Recently, a growing number of Chinese intellectual property judgements adopted non-statutory methodologies in calculating damages award. This follows from a recent change in legislation which introduces a new evidentiary rule and punitive damages in case of malicious infringements.

The Chinese courts are exploring innovative approaches on damage award above and beyond the conservative, entirely discretionary statutory basis within a fixed range. This is a welcoming change. Apart from the “Vanillin” trade secret case in which the Supreme People’s Court (“SPC”) awarded RMB 156 million which is remarkable in quantum, we note a positive trend that the Chinese courts are more willing to spend efforts to tackle complex damage calculation issue using an objective rationale in determining the contribution rate of the infringed technology and deciding on the application of punitive damages.

For the cases of technology infringement, Article 71 of the PRC Patent Law provide the legal grounds for damage determinations. Article 14 of the SPC’s Several Provisions on the Application of Law in the Trial of Patent Disputes and Article 16 of the related Judicial Interpretation further specifies the methodology where the formulae could be summarized as follows:

Damages = the infringer’s gain

Infringer’s gain = units of infringing goods sold ×reasonable profits

Reasonable profits = sales price × profit margin × contribution rate of the patent

VMI v. Safe-Run

In VMI Holland B.V. (“VMI”) v. Safe-Run Intelligent Equipment Co., Ltd. and Safe-Run Mechanical Engineering (Shanghai) Co., Ltd. (collectively “Safe-Run”) dispute over an invention patent infringement1 , the 1st instance court Suzhou Intermediate People’s Court ruled that the cutting device used in Safe-Run’s SRS-H tire building machine (TBM) infringed VMI’s patent rights, and granted an injunction against Safe-Run along with a damage award that Safe-Run shall compensate VMI for the economic losses and reasonable expenses incurred to stop the infringement, in the sum of RMB 3.06 million. The 2nd instance court Jiangsu High People’s Court upheld the verdict of the 1st instance judgement in its decision effective at the end of 2021. The case is selected by the SPC as one of the 50 exemplary intellectual property cases among Chinese courts in 2021, and is also selected by the Jiangsu High People’s Court as one of the top 10 exemplary IP judicial protection cases among Jiangsu Courts in 2021.

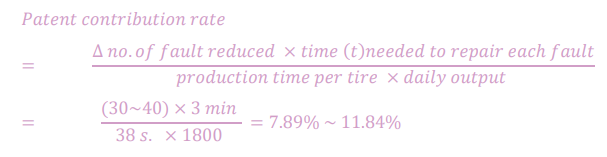

The importance of the case arises from the use of an objective methodology to ascertain the contribution rate from the infringed cutting device which forms a component of the TBM. The courts considered that the contribution rate could be deduced by comparing the reduction in “failure rates” between the TBM using the patented technology at issue (cutting device) and the one without it. Further, relying on the expert testimonies and the pertinent data disclosed in Safe-Run’s prospectus, the courts adopted the following formulae to calculate the contribution rate of the asserted patent:

Based on the above calculated contribution rate, the court adopted the formula regarding damage calculation above (i.e. damage = average sale price of SRS-H TBM × sales amount of SRS-H TBM × profit margin × contribution rate of the asserted patent) to conclude the damage amount.

Aux v. Gree

In Aux v. Gree2, the patentee submitted an economic report to assess the contribution rate of the patent-indispute for the two kinds of infringing products. In the first instance judgments issued in December 2021, the Ningbo Intermediate People’s Court ascertained that the contribution rate to be 20% based on a more qualitative approach. The judgments listed out a number of factors which should be taken into account:

1. The assessment of the technical value of the patented technology – relevant considerations are the nature of the patent, the terms, the number of patented claims, number of patents in the family, forward citations of the patent families. Generally, invention patents are taken to have higher values than utility models.

The economic report submitted by the patentee found that the patent has 13 claims, there are 17 patents in the same family, and 41 citations. The total number of similar patents in the industry is 357, and the patent quality belongs to the top 1.4%. The report also noted that the patented technology is widely used by different air-conditioners.

2. The market value of the patent – e.g. the technical problem solved by the patent, the utility conferred by the patent, the increase in values to the consumers, the scope of use, and whether the patent is used in advertisements, the costs of the patented components in the whole product and profit margin, etc.

3. Other facts which should be taken into account – e.g. whether technology and patents play an important role in the business models of the patentee and the defendants, and in the market generally.

The two cases are on pending on appeals, but the accumulative first instance damages assessment in the region of more than RMB 160 million represent one of the highest awards in Chinese patent cases.

Tinci v. Newman

Guangzhou Tinci Materials Technology Co., Ltd. (“Tinci”) et al. v. Anhui Newman Fine Chemicals Co., Ltd. (“Newman”) et al3 is a dispute over misappropriation of technical secrets, the SPC awarded punitive damages for the misappropriation of technical secrets with a multiplier of five times the damages award under the AntiUnfair Competition Law. The case also reflected the application of the evidence production order.

The courts recognized that the Tinci’s formula to manufacture Carbomer (polyacrylic acid, carboxyl ethylene copolymer) had been widely used in lotion, cream, gel constituted technical secret and such technical secret was misappropriated by the defendants. Considering that 1) Newman’s entire business is to manufacture the infringing Carbomer products, 2) after Newman’s former legal representative was prosecuted for the criminal liability, Newman did not stop the production of the infringing products and even sold the same to more than 20 countries and regions, and in particular, 3) Newman refused to submit the pertinent accounting books and underlying documents without reasonable grounds that constituted obstruction of evidence, the courts determined that it reached the threshold of malicious infringement and serious circumstance of infringement stipulated in the new regulations, such that the punitive damage shall be warranted in this case. As the defendants were able to but refused to submit the account books and relevant documents without reasonable grounds, against the evidence production order, the courts shifted the burden of proof and fully accepted the Tinci’s evidence on the damages

An interesting point is that the infringing activities in this case span before the latest PRC Anti-Fair Competition Law came into effect on April 23, 2019, when the punitive damage regime was introduced. In principle, the punitive damage should not be applied retroactively on the damages caused before April 23, 2019. However, as the defendants failed to present any evidence to prove its profits, the courts are not able to calculate the damage amount caused before and after April 23, 2019 on a separate basis. Given that Newman did not cease infringement after the 1st instance judgement was handed down, the SPC applied the punitive damage based on the total damage amount as determined.

Since the infringing acts have been continuing during the case trial and even after the first instance decision is handed down, the SPC also awarded the damages for the period from the case docket date of first instance to the trial of second instance.

The quantum of the damages award is around RMB 30 million.

This case is the first trade secret misappropriation case adopting punitive damages with the highest multiplier.

Trends on damage awards with contribution rate in future IP cases

For the civil lawsuit in China, the courts mainly rely on the evidence voluntarily presented by the parties to find the facts. Due to the lack of mandatory discovery, it has been some plaintiffs’ tactics that withholding evidence to leave the trial court to judge the case based on limited evidence, especially on finance documents related to damages. Thus, the damage calculation has been one of the most difficulty parts in IP litigations. To further complicate the damage determination on technical IP disputes, it is the reality that most of the judges are not as familiar with the patent or technical secret as the parties, and the trial court may be reluctant to raise the issue of contribution rate of the infringed technology on the total damages. Another consideration on technology rate is obviously the additional costs to prove the contribution rate since it usually needs the industrial experts and economic experts to testify with substantive analyses on the technical and economic aspects of the technology.

Based on these breaking through in recent cases on more precise determined damages with contribution rates, plaintiffs will benefit from spending more efforts and costs in their high-stake IP disputes, to explore a more accurate damage recovery calculation.

It appears from these cases, that the PRC courts are now willing to rigorously determine the damage amount and adopt more sophisticated approaches to address complicated damage calculations. We expect to see that in the near future more sophisticated economic models will emerge in calculating damages, as the average amount awarded by the Chinese courts continues to increase.

For further information, please contact:

Christine Yiu, Partner, Bird & Bird

christine.yiu@twobirds.com

1. First Instance Civil Judgement by Suzhou Intermediate People’s Court, (2016) Su 05 Min Chu No. 780; Second Instance Civil Judgement by Jiangsu High People’s Court, (2018) Su Min Zhong No. 1384.

2. First Instance Civil Judgements by Ningbo Intermediate People’s Court, (2019) Zhe 02 Min Chu Nos. 165 and 183.

3. First Instance Civil Judgement by Guangzhou Intellectual Property Court, (2017) Yue 73 Min Chu No. 2163; Second Instance Civil Judgement by Supreme People’s Court, (2019) Zui Gao Fa Zhi Min Zhong No. 562.