicants and investors in the country, market experts said.

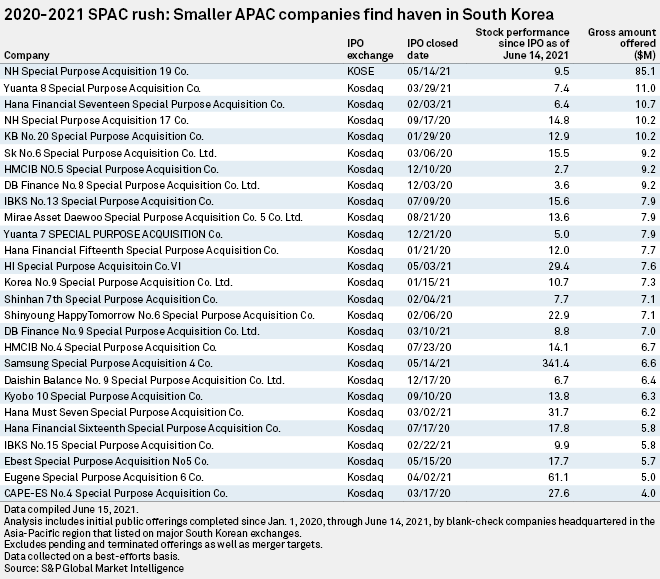

As of June 14, there were 27 SPACs with headquarters in Asia-Pacific listed in South Korea, all of which were based in South Korea. All but one were trading on the Korean Securities Dealers Automated Quotations, the South Korean exchange for small and medium-sized businesses. One, NH Special Purpose Acquisition 19 Co., recently debuted on KOSE, the main stock market of South Korea.

Please click on the image to enlarge

The US$85.1 million IPO of NH Special Purpose Acquisition 19 marked the first SPAC listing on the main board of the South Korean exchange in more than 10 years. All of the SPACs listed on the Kosdaq had IPOs that raised no more than US$11 million.

The pace of SPAC listings in South Korea is picking up. As at March 2021, the number of SPACs debuting on the Korean stock markets was 50% higher than in the year-ago period, noted Leon Yee, chairman of law firm Duane Morris & Selvam, and investors in the country are increasingly more willing to consider SPACs. Yee serves as the global head of corporate and leads the banking and finance and energy practice groups at Duane Morris & Selvam.

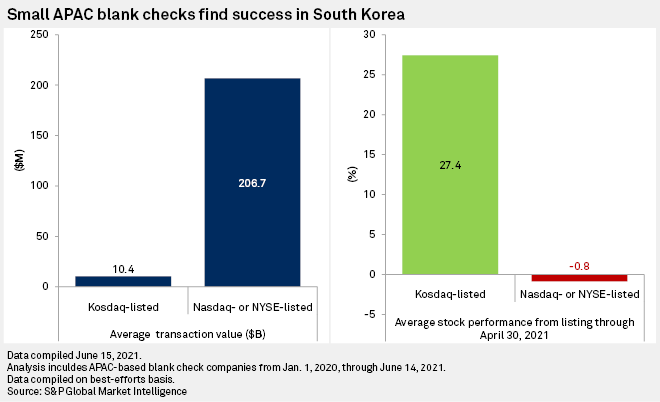

The SPACs on the South Korean exchanges were trading 27.4% higher on average than their issuing price as of June 14, representing a better return compared to those listed on the U.S. exchanges. The Asia-Pacific-based SPACs listed on the Nasdaq fell by an average 0.8% from their issuing prices over the same period.

Some South Korean investors have an aversion to SPACs due to several recent notorious SPAC failures, Yee said. Three — Daewoo Securities SPAC, Tong Yang Value SPAC and Woori SPAC — listed on the South Korean exchange main board in 2010 and failed to acquire a company within three years, violating the exchange's requirements.

Please click on the image to enlarge

"Some investors [in South Korea] would think it is a good opportunity to pick up the wave and to test the water," said Li of Morrison & Foerster, referring to the current market environment. "We just have to wait to see whether they can complete a successful [acquisition] transaction."

For further information, please contact:

Ruomu Li, Partner, Morrison & Foerster

rli@mofo.com