Introduction

On 16 December 2024, the Companies Commission of Malaysia (“CCM”) introduced new criteria for audit exemptions, offering significant relief to certain private companies. This new audit exemption criteria were outlined in Practice Directive No. 10/2024 (Qualifying Criteria for Audit Exemption for Certain Categories of Private Companies), which shall come into effect for financial periods beginning on or after 1 January 2025. This marks an essential step in enhancing the ease of business for small and medium enterprises (“SMEs”), greatly reducing compliance costs and administrative burdens.

Overview

Pursuant to Section 267(1) of the Companies Act 2016 (“CA 2016”), a private company shall appoint an auditor for each financial year of the company. Section 267(2) of CA 2016 further states that, notwithstanding subsection (1), the Registrar shall have the power to exempt any private company from the requirement stated in that subsection according to the conditions as determined by the Registrar.

While audits ensure financial accuracy and compliance with regulatory standards, they can impose substantial costs on smaller businesses with limited resources. Therefore, CCM has engaged in extensive consultations between February 2023 and June 2024 to evaluate the need for reform. The results were overwhelmingly supportive, with 88% of respondents backing the proposed changes.[1]

Key Highlights of the New Criteria

The new criteria aims to strike a balance between maintaining corporate governance standards and alleviating the financial and administrative burden on smaller companies. Under the new criteria, private companies can qualify for audit exemption if they meet at least two (2) of the following conditions:

- The annual income of the company during the current financial year and in the immediate past two (2) financial years does not exceed RM3,000,000;

- The total assets of the company in the current statement of financial position and in the immediate past two (2) financial years do not exceed RM3,000,000; or

- The number of employees at the end of the current financial year and in the immediate past two (2) financial years does not exceed thirty (30).

Implementation

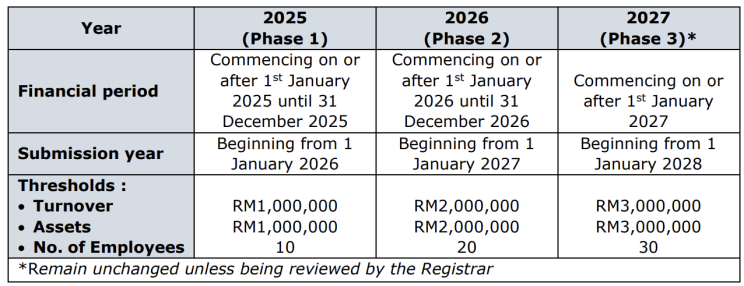

To ensure a smooth transition, the audit exemption threshold criteria will be implemented in a gradual approach over three (3) years. This approach will allow companies to adapt progressively to the requirements while ensuring that the qualifying criteria remain achievable for businesses of different sizes. The thresholds for maximum turnover, assets and number of employees will increase incrementally each year from 2025 to 2027.

The implementation of Audit Exemption Thresholds can be as follows:[2]

In addition to these thresholds, dormant companies that have remained inactive since incorporation or during the current and previous financial year are also eligible for the exemption.

However, the exemption under this Practice Directive will not be applicable to:

- an exempt private company which has opted to lodge a certificate relating to its status as an exempt private company to the Registrar pursuant to Section 260 of CA 2016;

- a public company including listed company;

- a private company that is a subsidiary of a public company; and

- a foreign company.[3]

Implications of the implementation of the new criteria to the SMEs[4]

The introduction of these criteria is expected to have an impact on 42% of active companies. However, several factors need to be considered as these might reduce the number of eligible companies:

- Employee Thresholds: The exemption criteria include financial thresholds (revenue, assets, etc.), but the analysis does not account for the number of employees employed by companies.

- Regulatory Requirements: Certain government agencies or regulatory authorities may still require companies to submit audited financial statements, regardless of their size or financial status.

- Financial Institution Requirements: Companies with existing financial commitments, such as loans or credit facilities, may still need to audit their financial statements. This is because banks and other financial institutions often require audited accounts as part of their terms for lending or financial arrangements.

- Other Legal Obligations: Companies may still need to audit their financial statements due to specific legal obligations, such as clauses in contracts, grants, or agreements that mandate audited accounts. These requirements might make companies voluntarily opt for audits even if they are technically exempt.

Conclusion

The new audit exemption criteria mark a significant milestone in Malaysia’s corporate regulatory framework. By striking a balance between reducing compliance burdens and upholding governance standards, CCM has paved the way for a more dynamic and inclusive business ecosystem. As these changes take effect in 2025, eligible private companies stand to benefit from cost savings and operational efficiencies, reinforcing their role as key drivers of the nation’s economic growth.

For further information, please contact:

Izzati Asyiqin Adzhar, Azmi & Associates

Izzati.Asyiqin@azmilaw.com

- The Edge Malaysia, ‘SSM – New audit exemption criteria for private companies kick in January 1’ (18 Dec 2024) <https://theedgemalaysia.com/node/738203>.

- FAQ Audit Exemption <https://www.ssm.com.my/Pages/Legal_Framework/Document/FAQ-AUDIT-EXEMPTION.pdf>.

- Practice Directive No. 10/2024 Qualifying Criteria For Audit Exemption For Certain Private Companies In Malaysia <https://www.ssm.com.my/Pages/Legal_Framework/Document/PD10-2024-Qualifying-Criteria-for-Audit-Exemption-for-Certain-Categories-of-Private-Companies.pdf>.

- SSM New Qualifying Criteria For Audit Exemption <https://www.ssm.com.my/Pages/Publication/PDF%20Files/AD%202024%20-%20New%20Audit%20Exemption%20Qualifying%20Criteria.pdf>.