12 June, 2018

On 5 June 2018, the Price Control and Anti-Profiteering (Mechanism to Determine Unreasonably High Profit) Regulations 2018 (2018 Regulations) was introduced by way of a statutory order published in the Federal Gazette.

In our previous alert issued on 4 June 2018, we provided highlights of the developments arising from the zerorisation of GST that is likely to lead to greater scrutiny on pricing.

In this alert, we address the application of the 2018 Regulations and its key implications.

Broad Scope of Application

The 2018 Regulations revokes the earlier Price Control and Anti-Profiteering (Mechanism to Determine Unreasonably High Profit for Goods) Regulations 2016 which sought only to regulate certain classes of goods which are food and beverages and household goods.

With immediate effect from 6 June 2018, the 2018 Regulations will apply to:

(i) any goods sold or offered for sale; and

(ii) any services supplied or offered for supply.

Mechanism to Determine Unreasonably High Profit

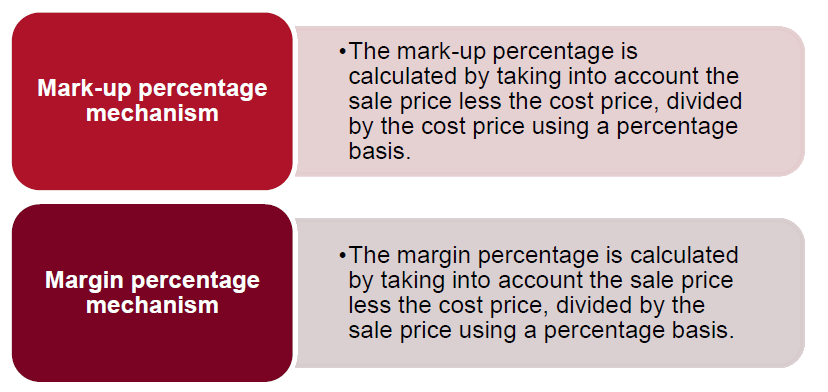

The 2018 Regulations prescribes a specific formula for the determination of unreasonably high profit is done. The determination of "unreasonably high profits" is made by examining the mark-up percentage mechanism or the margin percentage mechanism using the prescribed formulas.

A comparison is done by comparing the percentages of any

(i) goods sold or offered for sale or

(ii) services supplied or offered for supply on the first day of a particular financial year (FY) or calendar year (CY), against the percentages of any

(i) goods sold or offered for sale or

(ii) services supplied or offered for supply in that particular FY or CY.

Please click to enlarge.

Implications for Businesses

With the broad application of the Regulations 2018, it is crucial that businesses should undertake a comprehensive review of its pricing policies and be cautious in the establishment of new prices following the reduction in the rate of GST.

The Ministry of Domestic Trade, Co-operatives and Consumerism (MDTCC) has broad powers under the Price Control and Anti Profiteering Act 2011 and is diligent in its conduct of price monitoring exercises. This is also supported by the fact that there is a heightened awareness on the part of consumers who will not hesitate to make comparisons of pricing and initiate complaints against businesses who appear to profiteer through price increases.

Summary

Please click on the image to enlarge.

It is evident in the past week that the MDTCC has been conducting checks on businesses following the zerorisation of the GST to ensure that prices have been reduced accordingly. All businesses must take immediate steps to ensure compliance with the 2018 Regulations.

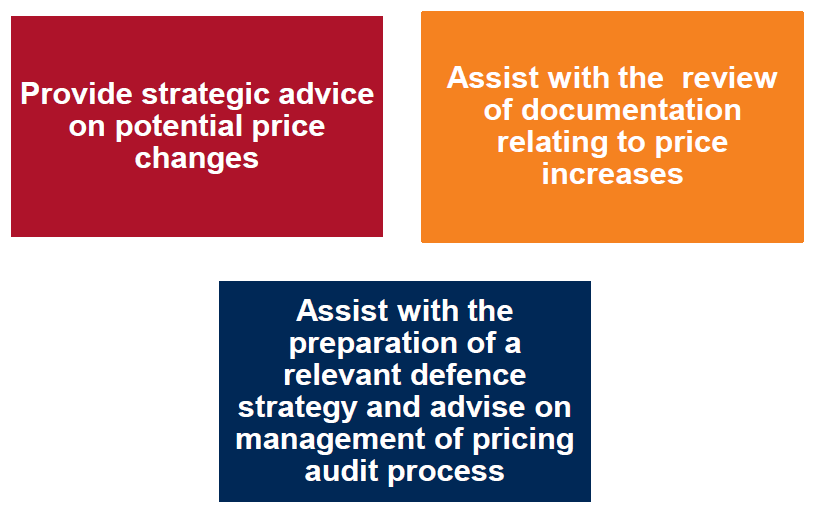

How We Can Help

Please click to enlarge.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com