The Firm acted for a corporate licensed Moneylender in an appeal against the High Court decision in Summerhay Development Sdn Bhd v Ivory Ascent Sdn Bhd (2020 1 LNS 1491 and 2020 MLJU 1549) and was successful in overturning the High Court decision in J-02(NCvC)(A)-1095-08/2020. The Court of Appeal’s decision was subsequently affirmed by the Federal Court and the borrower’s motion for leave to appeal was dismissed by the Federal Court (08(f)-415-09/2021(J)).

Scope of dispute

The question of law revolved around the freedom to contract on interest calculation in an instance of a breach of a moneylending agreement under the under Moneylenders Act 1951 (“MLA”). By way of context, the moneylending agreement, or the Schedule K Agreement1 is a strictly construed instrument regulated by the MLA such that any deviation can result in an unenforceable agreement (similar to Schedule H of Housing Development (Control and Licensing) Regulations 1989). Parliament’s intention was always to create a “simple” fixed term contract on a fixed rate of interest between the moneylender and the borrower within the comprehension of the ordinary man on the street. The statutory contract therefore makes provision on all matters during the tenure of a loan (rate of interest, no compounding, etc).

However, since the MLA was enacted, moneylending agreements are now also deployed by sophisticated lending institutions (credit agencies and similar institutions) who service the need for quick capital by their corporate clients. In these instances, where Schedule K is silent as to the method on which interest is apportioned throughout the lifetime of the contract, such lending institutions, bound by Malaysian Private Entities Reporting Standard (“MPERS”), are required to recognise that interest can only be earned on an outstanding amount remaining (Section 23.29(a) and 11.16 of MPERS2 ). This means that a “straight line” application of interest cannot be deployed, and more sophisticated methods must be applied such as the Sum of Digits / Rule of 78 Method or more recently, Effective Interest Rate.

Straight-line Interest Calculation

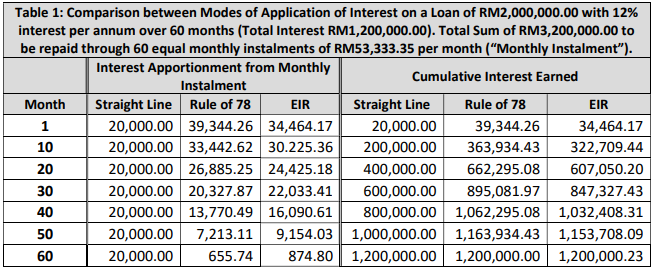

This method attributes equal interest portions to every accounting period. In other words, the total interest sum is divided over the life of the lending by number of periods (be it months, quarters, years or otherwise). For example, where a loan of RM2,000,000.00 is to be paid over 60 months at a rate of 12% per annum, total interest of RM1,200,000.00 is applied at RM20,000.00 per month.

Sum of Digits / Rule of 78 Method

Hire-Purchase Act 1967 expressly provides for statutory rebate for contracts to be calculated on the Sum of Digits / Rule of 78 method at Section 2, i.e. “amount derived by multiplying the terms charges by the sum of all the whole numbers from one to the number which is the number of complete months in the period of the agreement still to go (both inclusive) and by dividing the product so obtained by the sum of all the whole numbers from one to the number which is the total number of complete months in the period of the agreement (both inclusive)”. This method apportions a higher amount of each monthly repayments towards repayment of interest at the beginning of the lending to correspond with the higher outstanding principal balance at that juncture. This method is simple enough to be worked out by hand and at the same time goes some way in conforming with the principle that interest is earned based on the outstanding principal balance which will decrease proportionately as the loan is repaid.

Effective Interest Rate (“EIR”)

This is the current standard required by the MPERS which follows the principle of interest being earned on the outstanding principal amount which decreases proportionately as the loan is repaid — a more refined mode of calculation, now possible using accounting software.

Comparison of all three Modes of Application

It is important to note that if the loan is complied with, the above methods would make no difference to the borrower as the total interest paid is exactly the same. In our example of a loan of RM2,000,000.00 to be paid over 60 months at a rate of 12% per annum, the total interest repaid will remain at RM1,200,000.00.

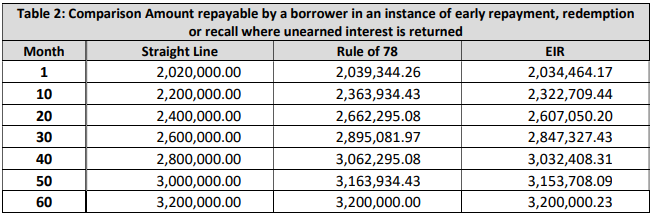

The impact of the mode of application of interest lies in an instance of early repayment, redemption or recall where unearned interest is returned pursuant to the principles of mitigation of contract (particularly if redemption is effected nearer the middle of the tenure of the loan e.g. on or around month 30). Schedule K does not in itself specify or provide for the mechanism to be deployed in such instances (by way of contrast, the Hire-Purchase Act 1967 provides for the Sum of Digits / Rule of 78 Method to be used in the instance of a fixed term contract).

The Court of Appeal’s Decision in J-02(NCvC)(A)-1095-08/2020

The Court of Appeal accepted that in the absence of any provision on the mode of application of interest, a lending party is at liberty to apply the sum of digits calculation in the instance of early repayment, redemption or recall. The decision at first glance appears counter to Parliament’s intention of a “simple contract” (the argument proffered by the borrower was that the Sum of Digits / Rule of 78 calculation resulted in a breach of the 12% provided under the MLA, which is, the interest earned as at the 28-month mark was in essence 18.295% interest per annum).

However, the Court of Appeal accepted our submissions that:

(a) The 18.295% calculation was erroneous as it treats the 60 months Moneylending Agreement as 28 months agreement, changing the fixed term nature of the Moneylending Agreement entered between the parties.

(b) A straight-line method of application of interest finds little commercial support. The Court of Appeal accepted that the UK position (pre-EU) that the “minimum standard” for an

application of interest in a consumer credit contract was the Sum of Digits Method to protect

lenders (Broadwick Financial Services Ltd v Spencer [2002] 1 All ER (Comm) 446) where:

(i) interest being apportioned towards the beginning of a lending was recognised as

reasonable to prevent unfairness to the lender; and

(ii) the Sum of Digits / Rule of 78 method was widely recognized in the UK as a viable mode of calculation and does not give rise to any “extortionate” bargain against consumers (The UK and other Commonwealth positions, including Malaysia, have since moved on to

recognizing effective interest rates being charged)

(c) Parliament’s intention only extended as far as the creation and full compliance of a moneylending contract, that is, clear terms provided to the borrower and at a fixed rate of interest (to combat unconscionable practices). This did not extend to the mechanics of the lending institutions who were in any event bound to conduct their business in line with “all other laws” including the Companies Act which required compliance with Accounting Standards.

(d) The legislative intent is even clearer when one considers that Parliament was already cognisant of various modes of calculation of redemption/early settlement for a fixed term contract as evident from the Hire-Purchase Act 1967 enacted some 15 years after the MLA — providing for not only detailed provisions on early redemption but modes of calculation for full term as well as month-to-month calculation of statutory rebate. Subsequent amendments/ revisions to the MLA in 1989, 2003 and 2011 did not include such provisions.

Ultimately, the Court of Appeal (and agreed by the Federal Court in dismissing the motion for leave to appeal) accepted that this “gap” was not something to be bridged by the courts and in the absence of specific legislation, the freedom of contract and/or market practice must be allowed to prevail.

Going forward — possible impact of a Consumer Credit Act

On 4 August 2022, Bank Negara Malaysia (“BNM”) announced that the government is working on the formulation of a Consumer Credit Act and the establishment of Consumer Credit Oversight Board (“CCOB”) which intends to strengthen protection for credit consumers in Malaysia3 . The Public Consultation Paper (Part 1) on Consumer Credit Act issued by CCOB Task Force supported by Bank Negara Malaysia and Securities Commission Malaysia (“Task Force”) does not at the moment appear to resolve the apportionment of interest in moneylending agreements4 . However, the Task Force has caveated that further details on the authorisation, requirements and conduct standards will be set out in Part 2 of the consultation paper (targeted for issuance by the fourth quarter of 2022).

Separately, the Consultation Paper (Part 1) is also clear that entities such as the conventional and Islamic moneylenders, pawnbrokers, and non-bank hire purchase and credit sales companies will come under the regulatory ambit of the CCOB (with the corresponding transfer of regulatory powers from KPKT and KPDNHEP to CCOB which is targeted to be commenced no earlier than 2025).

The above decision highlights that the doctrine of freedom to contract prevails and can only be curtailed by specific legislation — and until then, a borrower may stand to save / recover a lesser sum due to the apportionment of interest over a tenure in the event of early payment, redemption or recall.

For now, lending institutions are still advised to act as close to the spirit of the money lending provision and provide clear, accurate, consistent, and timely disclosures of information to borrowers, including on the mode of application of interest, for example, set out the provision of Sum of Digits/Rule of 78 method in clear and unambiguous terms which will give borrowers a clear picture of the impact of any early payment, redemption or recall.

For further information, please contact:

Datin Jeyanthini Kannaperan, Partner, Shearn Delamore & Co.

jeyanthini@shearndelamore.com

1 Schedule K of Moneylenders (Control and Licensing) Regulations 2003.

2 https://c0aa0d68-de31-44c8-bb40- ac5f2e0a9fe4.filesusr.com/ugd/a87018_5b13be37ec354e388901ef7342d8f641.pdf?index=true.

3 https://www.bnm.gov.my/-/ccobtf-invites-fdbk-cca-cp1.

4 https://www.ccob.my/assets/Consultation_Paper_Part_1.pdf.