13 February, 2019

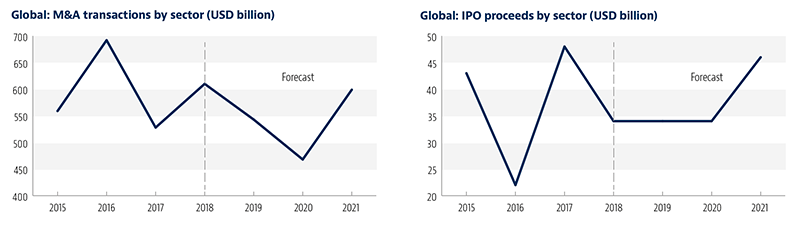

Deals in the industrials sector are to experience a small drop in 2019, before reaching a cyclical trough in 2020. This is according to our Global Transactions Forecast, issued with Oxford Economics. M&A deals are expected to fall 11 % in 2019, from USD 610 billion to USD 543 billion, before a further 13% drop in 2020 to USD 468 billion. IPOs meanwhile are to remain stable, totalling USD 34 billion in 2019 and 2020.

As industrials conglomerates fight to maintain healthy profits, many are substantially changing their business models.

For example, in June 2018 General Electric announced major changes to its business portfolio, designed to stimulate growth and generate more value for shareholders. Nikolaus Reinhuber, Global Chair of our Industrials, Manufacturing and Transportation Industry Group, explains why companies are taking this action.

"Industrial conglomerates retreating from the traditional model are under pressure from investors to find new ways to increase profitability, so we’re seeing a rise in spin-offs and joint ventures, among other transactions," Nikolaus said.

"In 2018, we witnessed this e.g. in ThyssenKrupp spinning off its traditional steel business into a joint venture with Tata Steel and now by separating the entire ThyssenKrupp group into two separate listed legal entities."

Please click the graphs to enlarge.

Jannan Crozier, EMEA IMT Lead, explains that 2018 was a seller's market and with valuations for assets strong there was pressure on companies to divest assets.

"Market pressures, availability of cheaper debt and a continuing drive toward digitization and technology is creating a lot of competition for assets, this is being reflected in the valuations for assets and as such, pressure is on companies operating within the sector to divest of their non-core or under-performing assets now," she said.

"Additionally, financial sponsors are further pushing this trend. They are prepared to bid on ever increasingly more complex carve-out deals, whereas historically they wouldn’t have done that because it takes time ad resources to stand these companies up on their own."

One of the most significant deals of this kind in 2019 was the USD 12.5 billion acquisition of Akzo Nobel NV’s s chemicals unit to US private equity firm Carlyle Group.

All eyes on Asia

For much of Asia, low interest rates as well as the need for companies to acquire new technology and global talent was a key driver of deals in 2018. We expect this trend continue into 2019. Japan in particular has seen a surge in activity, as Yaeko Hodaka, M&A Partner explains.

"Japanese companies’ outbound M&A deals reached a record high in the first half of 2018, surpassing China for the first time in six years. Japanese companies have a strong appetite for deals in Germany (for manufacturing), Israel (for defense technology and software for security), and West Coast US (for new services) as the competition to internationalize their operations becomes fierce."

China will still play a significant role in generating transactions in the sector, due to the size of its economy. The largest deal by a Chinese company was automaker Geely’s 10% stake in German automaker Daimler AG, in a deal worth USD 9 billion.

The Chinese government has also proposed the introduction of special funds to promote M&A deals to enhance the sector's competitiveness. Aimed at boosting the industrial upgrades via promoting M&A in the steel sector, such funds will help big industry players gain larger market share to generate scale benefits, lower production costs and help the sector to better cope with external pressures, experts said.

Meanwhile, we expect to see deal activity reach significant levels in Latin America due to new political developments in the region, including the agreement to replace NAFTA with the United States–Mexico–Canada Agreement.

Challenges facing the sector

As with many industries at the moment, the industrials sector is being hit by uncertainty surrounding trade negotiations and protectionism, as well as political factors such as Brexit.

In the US, the recent government shutdown is also delaying IPO activity, as there is no resource at the SEC to review filings. Dominique Maes, M&A Partner at Baker McKenzie, explains that, in addition, the rise in complex deals, such as carveouts, and older or underperforming assets being brought to market, may also slow activity.

"Some companies in this sector, particularly those who aren’t used to complex deals, may need longer time to agree and effect transactions. When also the assets being sold have been an integrated part of the selling group for a long time and/or have become less performing, certain transactions may even require more time to be realised."

Market uncertainty and volatility is also impacting IPO transactions as Matthias Courvoisier, Capital Markets Partner explains, "With higher uncertainty in the market and the volatility that it brings, we expect it to be a challenging year ahead for IPO deals in the sector. If the expectation is that prices are dropping, the appetite to invest in an IPO in the sector is greatly reduced."

For further information, please contact:

Dr. Nikolaus Reinhuber, Partner, Baker & McKenzie

nikolaus.reinhuber@bakermckenzie.com