11 May 2021

1. The latest developments of SPAC in Hong Kong

Although SPAC (Special Purpose Acquisition Company) has only been popular in the US capital market for many years, after the explosive growth in the number of listings and the amount of funds raised in recent years, the global market has begun to pay more attention to SPAC. As of March 31 this year, in just three months, the number of US SPAC listings has reached 298, and the amount of funds raised is about 97.126 billion U.S. dollars. Both the number of listings and the amount of funds raised have surpassed the figures for the whole of 2020. According to reports, Hong Kong entrepreneurs such as Li Ka-shing, the founder of the Changhe Department, and Zheng Zhigang, the chief executive of New World Development, are also planning or in the process of organizing a SPAC listing in the United States, with individual funds raised up to US$400 million.

In order to improve Hong Kong’s competitiveness as an international financial center, the Hong Kong Special Administrative Region Government has formally requested the Hong Kong Stock Exchange and the Securities Regulatory Commission to seriously study the introduction of the SPAC listing system in Hong Kong at the beginning of last month, and is expected to implement the SPAC listing system in Hong Kong before the end of the year. Share a slice of the global SPAC capital market. However, after the explosive growth of the United States in the past two years, many SPACs have also faced the problem of failing to complete mergers and acquisitions before the deadline. Therefore, policy makers should also beware of the possibility of the SPAC bubble bursting.

At the same time, although many Eurasian countries have allowed SPACs to be listed, and South Korea and Malaysia in Asia alone, there has not been a boom like the United States for the time being. Hong Kong's introduction of SPACs during this period should refer to the experience of other countries in SPAC supervision and governance, and strike a good balance between attractiveness to investors and protection.

Click on the image to enlarge.

2. What is SPAC?

In simple terms, SPAC is a "shelf company" that only raised funds at the time of listing and was established for the purpose of acquiring other companies without any other business. From the perspective of investors, it is a financial tool that integrates the characteristics and purposes of financial products such as listing, mergers and acquisitions, and private equity investment. It is favored by funds and investment banks with sufficient funds and extensive customer resources.

SPACs are generally initiated and established by promoters (such as fund management institutions) to conduct IPO (Initial Public Offering). Securities firms raise funds from institutional investors and retail investors. After approval, they only have funds but no operations. The business company is listed and traded on the stock exchange. Generally, 100% of the cash raised in the IPO is placed in the regulatory account and is not released until the SPAC completes the business combination.

The sole purpose of SPAC is to find target companies that want to go public and negotiate mergers and acquisitions, so that the target companies can obtain financing and replace SPAC as a listed company. This process is called de-SPAC (ie "de-SPAC"). If the SPAC fails to complete the de-SPAC within 24 months, the SPAC will face liquidation, and the funds it escrows for investors should be returned to the investors with capital and profits.

In the process of de-SPAC, the sponsor of SPAC will identify suitable target companies. If the two parties reach a consensus, they will sign a cooperation agreement and draft the merger document, which will be submitted to the regulatory agency for approval. After approval, SPAC shareholders still have to vote at the general meeting of shareholders. If approved, the merger process will continue. On the day of completion of the merger, the target company not only obtained funds, but also landed on the stock exchange to become a listed company.

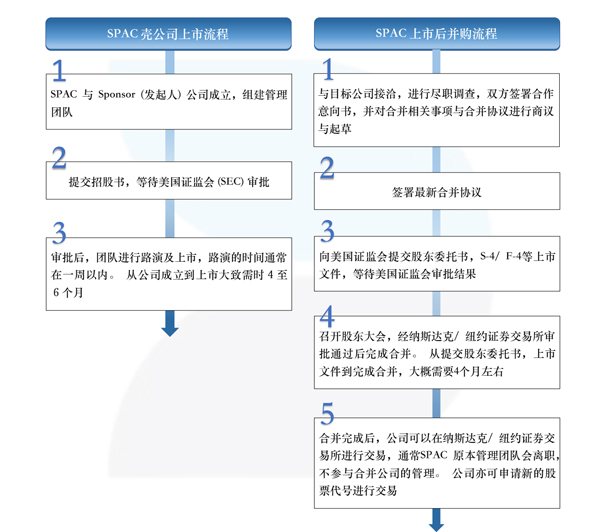

According to the practice of US SPAC, its listing and de-SPAC process is shown in the figure below.

Click on the image to enlarge.

3. The difference between SPAC and traditional IPO

Unlike traditional IPOs, SPACs first have listed companies and funds, and then acquire suitable companies. For the target company, this has the certainty that it can be listed on the main board market, avoiding the risk of failure or delay in the listing of traditional IPO applications that are not approved, and the cost of listing is also lower. For investors, there is also an exit mechanism for redemption of stocks if the target of the merger is not as desired or the merger fails in the end.

But the disadvantages of SPAC cannot be ignored. First of all, there is great uncertainty in the acquisition target of SPAC. Investors of SPAC cannot know what company they will invest in in the end, and there is no performance record for reference, and there is no guarantee that the merger will be completed. You can only trust the insight of the sponsor team. And ability. Secondly. Although SPAC merger transactions need to be reviewed by the Securities Regulatory Commission and the exchange, this review is far less stringent than the IPO review, and it will not fully disclose information at the same time. If the due diligence of the SPAC management team is not in place, fraudulent listings may occur. Therefore, for public investors, the SPAC model still has certain investment risks.

Fourth, the focus of the supervision of SPAC

1. Is SPAC equivalent to backdoor listing?

SPAC and the backdoor listing (buying shell) that Hong Kong regulators have determined to crack down on for many years seem to be similar. Both are private companies obtaining listing status through mergers and acquisitions with shell companies, but both are in terms of process, disclosure and investor protection. There is a fundamental difference.

Backdoor listing (also known as reverse takeover) generally occurs between a small-scale or unsustainable listed company and a relatively large-scale private company. In name, the listed company acquires a private company to expand its business. In essence, it is a way to circumvent the new listing requirements while listing private businesses and assets. The value of shell companies has reached hundreds of millions of Hong Kong dollars, leading many people to create shells for profit. However, this method generally squanders the interests of other investors, changes the business of listed companies and disposes of assets without authorization. It also greatly damages the integrity, stability and quality of the market and affects investor confidence. Therefore, it has become a key target of the Hong Kong Stock Exchange.

In order to address and curb the practice of backdoor listings, the Hong Kong Stock Exchange revised Chapter 14 of the Listing Rules and issued three guidance letters in 2019 to define and regulate backdoor listings in the market, giving the Hong Kong Stock Exchange More room to exercise regulatory powers such as suspension and delisting, raise the threshold for backdoor listings to similar IPO disclosure requirements, and restrict asset disposal after the transfer of control rights. Under the current regulatory system, backdoor listing in Hong Kong has become quite difficult.

The difference of SPAC is that its purpose of "establishing a shell company" and "merging and acquiring private companies" is transparent and open. Whether it is the establishment of shell companies, fundraising, and the disguised listing of private companies mergers and acquisitions, they are all led by the promoters and controlled by the regulators. The surveillance is conducted in accordance with the rules of the game, and shareholders have the right to leave the market and vote on the merger during the process. Under this frank and honest prerequisite, there is no such thing as a backdoor listing in the past that would affect the operation of the market and cause a false market.

2. How to ensure that the sponsors of SPACs perform their duties?

Generally speaking, when setting up a SPAC, the sponsors of the SPAC can obtain the founder's shares, which account for about 20% of the total share capital of the SPAC, which is the responsibility of the SPAC establishment and maintenance costs (approximately US$5 million) before the merger transaction is completed. The consideration. In addition, sponsors cannot withdraw salaries or charge any management fees from SPAC funds raised. The promoters’ shares are usually banned for sale within one year after the completion of the SPAC merger. In addition, if SPAC fails to de-SPAC within the time limit, 20% of its shares will not be refunded, because the consideration (ie establishment and maintenance costs) has already been paid.

Under this premise, promoters have great incentives to complete de-SPAC to prevent their efforts from being lost; at the same time, promoters must carefully select the business of mergers and acquisitions, and strive to use the promoter’s influence to make it successful. In order to ensure that its shares can be converted into valuable investment. On top of this, the sponsors (including the board members and management of the SPAC) and the directors and executives of the target of the merger may not have any relationship or have any interests.

Relatively speaking, the sponsors of traditional IPOs are institutions regulated by the China Securities Regulatory Commission. They should do their responsibilities as sponsors for their own business and have greater incentives to ensure that the entire IPO process is compliant and legal. However, since its remuneration is not affected by the stock price performance of listed companies, even if a thorough investigation of past performance has been done, the success of the business in the future may not necessarily be its top priority.

In order to strengthen the incentives for SPAC sponsors and prevent sponsors from rushing to de-SPAC, regulators can consider adding sponsors’ funding requirements and extending the lock-up period. At the same time, if you want to strengthen the supervision of sponsors, you can also consider adding a licensee role similar to the traditional IPO sponsor in the de-SPAC intermediary team to ensure the compliance of the de-SPAC team's work and improve the supervision of the Securities Regulatory Commission. Accountability.

3. Is the disclosure of the information about the acquired target sufficient?

Usually, after the SPAC signs a letter of intent with the acquisition target, it will take about three to five months to complete the audit of the acquired party, restructuring (if necessary), legal due diligence, price evaluation by the investment bank, and the attorney to draft the merger documents. In general SPAC mergers and acquisitions, the supervision and review of target companies are not as good as traditional IPOs, and the investigation conducted by intermediaries is relatively limited.

The significance of due diligence is to reduce the risk of the target company deceiving investors and regulators on important matters. No matter how much experience and reputation the sponsor has in management or investment, it cannot replace substantive and in-place due diligence work.

However, if de-SPAC is required to meet the IPO standards according to Chapter 14 of the Listing Rules regarding reverse takeovers, SPAC will lose its advantage in allowing private companies to go public quickly. When Hong Kong's regulatory agencies formulate relevant due diligence requirements, it is appropriate to focus on the middle, so as to maintain market competitiveness and enhance investor protection.

4. Does the exit mechanism protect investors?

After experiencing the upsurge of SPACs in the United States, many SPACs are facing the problem of not being able to acquire targets within a limited period of time. Even if the promoters are given sufficient incentives, it will not solve the possible oversupply of SPAC funds in the market. Therefore, it is very important to protect the exit mechanism of investors (including exiting investors and remaining investors).

There are generally two exit mechanisms for SPACs. First of all, if the SPAC fails to complete the merger transaction within 24 months after its establishment, the raised funds in the regulatory account (including the sponsor’s capital and investor’s capital) will be returned in full. Secondly, before SPAC completes de-SPAC, investors can request SPAC to buy back shares at any time to get back their investment. When investors may be dissatisfied with the initiator or the target of the merger, they can terminate their investment in the project.

Only the investor's exit in the middle of the market means that SPAC's funds for mergers and acquisitions are reduced, which affects the final success of the merger. To protect the remaining investors, you can consider limiting the time to exit before SPAC proposes the merger target, and after shareholders vote (only investors who vote against it), so as to avoid the merger process from failing due to investors' improper exit.

Five, summary

As mentioned earlier, Hong Kong is actively considering the introduction of the SPAC system. As the party who joined the SPAC market later, Hong Kong has the advantages that can be learned from the past, and it also faces the competition of Singapore to join the SPAC during the same period. If the SAR government hopes that SPACs can succeed in Hong Kong, it must proceed from the actual situation in Hong Kong. While enhancing the attractiveness of Hong Kong as a listing platform for SPACs, it also strengthens the protection of investors, especially retail investors.

The article by the Zenghao Xian senior lawyer , Chen Zhengbin lawyers and Chinese lawyers Chen Jiaying together co-author. If you have any questions or need further information, please contact our senior lawyer Zeng Haoxian .

For further information, please contact:

Tsang Ho-yin, Stevenson & Wong Law

gordontsang.office@sw-hk.com

.jpg)