In June 2025, the Chairman of the China Securities Regulatory Commission (CSRC) Mr. Wu Qing, delivered the keynote speech at the 2025 Lujiazui Forum. He announced that the CSRC will accelerate the implementation of a package of key capital market opening-up measures this year, including expanding the scope of products accessible to foreign investors. On June 17, 2025, the CSRC announced that it would permit Qualified Foreign Investors (QFIs) to participate in exchange-traded fund options (ETF options) listed and traded on exchanges approved by the State Council or the CSRC. QFIs participating in ETF options trading should comply with the trading rules prescribed by the CSRC and the relevant exchanges, and such trading shall be limited to hedging purposes.

On September 30, 2025, the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE) respectively issued the Circular on Matters Relating to Qualified Foreign Institutional Investors and RMB Qualified Foreign Institutional Investors Participating in Stock Options Trading (collectively, ‘the Circulars’). According to the Circulars, QFIs can submit applications for hedging quotas for option contracts through their options broker. Upon the exchanges’ approval and determination of the quota, QFIs may then participate in hedging transactions. The SSE and SZSE began accepting QFIs’ applications for stock options trading on September 30, 2025 and October 9, 2025, respectively.

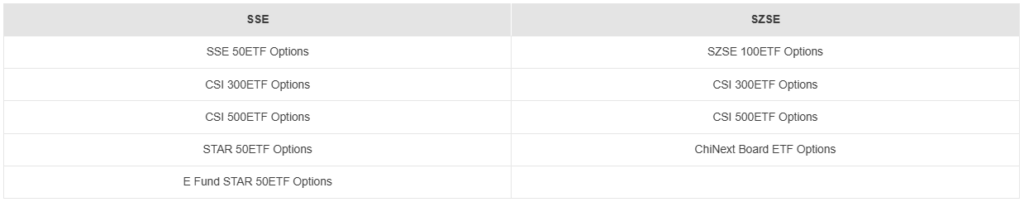

I. Tradable ETF Option Products

The SSE and SZSE have listed a total of nine ETF option contracts as follows:

II. Hedging and Position Limits

The Circulars clarify that QFIs may apply for hedging quotas in respect of both long and short hedging positions. Neither the SSE nor the SZSE has yet released detailed implementation rules specific to QFIs’ participation in ETF options trading. We understand that the exchanges may refer to the previously issued Guidelines on Position Limit Management for Stock Options of the Shanghai Stock Exchange and the Guidelines on Position Limit Management for the Pilot Stock Options of the Shenzhen Stock Exchange (collectively, ‘the Guidelines’) when formulating detailed implementation rules for QFI participation. The key provisions of the Guidelines are summarized below:

(1) Definition of Hedging

Pursuant to the Guidelines, long hedging refers to buying put options corresponding to the quantity of the underlying assets held, while short hedging refers to buying call options corresponding to the quantity of the underlying assets sold short through securities lending.

(2) Conditions for Adjusting Position Limits

According to the Guidelines issued by the SSE, investors who need to hedge and meet the following conditions may apply to the SSE to increase their position limits (including rights positions, total positions, and daily opening limits) for a single option contract:

(a) Long hedging: The applicant’s average daily holdings of the underlying securities during the past month (based on daily end-of-day data) exceeds the position limit for rights positions of that contract.

(b) Short hedging: The applicant’s average daily securities borrowing balance of the underlying securities during the past month (based on daily end-of-day data) exceeds the position limit for rights positions of that contract.

The SZSE adopted a slightly different standard, i.e., the Guidelines issued by the SZSE quantify ‘exceedingly’ as occurring three or more times within a period of 30 trading days and replace the one-month measurement period with 30 trading days. Specifically, an investor may apply for an increase in position limits if:

(a) Long hedging: During the past 30 trading days, the number of occurrences where the investor’s holdings of the underlying securities (calculated daily at the end of the day) exceed the position limit for rights positions reaches three or more.

(b) Short hedging: During the past 30 trading days, the number of occurrences where the investor’s securities borrowing balance (calculated daily at the end of the day) exceeds the position limit for rights positions reaches three or more.

(3) Upper Limits for Adjusted Position Limits

In accordance with the principle of equal treatment of similar market participants, the SSE determines the upper limit for adjusted position limits as follows:

(a) Long hedging: The upper limit for adjusted rights positions shall be the lower of: (A) the position limit applied for; and (B) 1.5 times the applicant’s average daily holdings of the underlying securities during the month prior to the application.

(b) Short hedging: The upper limit for adjusted rights positions shall be the lower of: (a) the position limit applied for; and (b) 1.5 times the applicant’s average daily securities borrowing balance of the underlying securities during the month prior to the application.

The SZSE’s Guidelines replace the ‘average daily holdings in the one month prior to application’ with the ‘maximum holdings or balances in the 30 trading days prior to application’.

III. Our Observations

Although QFIs are already permitted to participate in ETF options trading, detailed implementation rules are yet to be finalized. We recommend that foreign investors maintain close communication with their brokers and be prepared. Foreign investors intending to conduct ETF options trading should first apply through their custodian banks to the CSRC for an amendment to their QFI investment plan to include ETF options as eligible investment products. Only after such an amendment is completed may QFIs, through their options brokers (i.e., qualified securities brokers), submit hedging quota applications for the relevant ETF options to the exchanges.

The CSRC has successively relaxed QFI participation restrictions on commodity futures, commodity options, and now ETF options, with the aim of further expanding the permissible investment scope of QFIs. These measures enhance the attractiveness of the QFI regime, facilitate the use of appropriate risk management tools by offshore institutional investors (particularly allocation-focused funds), and promote stable, long-term investment behavior in China’s capital markets. We anticipate that the CSRC will introduce further reforms and refinements to the QFI regime, thereby advancing the high-quality regime-based opening-up of capital markets.

For further information, please contact:

XIE, Qing (Natasha), Partner, JunHe

xieq@junhe.com