As a continuation of the efforts to increase tax revenue in Indonesia, the Minister of Finance (MoF) recently issued MoF Regulation No. 79 of 2023 on Valuation Guidelines for Tax Purposes. This regulation was issued on 22 August 2023 and would become effective on 24 September 2023. As stated in the title, this regulation generally regulates guidelines for tax officials in determining the (i) Sales Value of Taxable Object (NJOP) (for the determination of the land and building tax) and (ii) value of tangible assets, intangible assets, and business. This article consists of three main parts, i.e., (A) the Valuation for the Land and Building Tax, (B) the Valuation of Tangible/Intangible Assets and Business, and (C) Valuation Procedures.

- Valuation for the Land and Building Tax (PBB)

The valuation method can be in the form of:

- Office Valuation, OR

This type of valuation is carried out by analysing the documents submitted by the taxpayers in the Taxpayer’s Object Tax Return.

- Field Valuation

This type of valuation is carried out by identifying, collecting, and analysing relevant data with the PBB’s object. This method is usually used for the implementation of supervision, inspection, objection settlement, reduction of incorrect PBB assessments, examination of preliminary evidence, and investigations.

The valuation can be for one current financial year or the preceding years.

- Valuation of Tangible/Intangible Assets and Business

Similar to the valuation for the PBB, the valuation of tangible/intangible assets and business can be in the form of:

- Office Valuation, OR

This type of valuation is used in carrying out supervision, audits, mutual agreement procedures, transfer pricing agreements, resolving objections, reducing or cancelling tax assessments, billing, examining preliminary evidence, and tax investigations.

- Field Valuation

Similar to office valuation, field valuation is used in carrying out audits, mutual agreement procedures, transfer pricing agreements, resolving objections, reducing or cancelling tax assessments, billing, examining preliminary evidence, and tax investigations. The only difference is that the field valuation is not used in carrying out supervision.

The valuation can be for one or more tax periods, part of or whole tax year.

The regulation provides examples of the valued objects, i.e.:

| No. | Tangible Assets | Intangible Assets | Business |

| Land/waters | Marketing-related intangible assets | Business entity | |

| Buildings | Customer-related intangible assets | Participation in a company | |

| Machines and/or equipment, including the installation | Art-related intangible assets | Financial instruments in public/private companies, | |

| Transportation equipment, heavy equipment, or vehicles | Intangible assets related to company contracts | Fairness of the accounting accounts contained in the financial statements | |

| Building equipment and supplies | Technology-related intangible assets | – | |

| Furniture, electronic devices, medical devices | Intangible assets related to the research process and development | – | |

| Communication tools and equipment | Goodwill | – | |

| Art and jewellery | – | – | |

| Biological assets | – | – |

The result of the valuation would be used for among others (i) a basis for calculating the tax payable on the fulfilment of tax obligations, (ii) a basis for determining a reasonable transfer pricing analysis and negotiation position during the mutual agreement procedures, (iii) the basis for calculating the tax payable in the decision on the resolution of an objection, and (iv) the basis for calculating the tax payable in decisions concerning the resolution of requests for reduction or cancellation of tax assessment.

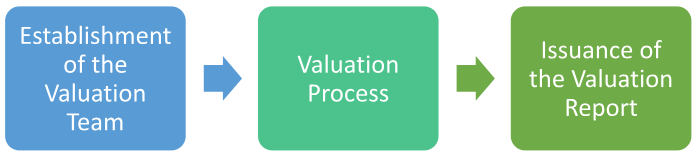

- Valuation Procedures

- Establishment of the Valuation Team

A valuation team would be established to carry out the evaluation process. The team would start the process based on the valuation order that is issued by the directorate general of taxation.

- Valuation Process

The valuation process should be completed three months after the issuance of the valuation order. In conducting the valuation, the Valuation Team must (i) prepare the valuation materials, (ii) collect object data and supporting data, (iii) analyse the object data and the supporting data, and (iv) apply the relevant valuation approach that is suitable for the valuation object.

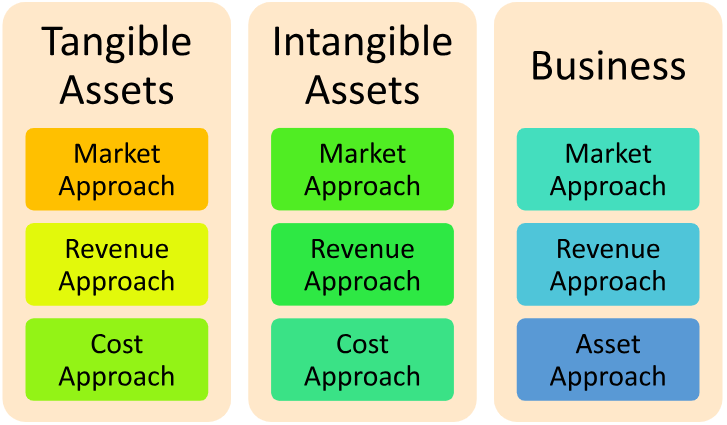

The valuation approaches that can be used for tangible assets, intangible assets, and business are as follows:

Remarks:

- Market Approach: approach method that compares the valuation object with other similar objects.

- Revenue Approach: approach method that converts the economic benefits or estimated revenue with a discounted rate.

- Cost Approach: approach method that calculates the cost of a new reproduction or new replacement cost of the valuation objects and reduces it with depreciation or obsolescence.

- Asset Approach: approach method that adjusts all assets and liabilities to market value following with the value premises used in the valuation to determine the value of the business.

- Valuation Report

The last step of the process is the issuance of the valuation report by the Valuation Team. The report should at least contain the following information:

- Valuation assignments,

- The date when the value is stated in the valuation report,

- Information on the valuation objects,

- Identity of the taxpayer,

- Available data/information,

- The valuation approaches and methods that were used,

- Value conclusion,

- Date of the report, and

- Signature of the valuation team members.

Commentary

As stated in the regulation itself, one of the considerations for the issuance of this regulation is to provide greater justice and legal certainty concerning the implementation of valuation in the fields of income tax, value-added tax, land tax building and tax collection by warrant. Therefore, this regulation is issued in the hope that this regulation can be used as the “reference” of the valuation of land and building, tangible assets, intangible assets, and business.

We believe once this regulation is implemented correctly by the tax officials, it should be able to serve its main purposes, i.e., providing justice and legal certainty to the taxpayers. If the tax officials implement the valuation guidelines stipulated in the regulation, there should be no discrimination amongst the taxpayers as the same standard would be applied to every taxpayer that undergoes the same process.

Amongst all, we hope the issuance of this regulation can assist the government in reaching its goal of increasing the tax revenue in Indonesia.

For Further Information, Please Contact:

MetaLAW, Legal Consultant, Jakarta, Indonesia

general@metalaw.id

¹ Peraturan Menteri Keuangan No. 79 Tahun 2023 tentang Tata Cara Penilaian untuk Tujuan Perpajakan