Sabah, better known as “The Land Below The Wind” is strategically located on the island of Borneo with its top-tier tourist destinations and attractions lying below the typhoon belt of East Asia. Given its serenity and richness of natural resources, the Chief Minister of Sabah has initiated a long-stay multiple-entry visa program called Sabah My Second Home (“SMM2H”) in June 2022.1 This proposal targets foreigners who wish to live in Sabah while promoting them to acquire and invest in Sabah’s real estate.

Following the discussion above, it is pertinent for any local or foreign investors to be well-equipped with the guidelines before embarking on their investment journey in Sabah. The Sabah Economic Development and Investment Agency (“SEDIA”) has set up the SEDIA Investment Promotion Unit to promote the investment sector in Sabah and facilitate the licensing and incentives for interested investors.2 Primarily, four (4) key steps are crafted to assist investors and businesses in investing and establishing operations in Sabah.

Firstly, the registration of a company. Any company intending to establish and operate a business in Malaysia must register with the Companies Commission Malaysia.3 Specifically in Sabah, a Trading License must be procured from the relevant district council after a company has been incorporated. It is defined under Section 2 of the Sabah Trades Licensing Ordinance 1948 (“STLO 1948”) as a licence issued under this STLO 1948.4 The council managing the area refers to where the company office is physically situated. In reference to Section 5 of the STLO 1948, a Trading License is a pre-requisite for any business activities conducted in Sabah. All business entities including sole proprietorships, partnerships to companies are required to obtain the Trading License. The pre-conditions for application as spelled out in the STLO 1948 are as follows5:

- the Trading Licence Form must be complete;

- Applicant must be 18 years and above;

- Applicant must be a local resident/permanent resident of Sabah’ or holds a valid work pass for residents of Sarawak and Peninsular Malaysia; and

- For Foreigners, application must be made via establishing of a registered company with a valid work pass.

The licensing rate is to be calculated at RM25.00/per annum together with processing fee of RM10.00.6

Secondly, any foreign investors must be alert to the equity policy imposed in Malaysia as the Foreign Investment Committee Guidelines are administering it prior to 2022, which aims to encourage “Bumiputera” involvement.7 After years, the concept of Bumiputera participation has been liberalized but still requires some foreign equity caps based on sector-specific regulation.8 For information and communication sector, Malaysia has permitted up to 100% foreign equity participation in application service providers, network service providers and network facilities providers.9 However, an exception applies to our national telecommunications company, Telekom Malaysia, which provide an aggregate foreign share cap of 30%, or 5% for individual investors.10

For oil and gas industries, it is controlled by a wholly state-owned company Petroliam Nasional Berhad (PETRONAS) under the terms of the Petroleum Development Act 1974. Typically, foreign investors will adopt the Production Sharing Contracts (“PSC”) which PETRONAS will regularly requires its PSC partner to join with Malaysian firms.11 For non-Malaysian firms, they are authorized to participate in oil services in partnership with local firms. Furthermore, they are restricted to a 49% equity stake if the principal shareholder is a foreign party.12 Also, Malaysia allows up to 100% foreign equity participation in the manufacturing sector for new manufacturing investments by licensed manufacturers.13

Thirdly, any local or foreign investors must be aware that the Federal Government will impose various types of taxes on companies and individuals including company tax, petroleum tax, and personal income tax.14

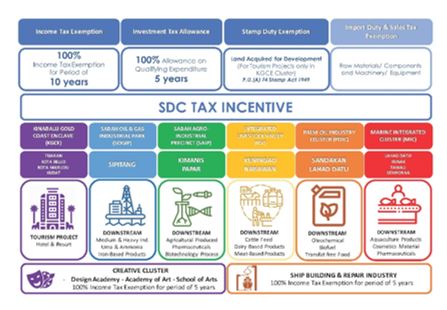

Nevertheless, the investors are still eligible for tax credits and incentives offered under the Promotion of Investments Act 1986, Income Tax Act 1967, Customs Act 1967, Excise Act 1976 and Free Zones Act 1990. Direct tax incentives grant partial or total relief from income tax payment for a specified period, while indirect tax incentives are provided as exemptions from import duty and excise duty.15 These incentives include various sector including manufacturing, agriculture, biotechnology industry, environmental management, research and development and others. In addition to the Federal Government’s incentives, Sabah also offers special tax incentives which have been customised for its economic region. In Sabah, special legislation has been introduced only regarding the Sabah Development Corridor (“SDC”).

Source: SEDIA Investment Promotion’s website

The following tax incentives are available for qualifying companies operating in the SDC.

- Schedule 1 of the Income Tax (Exemption) (No.11) Order 2018. This Order grants income tax exemption equivalent to 100% of Qualifying Capital Expenditure (QCE) incurred by the qualifying company for five (5) years in respect of specified qualifying activities in the shipping, creative, hotel and resort, manufacturing, education, and marine sectors.16

- Schedule 2 of the Income Tax (Exemption) (No.11) Order 2018. This Order grants income tax exemption equivalent to 100% of Qualifying Capital Expenditure (QCE) incurred by the qualifying company for ten (10) years in respect of specified qualifying activities in the halal sector.17

- Schedule 1 of the Income Tax (Exemption) (No. 12) Order 2018. This Order grants 100% income tax exemption for five years (5) of assessment on statutory income in respect of specified qualifying activities in the shipping and creative sectors.18

- Schedule 2 of the Income Tax (Exemption) (No. 12) Order 2018. This Order grants 100% income tax exemption for ten (10) years of assessment on statutory income in respect of specified qualifying activities hotel and resort, manufacturing, education, and marine.19

Moreover, the government has also enacted the Stamp Duty (Exemption)(No.8) Order 2018 to grant the stamp duty exemption for any instrument chargeable with ad valorem duty for the transfer of real property relating to ‘qualifying tourism project’ carried on in the SDC upon approval by the Minister.20

The initiative to invite more foreign investors under the SMM2H has also granted certain tax exemption for their participants. The government has given to the participants a tax exemption on the remittance of foreign fund into Malaysia.21 Furthermore, the Ministry of Housing and Local Government (“KPKT”) is requesting on a full stamp duty exemption under SMM2H for first-time homeowners of properties ranging between RM500,000 and 1 million.

With all these customed requirements under SMM2H, Sabah will surely attract more foreign investments and create sound economic activities.

Last but not least, any interested investors who is non-Sabahan or foreign workers in Sabah must apply for an employment pass. This visa and immigration application shall be obtained and made to the Sabah Immigration Department before starting work. The application must include the following:

- Letter of Authorisation by the company;

- A complete DP10 Form;

- Letter of Application from the company providing background on the company’s activities and justification for the position;

- Resume of expatriate;

- Latest Form 9,24,49;

- Latest statements and documents/of company profile;

- Letter of Review from regulatory bodies;

- Trading licence from local authority / manufacturing licence/rental agreement of premise;

- A copy of CIBD licence and ‘Letter of Undertaking’ form; and

- A copy of latest pay slip and income tax of expatriate.

In closing, in the upcoming years, more people and business will be anticipated to migrate to Borneo Island with all the special remarks offered by the federal and state government. Sabah will be the next main target for investment activities both domestic and foreign investors.

For further information, please contact:

Chris Lim Chee Kiung, Azmi & Associates

chrislim@azmilaw.com