10 May, 2017

Amendments were made to the Singapore Companies Act (Chapter 50) on 31 March 2017 to enhance the transparency of Singapore companies in line with Financial Action Task Force guidelines. As part of these amendments, the following registers have to be maintained:

- register of controllers for Singapore companies and branches

- register of nominee directors for Singapore companies

- register of members for Singapore branches

This memorandum sets out a summary of the requirements and 10 key things you need to know about the new registers.

Summary of requirements

Key features of the registers of controllers and nominee directors are as follows:

- The provisions are found in a new Part XIA of the Companies Act. Three new Schedules have also been added.

- All Singapore private companies and foreign companies with a Singapore branch are required to maintain a register of controllers. There are certain exemptions. For example, Singapore Government owned entities and financial institutions regulated by the Monetary Authority of Singapore (“MAS”) are exempt. Foreign companies listed outside Singapore and subject to similar transparency requirements are also exempt.

- A controller is an individual or a legal entity (wherever incorporated) with a "significant interest" in or a "significant control" over the company or foreign company.

- "Significant interest" and "significant control" are defined in the new Sixteenth Schedule of the Companies Act.

- One test for "significant control" is the ability to appoint or remove the directors who hold a majority of the voting rights at board meetings. The right to exercise, or actually exercising, significant influence or control over the company or foreign company is another test.

- The threshold for having a "significant interest" is an interest in more than 25% of the shares or votes attached to voting shares. Interest in shares is to be determined by reference to section 7, Companies Act (i.e. the same test as that used for substantial shareholder disclosures).

- Existing companies and branches have until 30 May 2017 to set up their registers. Companies incorporated or branches registered after 31 March 2017 must do so within 30 days of incorporation or registration.

- All Singapore private companies must keep a register of nominee directors unless they are exempt from doing so (for e.g. it is a financial institution regulated by MAS). The nominee has an obligation to inform the company and provide prescribed information relating to his nominee status. This requirement does not apply to Singapore branches of foreign companies.

In addition to introducing the two new registers above, the amendments also introduced new sections 379 to 384 (in Part XI) which require all Singapore branches of foreign companies to keep a register of members either at its registered office in Singapore or at some other place in Singapore. ACRA must be informed of the location of the register. There is currently no exemption from this requirement.

10 key things you need to know Resources

In addition to the provisions in the Companies Act, key requirements (for e.g. prescribed forms and deadlines) are set out in the Companies (Register of Controllers and Nominee Directors) Regulations 2017.

The Accounting and Corporate Regulatory Authority (“ACRA”) has a dedicated page on its website relating to the registers.

The page summarises the requirements and has links to helpful FAQs and a video guide. ACRA has also published three guidance notes on the registers.

Duplication

The provisions are intended to avoid duplicative reporting so that tracing can stop once it reaches an entity that is required to maintain a register of controllers or is exempt from the regime. However, this is not reflected in the legislation as section 386AC(c) requires each intervening entity to have a register or be exempt.

Relevance of 20% threshold

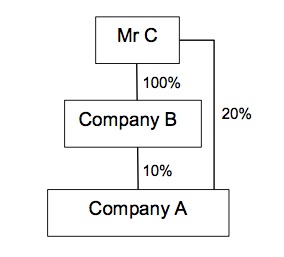

Although the significant interest and significant control tests has a 25% threshold, the application of section 7, Companies Act, in particular the deeming provision in section 7(4A)(a), to determine who has an interest in shares means that the 20% threshold is also relevant. By way of illustration:

Mr C is a registrable controller of Company A as he is deemed, because of section 7(4A)(a), to have an interest in ForeignCo B’s 26% interest in Company A.

The 20% threshold (as opposed to a majority stake) for interests which are held indirectly means that the Singapore controllers regime can potentially be quite extensive.

Significant interest vs significant control

In practice, the significant interest test will be easier to apply than the significant control test. From the guidance notes and sample form of the register of controllers, it appears that there is no need for a controller to identify the basis upon which he claims to be a controller. There is also no requirement to provide details (for e.g. the extent of his interest or the bases upon which he can exercise significant influence or control).

Aggregation of interests

It is unclear whether interests have to be aggregated. By way of illustration:

Arguably the “joint arrangement” rule set out in the Sixteenth Schedule may apply so that Company B and Mr C are registrable controllers of Company A with each being regarded as having a 30% interest.

Reasonable steps

Companies and branches are required to take “reasonable steps” to identify their registrable controllers. In its guidance note, ACRA has stated that this means that, as a minimum requirement, a notice must be sent to each member and director annually.

They must also keep the registers up to date and correct any inaccuracies. This duty does not have a reasonable steps requirement but it appears from the guidance note that sending a notice to every controller on the register annually would also discharge the duty.

If in the period between the annual notices, there is cause to believe that there is a new controller or that particulars have changed, then a notice should be sent within two business days of the company having reasonable grounds for such belief.

Compliance teams should put in place appropriate procedures to discharge these duties.

Information gaps

In a situation where a person was a controller but the company only found out after the person ceased to be one, it is unclear if the company still has an obligation to send a notice to obtain the relevant information. Our recommendation is that the company should do so in order to plug the information gap in the register.

Private registers

The registers are private and can only be accessed by ACRA and Singapore public agencies such as the Commercial Affairs Department, the Corrupt Practices Investigation Bureau and the Inland Revenue Authority of Singapore.

There are no exemptions for accessing the registers for purposes of legal due diligence or with consent of the controllers or nominators. In an M&A transaction, a purchaser will not be able to verify that the target is in compliance with its obligations to maintain the relevant registers and will have to seek appropriate protection in the SPA.

Who is a nominator?

A director is a nominee if he is accustomed or under an obligation whether formal or informal to act in accordance with the directions, instructions or wishes of any other person. Shareholders who appoint their representatives to the board will generally have to be entered in the register as a nominator.

It appears that only the immediate nominating entity has to be registered. For e.g. if the shareholder appointing the nominee is a SPV of a joint venture partner, only the SPV (rather than its ultimate controller) is registered as nominator.

Consequences

Generally, failure to comply with the provisions in Part XIA constitutes a criminal offence and the offender can be liable to a fine of up to S$5,000.

In the UK persons having significant control or PSC regime, the company is able to prevent transfers of the underlying shares and stop paying dividends if a PSC fails to respond to an information request. The Singapore regime does not go so far.

For further information, please contact:

Sophie Mathur, Partner, Linklaters

sophie.mathur@linklaters.com

.jpg)