Hong Kong’s Stablecoins Bill to undergo First Reading

On 6 December 2024, the Hong Kong Government published the much-anticipated Stablecoins Bill (“Bill”) in the gazette. The Bill will be introduced into the Legislative Council for the first reading on 18 December 2024.

What does the Bill cover?

The Bill addresses a broad array of topics, including licensing, investigation, offences, and other related matters, ensuring a comprehensive regulatory framework.

Industry stakeholders are likely to be particularly interested in the restrictions on activities involving specified stablecoins, as well as the licensing requirements and investigative powers of the HKMA.

In this article, we break down and summarise the key aspects of the aforesaid topics.

Do I need a Stablecoin Licence in Hong Kong?

According to the Bill, a person must not carry on (or hold out as carrying on) a Regulated Stablecoin Activity (defined below), unless that person is licensed or exempted.

The Bill consistently refers to three terms, the definitions of which are set out below:

| Stablecoin | Specified Stablecoin | Regulated Stablecoin Activity |

| A cryptographically secured digital representation of value that—(a) is expressed as a unit of account or store of economic value;(b) is used, or intended to be used, as a medium of exchange accepted by the public for any one or more of the following purposes—(i) payment for goods or services;(ii) discharge of a debt;(iii) investment;(c) can be transferred, stored or traded electronically;(d) is operated on a distributed ledger or similar information repository; and(e) purports to maintain a stable value with reference to a single asset or a pool or basket of assets.Subject to certain exclusions, such as stablecoins issued by a central bank or a government. | (a) A stablecoin that purports to maintain a stable value with reference wholly to— (i) one or more official currencies;(ii) one or more units of account or stores of economic value specified by the HKMA; or(iii) a combination of the above; or(b) a digital representation of value, or a digital representation of value of a class, specified by the HKMA. | Where:(a) the person issues a specified stablecoin in Hong Kong in the course of business;(b) the person issues a specified stablecoin in a place outside Hong Kong in the course of business, and the specified stablecoin purports to maintain a stable value with reference (whether wholly or partly) to Hong Kong dollars; or(c) an activity as specified by the HKMA.A person is regarded as holding out as carrying on a regulated stablecoin activity if:(a) the person actively markets, whether in Hong Kong or elsewhere, to the public that the person carries on, or purports to carry on, an activity; and(b) the activity, if carried on in Hong Kong, would constitute a regulated stablecoin activity. |

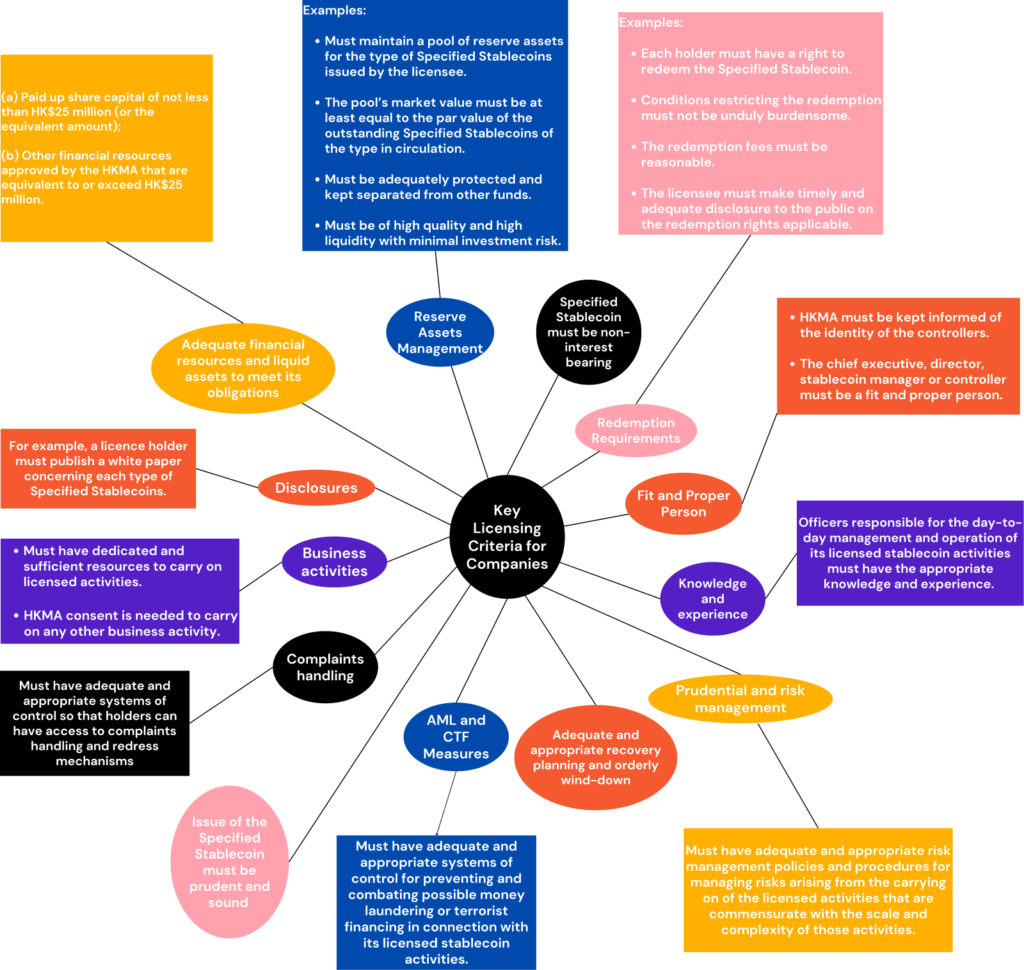

Do I qualify for a Stablecoin Licence in Hong Kong?

Subject to further changes to the Bill after the first reading, the key licensing criteria for companies are as follows:

What else should I know about the proposed licence?

- Only a company or an authorised institution incorporated outside Hong Kong can apply for a licence. The application should also state the applicant’s principal place of business in Hong Kong.

- A licence granted remains in force until it is revoked. The licence fee is HK$113,020. The HKMA may attach conditions (requirements or restrictions) to a licence granted and the Bill provides for comprehensive procedure requirements for attaching conditions to a new licence, attaching conditions to existing licence, or amending existing conditions.

- The Bill also provides that the HKMA should maintain a register of licensees made available for inspection by the public. Licensees are subject to certain duties. Licences can also be revoked, suspended or temporarily suspended by the HKMA with grounds.

- Regarding the ownership and management of the licensee, the Bill provides that a person must be approved by the HKMA before that person can become a controller of the licensee. Conditions may be attached to the HKMA’s consent. The HKMA may also object to a person continuing to be such a controller if it finds that (1) the person is no longer “fit and proper”, (2) the interests of the holders/potential holders of Specified Stablecoins would be threatened by the person being a controller, or (3) the person contravened a condition attached to the HKMA’s consent.

- A licensee must also appoint a chief executive, alternative chief executive and stablecoin manager approved by the HKMA. The director of a licensee must also be approved by the HKMA.

- In terms of managers and employees, notice must be given to the HKMA if a person is appointed/ceases to be a manager of a licensee. Certain employees (e.g. individuals who are bankrupt) need to be approved by the HKMA.

What are the proposed investigation powers of the HKMA?

- The Bill stipulates that the principal function of the HKMA under the Ordinance is to promote monetary and financial stability by addressing the risks in relation to specified stablecoins.

- Part 5 of the Bill also bears resemblance with the SFO. Section 116 provides that the HKMA can investigate if it has reasonable cause to believe that an offence under the Ordinance may have been committed, a requirement imposed by the Ordinance may have been contravened, or a condition attached to a licence, consent or other instrument granted by the HKMA may have been contravened.

- The investigator has powers to require production of records or documents from persons being investigated, or persons whom the investigator has reasonable cause to believe that possess information relevant to the investigation. The HKMA also has the power to conduct investigations.

The Bill represents a significant advancement in establishing clear regulations for stablecoins in Hong Kong. We have observed many enthusiastic investors looking to launch stablecoin businesses in the region, yet they face challenges due to the absence of a legal framework. This legislation will pave the way for Hong Kong to strengthen its position as a leading hub for digital finance.

We eagerly anticipate the first reading in the Legislative Council and will closely monitor developments as the Bill progresses.

In the meantime, feel free to read our other articles on the development of the stablecoins regime in Hong Kong:

- Hong Kong Takes a Step Closer to Enabling Stablecoins (29 July 2024)

- Hong Kong to Regulate Stablecoins (10 May 2023)

- HKMA’s Conclusion on Crypto-assets & Stablecoins (24 March 2023)

- Discussion Paper: Crypto-assets & Stablecoins (1 March 2022)

To learn more about the stablecoin regime in Hong Kong, contact us today.