Background of the case

The Supreme Court through its judgment in State Bank of India v. Rajesh Agarwal has read the doctrine of audi alteram partem into the classification of accounts as a fraud as per RBI Master Directions.

The Apex Court was of the opinion that the doctrine of audi alteram partem cannot be implied as excluded under the Master Directions on Frauds. The Court agreed that debarring borrowers from accessing institutional finance under Clause 8.12.1 of the Master Directions on Frauds resulted in serious civil consequences for the borrower.

The court laid down that principles of natural justice require that borrowers be served a notice, given a chance to explain the findings of the forensic audit report and be allowed to be represented before their account is classified as fraud under the Master Directions on Frauds.

Regulatory Process

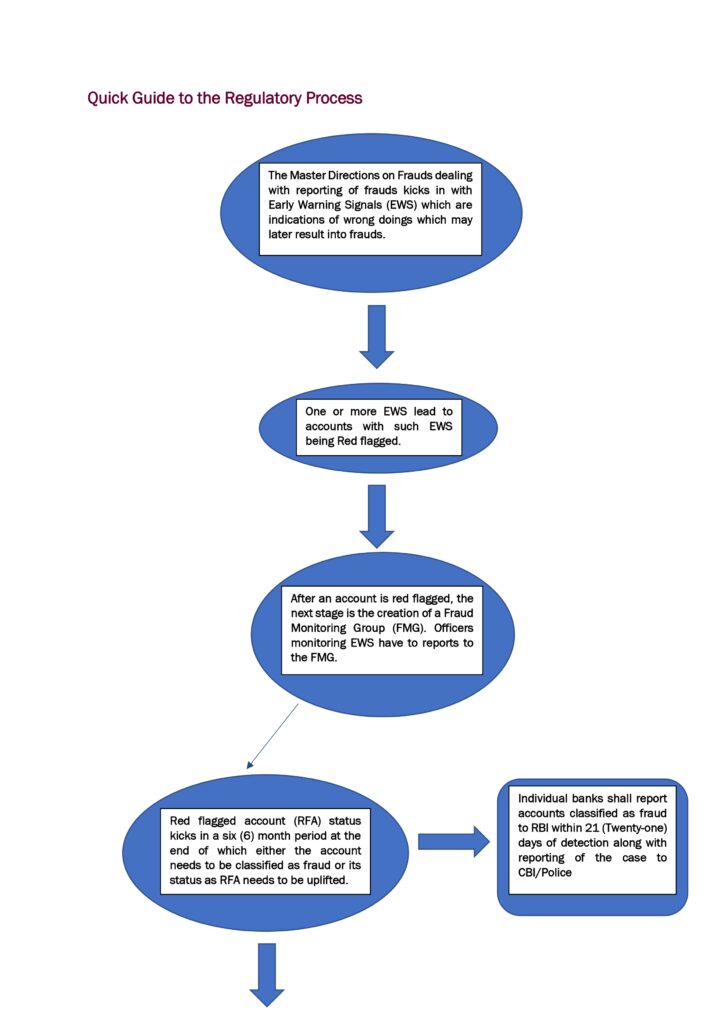

The Master Directions on Frauds under Chapter VIII deals with loan fraud. The aim of Chapter VIII is to provide banks with the mechanism of reporting frauds to investigate agencies after forming an informed opinion.

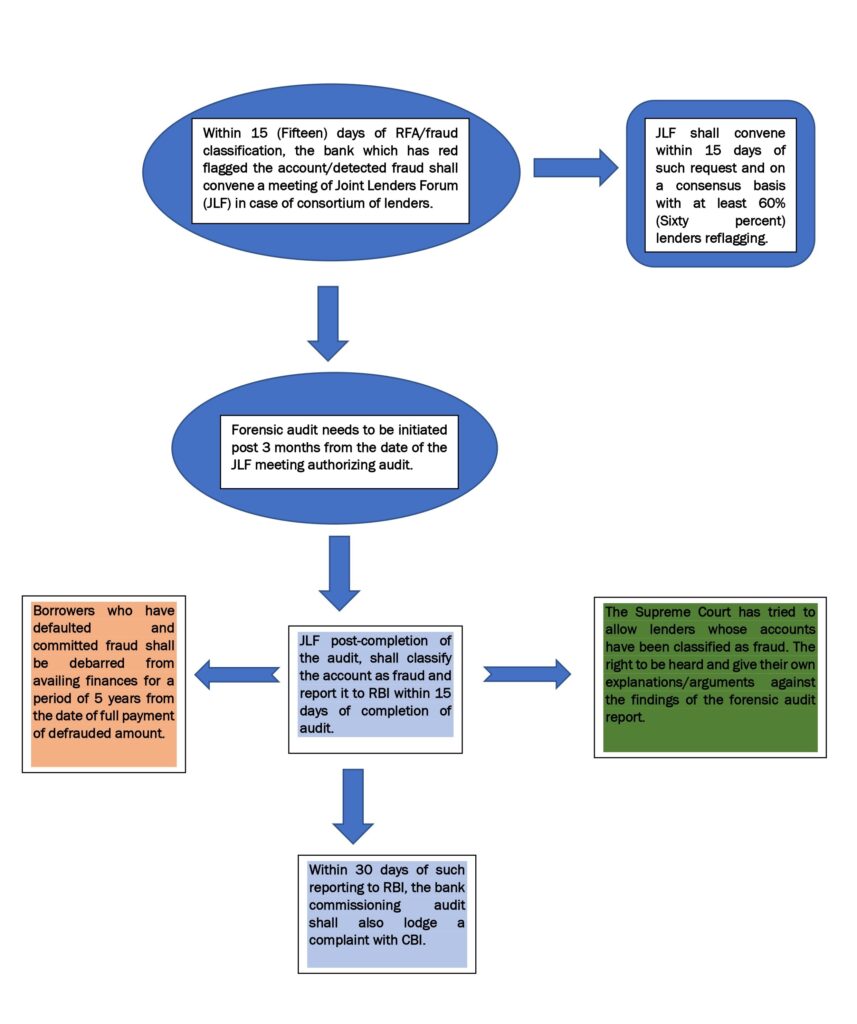

*For ease of understanding, we have explained the regulatory process in a diagrammatic format on the next page.

Key Takeaways from the Judgment

The Master Circular on Wilful Defaulters envisages a personal hearing to the borrowers in an in-house hearing before penal provisions akin to the Master Directions on Frauds are applied. It was clear that no such hearing was envisaged under the Master Directions on Frauds.

The court has harmonised this in light of the ‘civil death’ experienced by a borrower in light of being declared fraudulent and read the requirement of providing an adequate opportunity of hearing to the borrowers into the directions.

Lenders contended that the court rejected their argument stating accounts are not declared fraud overnight by construing the doctrine of audi alteram partem not to mean mere participation of borrowers in the preparation of forensic audit reports. Adding to the contentions, lenders stated that they give due opportunities to borrowers at all stages of the process from detection of EWS to declaring an account as fraudulent.

It is clear that the court took stock of the fact that in a lot of cases, it was being noticed that bankers and auditors were taking an ultra-cautious approach by red-flagging even minor transgressions associated with accounts. This was being done in fear of action by investigating bodies. It was felt that banks needed to be reminded that borrowers had to be given an opportunity of being heard before being declared as frauds. It remains to be seen how the lenders try to make the process more in tune with the court’s judgment going ahead. It would also be interesting to see at what stage and in what form is this opportunity of being heard given to the borrowers. However, it would not be a peculiar statement to make that the right to be heard is best given before initiating the audit and another after the audit is completed.